There's no denying that when Warren Buffett speaks, investors tend to listen. That's the attention you receive when you've built a trillion-dollar business -- Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B) -- and had decades of sustained success.

That said, not all of Buffett's words leave investors beaming with encouragement. Some are a bit more harsh, though much of what he says is for the better. One such piece of advice from Buffett is that people shouldn't own stocks if they're not prepared for them to drop 50%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Hearing that can make some wonder why anybody would invest if there was a chance they'd lose half of their money. However, Buffett's words are meant to mentally prepare investors for the irrational ways of the stock market, not deter them from investing.

The stock market is no stranger to sudden drops

People's actions (selling, buying, etc.) influence how stock prices move. And since people's actions are often irrational, so is the stock market. That's why it's virtually impossible to predict how the market will behave in the short term regardless of your experience or available tools.

The stock market goes through cycles. It goes through bull markets, rallies, corrections, and bear markets. The first two are welcomed because it means investors are making money. The last two, not so much.

The encouraging news, however, is that history has shown that huge drops aren't the end of the world. Below are some of the S&P 500's biggest bear markets in recent times and how much it has risen since.

| Peak Date | Trough Date | Percent Loss | Percentage Gain Since Trough |

|---|---|---|---|

| Jan. 3, 2022 | Oct. 12, 2022 | (25.4%) | 58.4% |

| Feb. 19, 2020 | March 23, 2020 | (33.9%) | 153.3% |

| Oct. 9, 2007 | March 9, 2009 | (56.8%) | 737.7% |

| March 24, 2000 | Oct. 9, 2002 | (49.1%) | 629.6% |

| Aug. 25, 1987 | Dec. 4, 1987 | (33.5%) | 2,430% |

Source: YCharts. Percentages since the trough are based on S&P 500 closing on March 21 and will vary based on the reading date.

I'm sure it was hard for investors to stomach these drops, but the S&P 500's gains since then have surely eased the pain (with the possible exception of people who retired during the decline).

That isn't to say this will always keep happening, because, again, the stock market is irrational. However, history shows that staying the course and not making short-term moves that go against your long-term interests is the way to go.

Berkshire Hathaway hasn't been immune from large drops

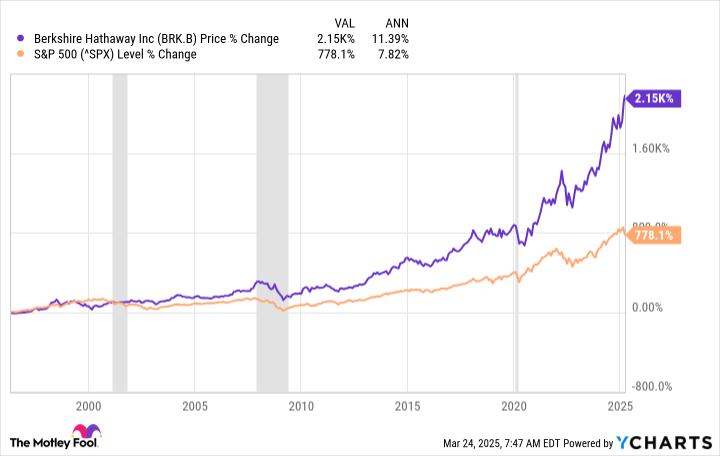

Buffett and company have built Berkshire Hathaway into one of the world's most valuable companies, yet it has had its fair share of large drops. It experienced huge drops during Black Monday, the Dot-Com bubble burst, the 2008 financial crisis, the COVID-19 pandemic, and many other corrections in between. Still, it's been one of the most rewarding investments over the past few decades.

BRK.B data by YCharts. Grey areas indicate U.S. recessions.

No company, index, or exchange-traded fund (ETF) is completely immune to huge drops. Some are better equipped to deal with them and bounce back, but there isn't one that's invincible to bad market conditions. Even the most thorough of companies experience it.

Dollar-cost averaging is your friend

There's a saying that "time in the market beats timing the market" and it has proven true repeatedly. It can be tempting to try and time the market -- selling before drops, buying before rallies -- but the truth is that it's virtually impossible to do this consistently.

As an investor, the focus should be on consistency, not waiting for the "right" time to invest. Of course, it's much easier said than done, but one way to help is to use dollar-cost averaging. When dollar-cost averaging, you decide on an amount you can invest, put yourself on an investing schedule, and stick to it regardless of market conditions at the time.

For example, if you have $1,000 available to invest in the S&P 500, you could decide to break it down to two $500 bi-weekly investments on payday, four $250 weekly investments on Mondays, or whatever works best for your schedule and financial situation.

When you dollar-cost average, you'll buy more shares when prices are dropping and fewer shares when they're rising. That's expected. What's most important is remaining consistent and trusting it'll work out in your favor long term. In many cases, it does.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $697,245!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 24, 2025

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)