/The%20App%20Store%20listing%20for%20Figma%20by%20Photo%20Agency%20via%20Shuttertsock.jpg)

Figma (FIG) reported a strong second quarter and issued better-than-expected future guidance on Thursday. Shares of the design software company still closed roughly 20% down on Sept. 4.

The NYSE-listed firm now sees its revenue coming in at a tad above $1.02 billion this year, marginally above $1.01 billion that analysts had forecast.

Figma stock had a blockbuster market debut in late July, but the initial excitement failed to sustain in recent months. Including today’s crash, FIG shares are down some 62% versus its record high.

Why Did Figma Stock Sink on Thursday?

Several concerning factors have contributed to investor skepticism surrounding FIG stock today.

The San Francisco-headquartered company saw a sequential decline in its net dollar retention rate from 132% to 129%, indicating some moderation in existing customer expansion.

Additionally, Figma’s recent $91 billion Bitcoin (BTCUSD) investment, made via an ETF as an inflation hedge, while strategic, introduces new risk factors to the business’ profile.

The imminent share unlock beginning Sept. 5, which will allow 25% of employee shares to be traded in the secondary market, may also be adding to the selling pressure on Thursday.

FIG Shares Are Overvalued at Current Levels

According to data from Barchart, options pricing indicates a wide trading range for Figma shares heading into 2026, with an expected high of $67.71 and a low of $41.55 in November.

However, investors’ response to the company’s earnings report and its stretched valuation suggests a continued decline toward the floor of that range is more likely in the months ahead.

FIG stock is currently trading at a forward price-earnings (P/E) multiple of 221x, sharply higher than the best-of-breed AI stocks, even including Nvidia (NVDA) that’s currently going for 41x only.

In short, given the combination of rich valuation metrics and upcoming share unlock pressures, investors may be better served waiting for a more attractive entry point in Figma stock.

How Wall Street Recommends Playing Figma Shares

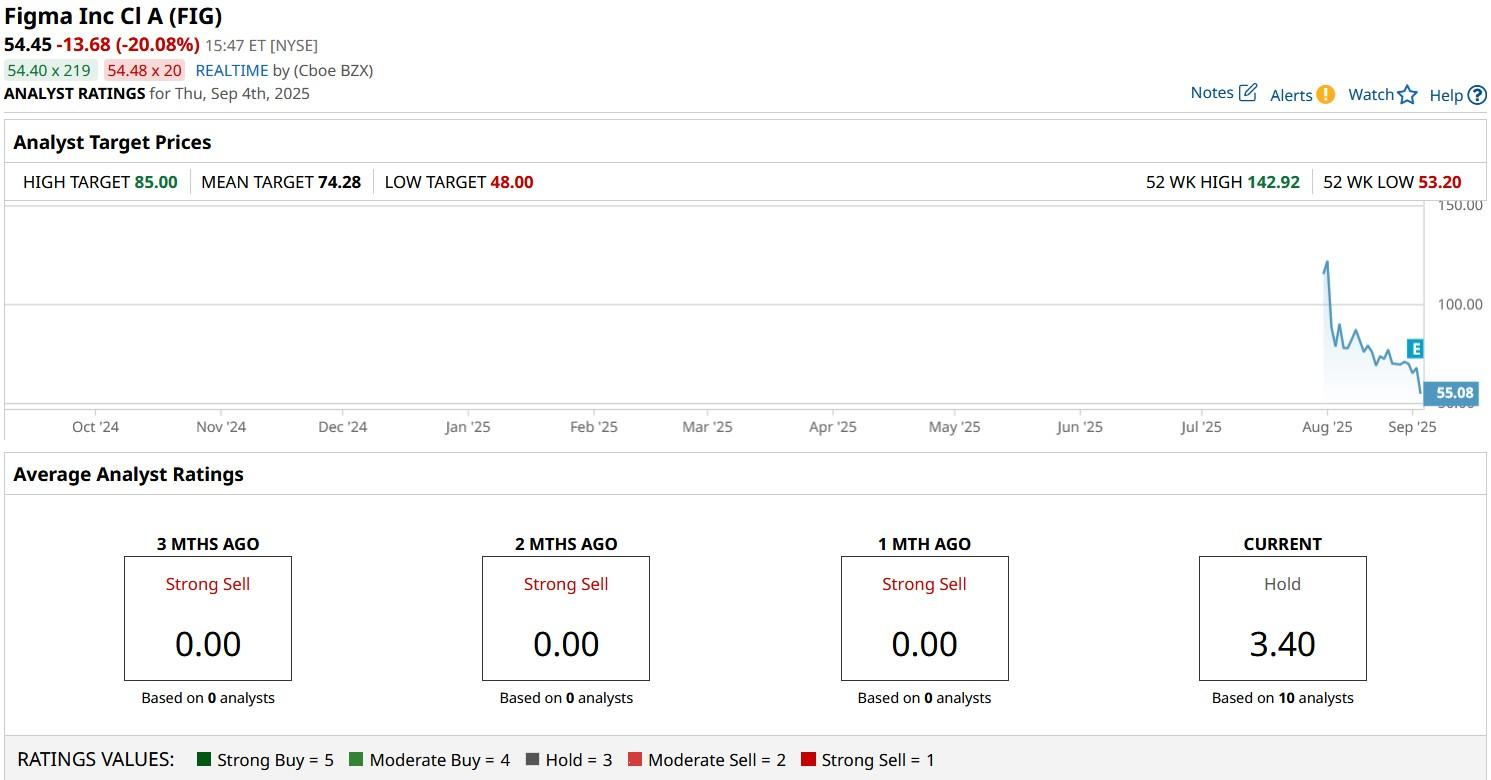

Wall Street analysts recommend caution in buying FIG shares at current levels as well.

The consensus rating on Figma stock currently sits at “Hold” only with price targets going as low as $48 indicating potential for another 12% downside from here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)