Quantum Computing Inc. QUBT has taken a major step toward commercial scalability with the full construction and early-stage operation of its Quantum Photonic Chip Foundry in Tempe, AZ. This facility gives Quantum Computing the in-house capability to produce thin-film lithium niobate (TFLN) photonic integrated circuits (PICs), which are key components in advanced technologies ranging from high-speed data networks to quantum information systems.

Bringing photonic manufacturing under its own roof reduces Quantum Computing’s dependence on overseas suppliers and allows it to tightly control the design, quality and scale-up of its hardware. Early traction is already evident. The company has received five purchase orders, including one from a top Canadian research institute, and has started generating revenues from the foundry in 2025. A stronger production ramp-up is expected in 2026 as demand increases.

The foundry strategically positions QUBT to serve fast-growing sectors like data communications, telecom, AI acceleration, and quantum applications. In a field traditionally dominated by foreign players, this domestic facility not only gives QUBT a competitive edge but also enhances its U.S. capabilities in nanophotonics manufacturing, a critical advantage in both commercial markets and national tech priorities.

(Read More: QUBT Stock Surges 3427% in a Year: Correction in Store or More Upside?)

How QUBT is Placed in the Competitive Landscape

Here’s a comparison of two major rivals of QUBT, Rigetti Computing RGTI and Arqit Quantum Inc. ARQQ, which, like Quantum Computing, are pursuing commercialization in quantum technologies but through different strategic lanes:

Rigetti: It focuses on superconducting qubits and recently launched its 84-qubit Ankaa-2 system aimed at improving quantum performance. While the company has secured contracts with U.S. agencies like DARPA and the Department of Energy, it continues to struggle with commercialization, posting modest revenue and ongoing losses. Unlike QUBT, which is already delivering quantum optimization solutions and generating revenues from its chip foundry, Rigetti remains largely in the R&D stage with limited real-world deployment.

Arqit Quantum: It has shifted from building satellite-based QKD systems to offering software-defined, quantum-safe encryption over classical networks. While its cybersecurity focus is timely, Arqit is yet to show strong commercial uptake or revenue momentum. In contrast, QUBT is actively shipping hardware, like its entangled photon source for quantum communications, and backing it with patented QKD architecture.

QUBT's Price Performance

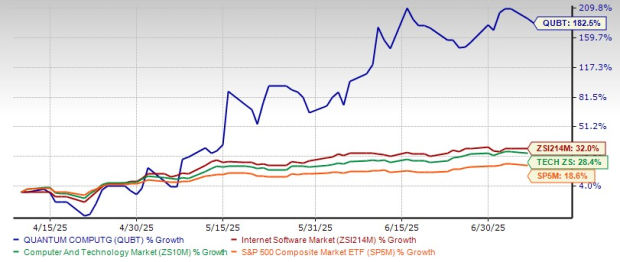

Quantum Computing has rallied 182.5% in the past three months compared with the industry's 32% growth and the sector’s 28.4% rise. The S&P 500 index, meanwhile, has improved 18.6% during the said period.

Three-Month Share Price Comparison: QUBT

Image Source: Zacks Investment Research

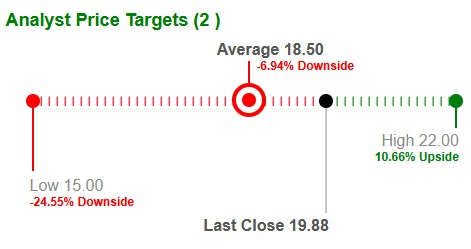

Average Target Price Shows Limited Near-term Upside

Based on short-term price targets, Quantum Computing is currently trading 6.94% above its average Zacks price target.

Image Source: Zacks Investment Research

QUBT currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quantum Computing Inc. (QUBT): Free Stock Analysis Report

Arqit Quantum Inc. (ARQQ): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)