When artificial intelligence (AI) chip maker NVIDIA Corporation (NVDA) heads for the exit, investors instinctively glance at the door. In its latest 13F filing, the chip giant disclosed that it had completely exited its position in the AI-driven drug developer Recursion Pharmaceuticals (RXRX).

At the end of Q3 2025, Nvidia held 7.71 million shares. The stake represented a modest slice of its expansive, meticulously managed AI portfolio. Still, the headline carried weight. Traders pushed the stock down as much as 14% during the session before buyers regrouped and lifted it to a nearly 2% gain by the close of Wednesday, Feb 18.

Yet Nvidia’s decision did not trigger a stampede for the exits. Shortly after the disclosure, Cathie Wood stepped in. ARK Invest (ARKK) purchased 1.25 million shares of Recursion across two ETFs, adding to a position it had steadily built in recent months. She saw opportunity where others saw uncertainty.

The contrast could not look clearer. Nvidia redeployed capital while ARK accumulated shares. One AI heavyweight stepped aside while another has pressed forward. So, let us examine which stance makes the most sense on the stock.

About Recursion Stock

Headquartered in Salt Lake City, Utah, Recursion Pharmaceuticals is a clinical-stage biotechnology company that industrializes drug discovery by integrating biology, chemistry, automation, data science, and engineering. With a market cap of roughly $1.8 billion, it advances multiple therapies across oncology, rare diseases, and infectious conditions.

However, the market has shown little patience. Over the past 52 weeks, RXRX stock has fallen 66.1%. Over the last six months alone, it has dropped 27.6%.

Valuation adds another layer to the debate. RXRX stock is currently trading at 29.82 times sales, a multiple that stands above the industry average and signals a premium.

A Closer Look at Recursion’s Q3 Earnings

On Nov. 5, 2025, Recursion reported its Q3 fiscal 2025 results, wherein the company generated $5.2 million in revenue, marking an 80.2% year-over-year (YOY) decline and falling well short of the $16.98 million which analysts had expected.

The bottom line told a similar story. Recursion posted a net loss of $162.3 million, widening 69.4% YOY. Loss per share came in at $0.36. Although that figure beat the consensus estimate of a $0.31 loss per share, it still deepened 5.9% from the previous year's quarter.

Management, however, reinforced its financial footing. After utilizing its at-the-market facility, the company reported approximately $785 million in cash and cash equivalents as of Oct. 9, 2025. Leadership expects that capital to fund operations through the end of 2027 under current plans, without additional financing.

Operationally, Recursion has also advanced its long-term strategy. It secured a $30 million milestone payment from Roche and Genentech for delivering a second neuro map focused on microglial immune cells. The achievement pushed total upfront and milestone payments from partnerships above $500 million, underscoring tangible validation from industry heavyweights.

Looking ahead, Recursion is scheduled to report fourth-quarter 2025 results on Wednesday, Feb. 25, before markets open. Analysts expect Q4 loss per share to narrow 47.2% YOY to $0.28. For full-year 2025, they project a 5.9% improvement to a $1.59 loss per share, followed by another 35.2% narrowing to $1.03 in fiscal year 2026.

What Do Analysts Expect for Recursion Stock?

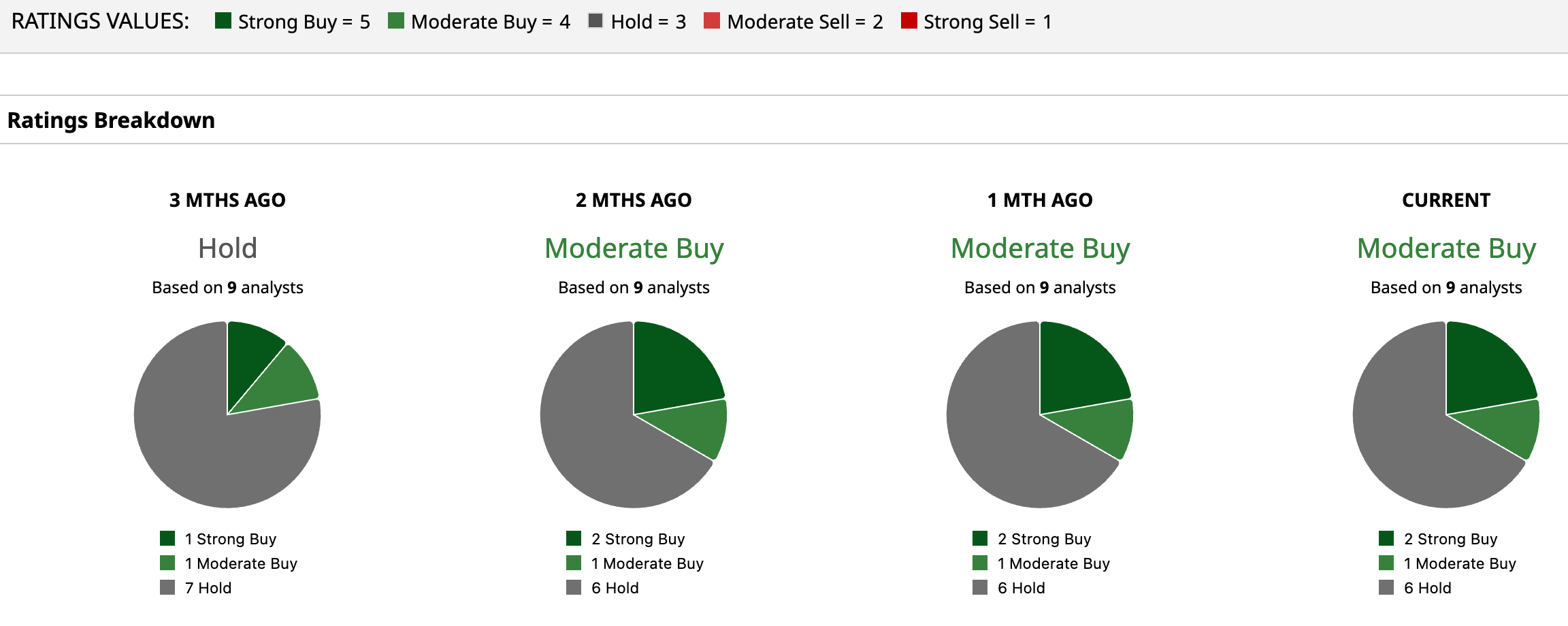

Despite the recent pullback, Wall Street has not abandoned RXRX stock. Analysts currently assign the stock an overall “Moderate Buy” rating. Among nine covering the name, two issue “Strong Buy” ratings, one recommends “Moderate Buy,” and six advise “Hold.”

Price targets further reinforce the measured confidence. The average price target of $7 represents potential upside of 88%. Meanwhile, the Street-high target of $11 suggests a gain of 195.7% from current levels. If the company delivers on expectations, those projections could turn today’s caution into tomorrow’s reward.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Starbucks%20Corp_%20logo%20by-%20eyewave%20via%20iStock.jpg)

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/The%20sign%20for%20Marvell%20Technology%20out%20front%20of%20a%20corporate%20office%20by%20Valeriya%20Zankovych%20via%20Shutterstock.jpg)