BlackSky Technology BKSY continues to attract attention in the space and defense technology sector, with one factor front and center: contract momentum with government clients. The company’s real-time geospatial intelligence services have positioned it to secure a string of agreements with U.S. defense agencies, providing the necessary visibility to its revenue outlook. For a company operating in a high-CAPEx, competitive field, recurring contracts are the strongest indicator of staying power.

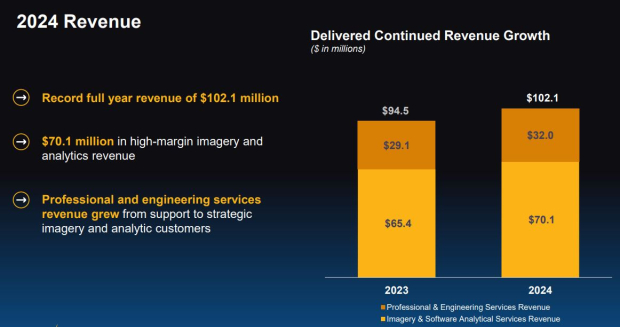

In the past year, BlackSky reported revenue growth of 8% year over year to $102 million, fueled by multi-year agreements. A growing contract base indicates that government reliance on its real-time geospatial data analytics is not only steady but also expanding.

Image Source: BKSY

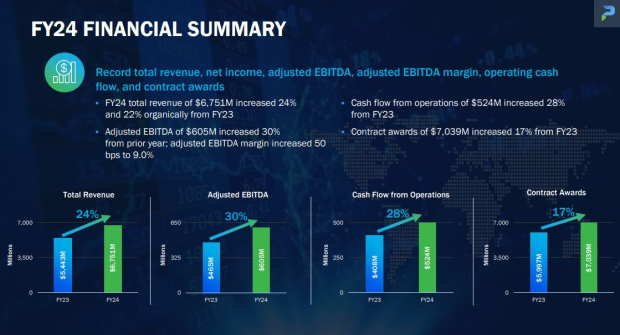

Parsons Corporation PSN, a much larger defense and space contractor with annual revenues above $6.7 billion, has long demonstrated the sector’s playbook: dependable government contracts produce predictable growth. In 2024, Parsons achieved 24% revenue growth, largely from defense solutions tied to cyber and space systems, underscoring how government budgets continue directing capital toward intelligence and infrastructure resilience. BlackSky’s emerging ability to post similar contract-driven trajectories, albeit on a smaller scale, increases its credibility as a growth candidate.

Image Source: PSN

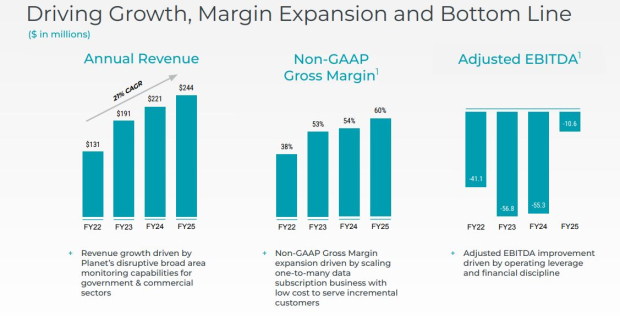

Planet Labs PL, by comparison, saw revenue growth of about 11% last year to $244.4 million, but it struggled with cash burn and lumpy contract renewals, a reminder of volatility in satellite imaging markets. Investors often weigh Planet’s commercial reach against its persistent negative free cash flow. BlackSky, in contrast, recently guided toward positive adjusted EBITDA by 2026, aided primarily by recurring government subscription revenues.

Image Source: PL

The broader market backdrop remains favorable. The geospatial imagery analytics market is expected to witness a CAGR of 9% through 2030, driven by defense modernization and real-time intelligence demand. BlackSky’s contract momentum aligns it toward this trend, while appearing less risky than Planet Labs and potentially on a Parsons-like trajectory of defensible growth.

BKSY stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Planet Labs PBC (PL): Free Stock Analysis Report

Parsons Corporation (PSN): Free Stock Analysis Report

BlackSky Technology Inc. (BKSY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)