Hyperliquid, the high-performance decentralized derivatives exchange founded by former Jane Street quant Jeff Yan, has emerged as one of the fastest-growing platforms in decentralized finance (DeFi). In just four months, the protocol’s Total Value Locked (TVL) has soared from $350 million in April to over $2.2 billion by August — a 470% increase — outpacing sector leaders such as dYdX and GMX in both usage and infrastructure capabilities.

Despite this rapid expansion, the platform’s native token, HYPE, has remained in a tight trading range between $40.59 and $46.3, below its all-time high of $49.75 set in July. This divergence between protocol performance and token valuation has sparked debate over whether the market is undervaluing HYPE’s long-term potential. The best-case scenarios suggest a rapid increase in HYPE price. Cryptona.co predicts HYPE will surpass $55 by year-end.

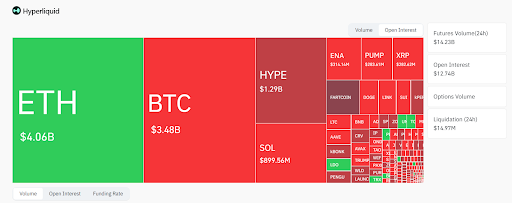

Record-Setting Growth and Performance Metrics

- Hyperliquid L1 TVL: $2.2 billion

- Assets Under Management: $5.5 billion

- Quarterly Fee Revenue (Q2 2025): $176.1 million

- Open Interest: $1.29 billion

These achievements have positioned Hyperliquid ahead of its peers, while maintaining DeFi’s core principles of transparency and self-custody.

These achievements have positioned Hyperliquid ahead of its peers, while maintaining DeFi’s core principles of transparency and self-custody.

Deflationary Token Model Designed for Value Accrual

From its November 2024 launch, Hyperliquid took a community-first approach, distributing 310 million HYPE tokens (31% of supply) via airdrop to over 90,000 addresses — avoiding venture capital dilution.

The Assistance Fund, which allocates 15% of all protocol fees to daily buybacks and burns of HYPE, has already reduced circulating supply to 334 million. On July 17 alone, the fund repurchased 99,620 HYPE at approximately $47.43. With 34% of supply staked and an estimated 4% annual supply contraction, this model mirrors equity buybacks, creating long-term scarcity.

Technical Outlook and Key Levels

Currently, HYPE trades near its 10-day SMA ($44.34) and 100-day SMA ($43.37), with indicators suggesting near-term consolidation:

- RSI: 59.65

- Stochastic: 70.39

- MACD: +0.2760

Support: $37.55 and $34.64

Resistance: $49.81 and $58.32A decisive break above $50 could pave the way for a move toward $58, representing over 20% upside from current levels. While a long-term price prediction for HYPE suggests an increase to $55 in Q4, a near-term consolidation phase is probable before a clear directional move, indicated by the convergence of key indicators.

Valuation Gap Compared to Market Peers

- Hyperliquid Market Cap: $15.4B

- dYdX Market Cap: $3.3B

- GMX Market Cap: $2.1B

If HYPE were valued at dYdX’s 18× price-to-sales ratio, its fair value would exceed $62, based on current fee revenue.

Potential Catalysts for Repricing

- Launch of on-chain options and structured perpetuals

- Integration of spot BTC, ETH, and SOL markets

- Possible Tier-1 exchange listings (Coinbase, OKX)

- Continued high burn rate via the Assistance Fund

- Regulatory clarity from agencies such as the CFTC

About Hyperliquid

Hyperliquid is a next-generation decentralized derivatives exchange, offering high-throughput, low-latency trading without compromising on decentralization or self-custody. Founded in 2024, the platform combines advanced matching engine technology with a community-driven token model to deliver sustainable long-term growth.

- RSI: 59.65

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)