/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

Shares of artificial intelligence (AI) server provider Super Micro Computer (SMCI) have risen significantly this year after the company regained compliance. Demand for AI servers is also a notable tailwind that is working in the company’s favor.

Given this situation, should you be excited about the company’s upcoming fiscal fourth-quarter earnings on Aug. 5? Here's what investors should know.

About Super Micro Stock

Founded in 1993 and based in San Jose, California, Super Micro offers high-performance, energy-efficient server and storage solutions. The company specializes in the design and manufacture of computer hardware, including server systems, motherboards, storage solutions, and networking equipment. Super Micro Computer has a market capitalization of $35 billion.

The company's products are used in data centers, cloud computing, enterprise IT, and high-performance computing (HPC) infrastructure. Super Micro’s offerings integrate advanced hardware with AI capabilities. The company’s servers are optimized for machine learning, deep learning, and data analytics, and the firm focuses on providing AI workload infrastructure, with a strong emphasis on Nvidia (NVDA) GPU-based systems.

Last year, Super Micro faced significant turmoil when Hindenburg Research, a short-selling firm, published a short report alleging “accounting manipulation.” Exacerbating this issue was the company’s auditor, Ernst & Young, quitting.

While a special committee found no evidence of wrongdoing on Super Micro’s part, this ordeal led the company to file its financials late, which put it at risk of being delisted from the Nasdaq. Still, Super Micro regained compliance just ahead of the deadline. As this overhang was lifted from SMCI stock, shares rallied significantly.

Over the past 52 weeks, SMCI stock is down by 15%. However, shares have been on a tear in 2025. The stock has gained 87% year-to-date (YTD). Over the past three months, the price has increased by 74%, reaching a three-month high of $62.36 on July 31.

Super Micro’s Q3 Financials Missed Estimates

On May 6, Super Micro reported its fiscal Q3 results for the quarter ended March 31. Net sales grew 19.5% year-over-year (YOY) to $4.60 billion. At the center of this growth was Super Micro’s server and storage systems revenue, which increased more than 20% YOY to $4.46 billion. The company is experiencing increased demand for GPU servers, HPC, and rack-scale solutions.

While the top line grew by double digits, revenue missed Wall Street analysts’ consensus estimate of $5.42 billion. This also indicates a significant slowdown since just a year prior, Super Micro’s net sales grew by a whopping 200% annually.

This slowdown also affected Super Micro’s profitability. For the period, non-GAAP gross margin declined from 15.6% in Q3 2024 to 9.7% in Q3 2025. Non-GAAP net income per share also declined 53% YOY to $0.31, coming in well below the Wall Street consensus estimate of $0.50 as well.

For the upcoming Q4 results, Super Micro expects net sales to be in the range of $5.6 billion to $6.4 billion, and non-GAAP net income per share to be in the range of $0.40 to $0.50. For the full fiscal year 2025, the company lowered its revenue guidance range from $23.5 billion to $25 billion to between $21.8 billion and $22.6 billion.

Wall Street analysts are not that optimistic about Super Micro’s near-term profitability growth. For Q4, EPS is expected to be $0.35, indicating a YOY decline of 36%. For the current fiscal year, EPS is projected to decline 14.4% annually to $1.72. However, Super Micro’s bottom line is expected to grow 19% to $2.05 in fiscal 2026.

What Do Analysts Think About Super Micro Stock?

Wall Street analysts are cautiously optimistic about SMCI stock. Recently, JPMorgan analyst Samik Chatterjee raised his price target from $35 to $46, maintaining a “Neutral” rating on shares. This move highlights that growing demand for AI is a tailwind, but intense pressure might affect margins.

Citi also raised its price target from $37 to $52 while keeping a “Neutral” rating on the stock. Citi cited increasing demand for AI servers and the easing of constraints on Blackwell GPU supply as reasons for this price target raise. However, the firm also pointed out intensifying competition, which could pressurize margins.

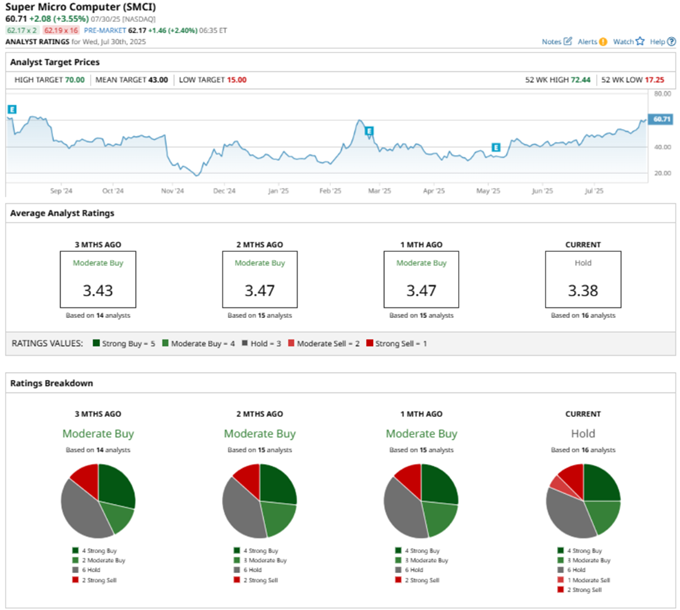

Wall Street analysts recommend caution in regard to Super Micro stock, with a consensus “Hold” rating overall. Of the 16 analysts rating the stock, four have a “Strong Buy,” three suggest a “Moderate Buy,” six play it safe with a “Hold” rating, one has a “Moderate Sell” rating, and two analysts have a “Strong Sell" rating.

The consensus price target of $43 represents 27% potential downside from current levels. However, the Street-high price target of $70 indicates nearly 19% potential upside from here.

Key Takeaways

Despite solid demand, Super Micro faces intensifying competition, which might curb some of its market position. Although the company has left delisting fears behind, a financial slowdown has also occurred. With a key Q4 earnings report on the horizon, investors might find it wise to wait for the upcoming update before making their next move.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)