President Trump was inaugurated as the 47th President of the United States on January 20 and has been in office for over 100 days. Optimism of pro-growth policies, deregulation, and corporate tax cuts quickly helped stocks to record highs in January, before a whirlwind of trade tariff turmoil sent the stock markets plunging and the S&P 500 briefly into correction territory.

While the three leading stock indices on Wall Street have recovered from their 2025 low, the S&P 500 is still down 6% so far this year. Worries that a US-China trade war could slow US growth or even spark a recession have hit risk sentiment, pulling stock indices lower.

But it is not all bad news. While the broader index remains in the red, specific sectors and stocks are outperforming and could continue to do so under a Trump administration.

With PrimeXBT, a global multi-asset broker, traders can go long or short on major US stocks via CFDs. Whether the price is falling or rising, they can trade both sides of the market driven by the political shifts.

Best & worst performing stocks under Trump

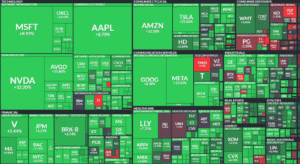

The top performers across Trump’s first 100 days in office have been defensive stocks – stocks that typically perform well in times of economic uncertainty. Meanwhile, growth stocks, which usually underperform in times of economic stress, have underperformed.

Source: Finviz

Utilities, consumer defensives, industrials, and healthcare are the defensive sectors that have outperformed. Stocks such as Coca-Cola, Philip Morris, GE, CVS, and Eli Lilly are among the market leaders.

Meanwhile, growth stocks such as big tech, semiconductors, car makers, consumer cyclical, and financials have been among the worst hit. Amazon trades 20% lower, Tesla is down 50%, and Bank of America has dropped 15% since January.

The big question is whether defensive stocks and sectors will continue to outperform big tech and semiconductors. This depends largely on whether President Trump pushes the US into a voluntary recession with his trade policies. It is worth noting that Trump’s tariff risk is different from the COVID or financial crisis risks in the sense that Trump could call this recession off at any point by removing changes to trade tariffs.

More recently, there has been a sense that the US and China could be prepared to de-escalate the trade war. Trump has said that China’s tariffs are too high and won’t stay at those levels. Meanwhile, China has granted some exemptions on its 125% trade tariffs on US imports. Trump. Trump has also signaled that he is considering some concessions on his auto tariffs to help cushion the impact on the US economy.

Time to buy the dip in tech?

Optimism that the worst-case scenario for trade tariffs, as announced on Liberation Day, will be avoided has resulted in renewed interest in tech and semiconductor stocks. Tech and chip stocks have rallied, with Amazon and Tesla among those leading the charge.

Despite the uncertainty, there are select opportunities in the tech and semiconductor sectors. Those companies building out artificial intelligence and cloud infrastructure, while not immune to tariff turmoil, are still creating a lot of value for customers and shareholders over time.

Bitcoin-related stocks to track BTC

While Trump has unleashed turmoil across the financial markets in his first 100 days in office, his support for cryptocurrencies has been clear. Across his election campaign, he pledged to make the US the crypto capital of the world. Trump also appointed Paul Atkin to lead the Securities and Exchange Commission, who signaled a shift towards pro-innovation crypto regulation just days after being sworn in as chief. Bitcoin has recovered over 20% from its 74.4k April low and could target 100k and fresh all-time highs. Crypto stocks such as Strategy (formerly MicroStrategy) and Coinbase give investors exposure to the crypto market and could benefit from a rally in Bitcoin.

Trading stock CFDs with PrimeXBT

Despite the uncertainty that Trump has brought to the markets in his first 100 days, there are still pockets of opportunity. PrimeXBT, a regulated multi-asset broker, has recently expanded its offering by introducing stock CFDs, allowing clients to trade shares of major global companies in key sectors, including MicroStrategy, Amazon, Netflix, Tesla, and more. The chance to trade big tech stocks with exposure to crypto and the AI narrative allows PrimeXBT traders to capture timely market opportunities as they arise.

Clients can trade these stocks using USD or crypto as margin, and take long or short positions to capture moves in either direction, with fees starting from zero. All stock CFDs are available on the industry-standard MT5 platform and PrimeXBT’s native trading platform, combining advanced charting and risk management features such as stop losses and limit orders.

With a focus on fast-moving sectors and innovative companies, PrimeXBT’s expanded stock range offers traders a better way to navigate today’s volatile markets and build targeted equity strategies within a secure, all-in-one trading environment.

Trade Stocks CFDs with PrimeXBT

Disclaimer: The content provided here is for informational purposes only and is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. The Company does not accept clients from the Restricted Jurisdictions as indicated on its website.

Some products and services, including MT5, may not be available in your jurisdiction. The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.

Media Details:

Contact Person: Mike Karkhalev

Company: PrimeXBT Trading Services Ltd

Email: pr@primexbt.com

Address: 1st Floor, Meridian Place, Choc Estate, Castries, Saint Lucia.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)