/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Broadcom (AVGO) shares could rip higher from current levels after reporting blockbuster earnings for its fiscal Q3 and offering impressive guidance for the full year, says Harlan Sur, a JPMorgan analyst.

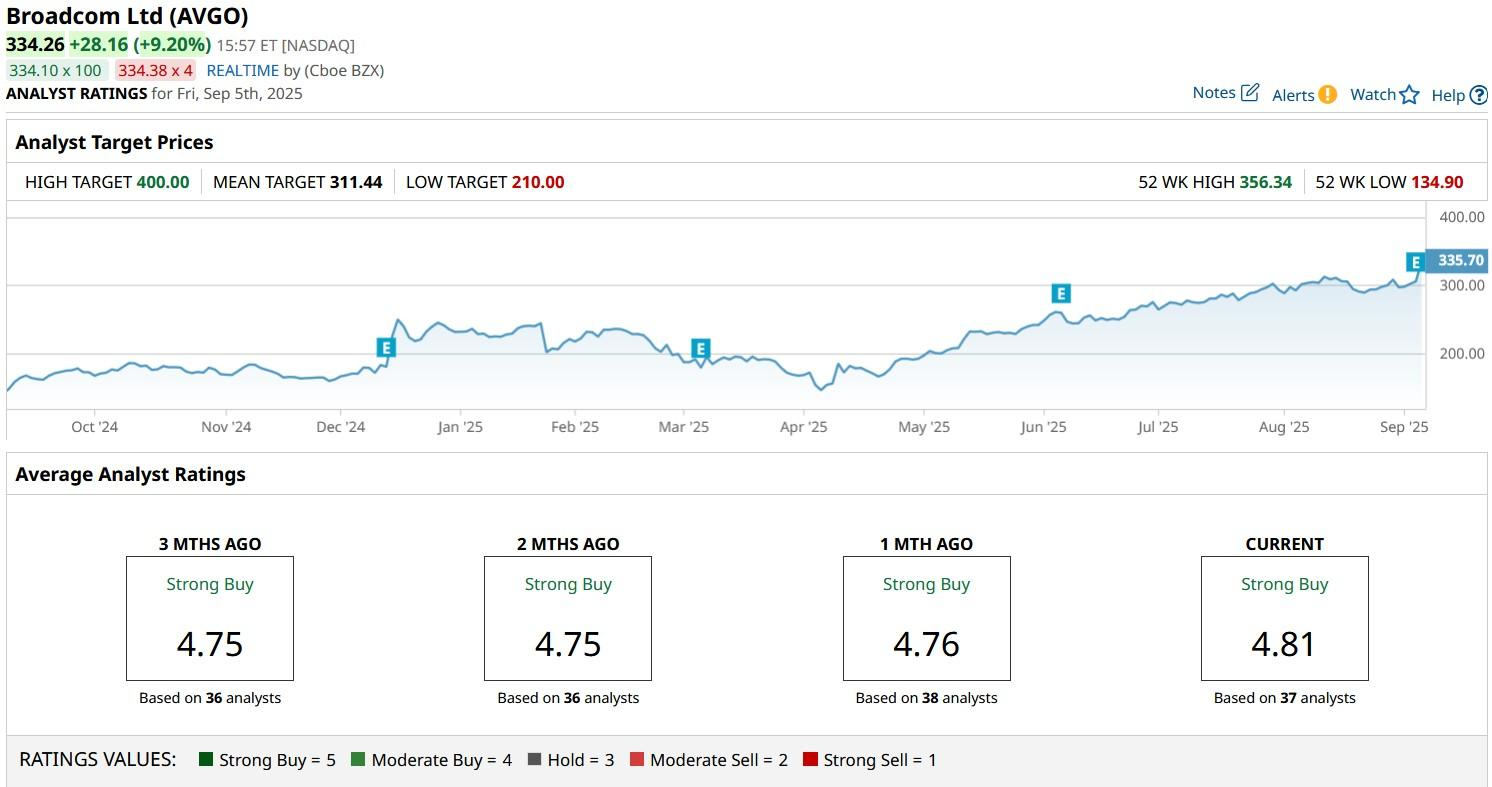

In a post-earnings research note today, Sur reiterated his “Overweight” rating on AVGO shares and raised his price target to $400, indicating potential upside of nearly 20% from current levels.

Broadcom stock has already been a lucrative investment in 2025. At the time of writing, AVGO is up more than 140% versus its low set in the first week of April.

What Could Drive Broadcom Stock Higher?

JPM recommends sticking with AVGO stock because a diversified portfolio and accelerating AI demand could drive it much higher from here.

Additionally, “continued momentum from VMware and product cycles also support solid revenue growth profile,” the investment firm told clients in a research note on Friday.

The company’s AI-driven revenue is now on course to hitting $20 billion this year. With a record $110 billion backlog, Broadcom shares are well-positioned for sustained growth.

A 0.71% dividend yield makes AVGO shares even more exciting as a long-term holding.

AVGO Shares Warrant Premium Multiple

Broadcom stock is worth owning here also because the company’s management also announced a mystery $10 billion AI customer on Friday that many are speculating is OpenAI.

Among other reasons Harlan Sur cited for the constructive view on AVGO shares include Google’s (GOOGL) next-gen TPU ramp.

While this AI stock at a forward price-earnings (P/E) multiple of more than 55x is not inexpensive to own, its EBITDA margin of about 67% does support the premium valuation.

Note that Broadcom generated a record $7 billion in free cash flow last quarter, up 47% year-over-year, highlighting strong operating leverage and capital return potential.

How Wall Street Recommends Playing Broadcom Shares

Other Wall Street firms that raised their price objectives on AVGO stock after the chipmaker’s Q2 earnings release today include Bank of America Securities, Barclays, and Deutsche Bank.

In fact, the consensus rating on Broadcom shares currently sits at “Strong Buy,” according to Barchart.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)