GameStop's (GME) recent strategic pivot has garnered significant attention with its landmark purchase of 4,710 Bitcoin (BTCUSD), valued at approximately $513 million, representing a major step into cryptocurrency investment. This substantial acquisition, funded partially through a $1.5 billion convertible notes offering from March 2025, marks the company's first significant cryptocurrency investment and utilizes about one-third of the raised capital. The market initially responded positively to this development, with GME stock surging more than 4% in premarket trading, though the retailer has since wobbled between gains and losses.

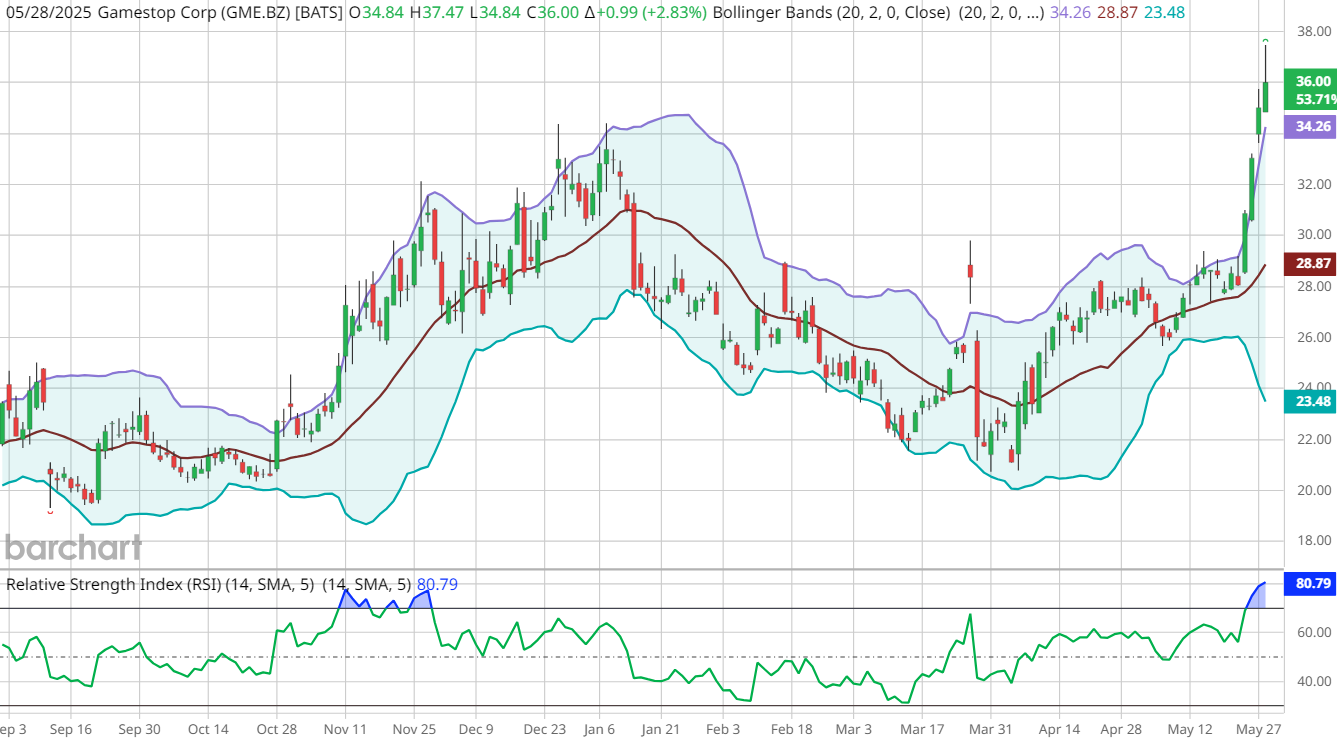

With the stock trading well above its upper Bollinger Band and sporting a 14-day Relative Strength Index (RSI) north of 80, investors should be aware that GME looks extremely overbought at current levels.

GameStop's stock has demonstrated remarkable volatility and returns, with the shares up more than 3,200% over the past five years. GME currently trades about 27% below its 52-week high, set in June 2024.

The timing of the retailer’s strategic move coincides with Bitcoin trading near historic highs around $108,900-$110,000, amid growing institutional interest and strong performance in spot ETFs. Despite the positive market reaction to the Bitcoin investment, GameStop's core business continues to face significant challenges, with the most recent quarter showing a steep revenue decline of over 28% year-over-year.

The upcoming Q1 earnings report scheduled for June 9 holds particular significance, as it will provide the first glimpse into the impact of GameStop's Bitcoin strategy on its financial position. For the current quarter, earnings of $0.08 per share are expected - an improvement from the previous year's loss of $0.12 per share.

The company's trailing price-earnings ratio exceeds 100x, indicating a substantial disconnect between market valuation and fundamental performance, while its plan to close numerous underperforming stores across its global network of over 3,200 locations signals a major transformation in its business model. This Bitcoin investment strategy, while bold, comes at a crucial juncture as GameStop attempts to navigate changing market conditions and revitalize its business operations.

With only one analyst covering GME stock, the retailer is rated “Strong Sell” with a bearish $13.50 price target.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Green%20hydrogen%20by%20Scharfsinn%20via%20Shutterstock.jpg)