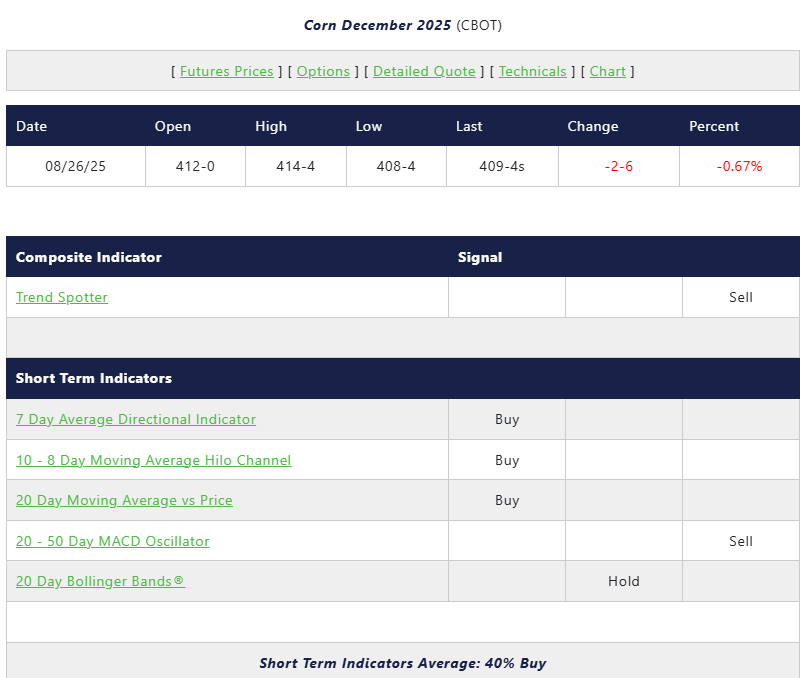

Daily Chart of December Corn below for your review:

in other news…..

Dog Days of August and Travis Kelce/ Taylor Swift are getting hitched! by John Thorpe, Senior Broker

What does the Redbook, Case Shiller Home Price Index, CB Consumer Confidence, Richmond Fed Svc and Mfg. Index, Dallas Fed Svc. index and the announcement of the Swift / Kelce nuptials have in common?

I am sure you are glad I asked, “They have everything in common with each other.” The markets failed to move on any of the breaking economic releases and celebrity gossip columns today.

For the Equity index markets, this is typical behavior at the end of the dog days of summer.

Low Volume, low energy. It seems like last Friday’s rally was months ago. And then? There is NVIDIA.

Earnings will be released tomorrow after the NYSE close for NVIDIA. The star AI Chipmaker EPS estimate is 1.01 usd with Revenues @ 45.94B usd. This 4.34 trillion market cap. company’s Q2 release and future guidance will move the Equity indexes after Wednesday’s NYSE cash market close and perhaps deep into Thursday’s trading session.

Below are the last few high-profile quarters and how NQ futures reacted in the hours after

results hit :

Feb 2024: NVDA crushed expectations; Nasdaq futures jumped nearly ~2% overnight.

May 2024: NVDA beat and guided strong; Nasdaq/S&P 500 hit intraday records the next session (futures were bid after the print).

Aug 2024: NVDA beat, but guidance/GM underwhelmed lofty expectations; Nasdaq 100 E-mini futures were flat to slightly down (around –0.1% to –0.7%) that night/morning.

Feb 2025: Heading into results, NVDA was the market focus; stock-index futures led gains as the print eased some AI demand fears (positive lean for Nasdaq futures).

Pattern: when NVDA positively surprises NQ futures usually pop; when results meet but don’t wow—or guidance suggests doubt—NQ futures are flat/down. This is consistent with NVDA’s outsized weight in the Nasdaq-100 and its role as the AI bellwether. The NFL is 2 weeks away.

Earnings tomorrow NVIDIA and Crowdstrike

Fed Speaker: Wed. 9:45 am Barkin.

Wed. EIA Crude Stocks, 17-week Bill auction

Trump Tarriff News , anything goes

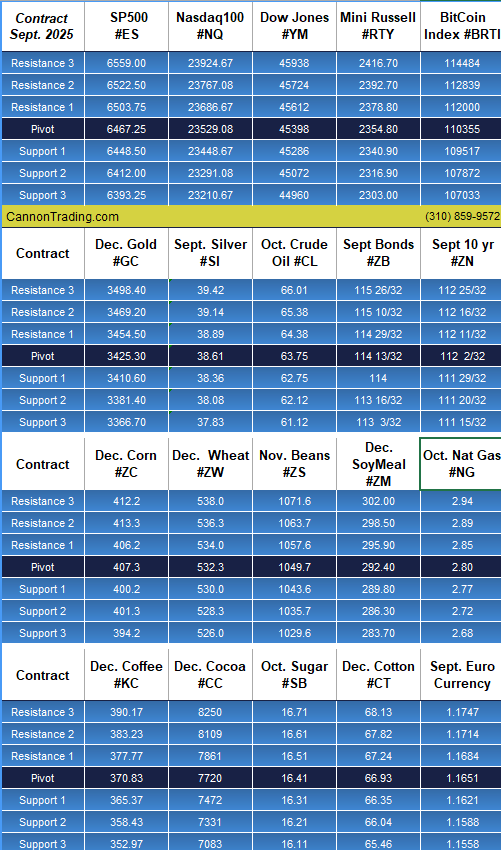

Trading Levels for major Futures for Tomorrow:

Major Reports for tomorrow:

Good Trading!

Ilan Levy-Mayer, M.B.A

Vice President

Cannon Trading Co, Inc. Est. 1988

www.CannonTrading.com

Toll Free: 800-454-9572

Int'l: +310-859-9572

Margins / Commissions / Platforms / Professional Traders /Free Demo

Trading commodity futures and options involves a substantial risk of loss.

The information here is of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future results.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)