Here are three stocks with buy rank and strong value characteristics for investors to consider today, March 17th:

Enersys ENS: This company which is engaged in manufacturing, marketing and distribution of various industrial batteries, carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.2% over the last 60 days.

Enersys’ has a price-to-earnings ratio (P/E) of 9.56 compared with 17.20 for the industry. The company possesses a Value Score of A.

Amalgamated Financial AMAL: This full-service commercial bank and a chartered trust company which provides commercial banking and trust services nationally and offers products and services to both commercial and retail customers, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.9% over the last 60 days.

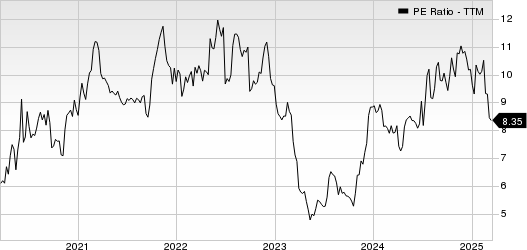

Amalgamated Financial has a price-to-earnings ratio (P/E) of 7.98 compared with 9.30 for the industry. The company possesses a Value Score of B.

First Financial Corporation Indiana THFF: This multi-bank holding company which provides various financial products and services in west-central Indiana, east-central Illinois, western Kentucky, central and eastern Tennessee, and northern Georgia, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.1% over the last 60 days.

First Financial Corporation Indiana has a price-to-earnings ratio (P/E) of 8.96 compared with 10.70 for the industry. The company possesses a Value Score of B.

ENSENSSee the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enersys (ENS): Free Stock Analysis Report

First Financial Corporation Indiana (THFF): Free Stock Analysis Report

Amalgamated Financial Corp. (AMAL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)