DTE Energy DTE has long-term capital expenditure plans to improve its infrastructure. The company is also making consistent investments to expand its renewable generation portfolio.

However, this Zacks Rank #3 (Hold) company faces risks related to its poor financial position and challenges in the energy trading business.

Tailwinds Favoring DTE

DTE Energy has a strong capital investment program to maintain and increase the dependability of its electric and natural gas utility infrastructure. The company plans to invest a total of $30 billion over the next five years. With these expenditures, DTE Energy should be able to meet its long-term operating earnings growth rate of 6-8%.

DTE Energy has also been making consistent investments to improve its assets for renewable generation. Its DTE Electric subsidiary put 2,300 megawatts (MW) of renewable energy into service as of Dec. 31, 2024. It has also commenced the development of a 220 MW battery energy storage facility. Over the next 10 years, the company expects to invest more than $11 billion in the clean energy transition.

Aside from its utility operations, DTE Energy continues to make headway in its non-utility business, which diversifies its earnings stream. DTE Vantage expects to invest $1.5-$2 billion in renewable energy and customized energy solutions between 2025 and 2029.

Headwinds Faced by DTE

DTE Energy’s cash and cash equivalents as of Dec. 31, 2024 totaled $0.09 billion. As of the same date, its long-term debt was $20.69 billion, significantly higher than the cash balance. Its current debt of $2.36 billion also came in quite higher than its cash position. This implies that the company holds a weak solvency position.

Moreover, DTE Energy anticipates that the market circumstances for its Energy Trading business will continue to be difficult. According to the company, fluctuations in commodity prices and the unpredictability of the effects of regulatory changes and modifications to Regional Transmission Organization operating guidelines might affect this segment's profitability.

DTE Stock Price Movement

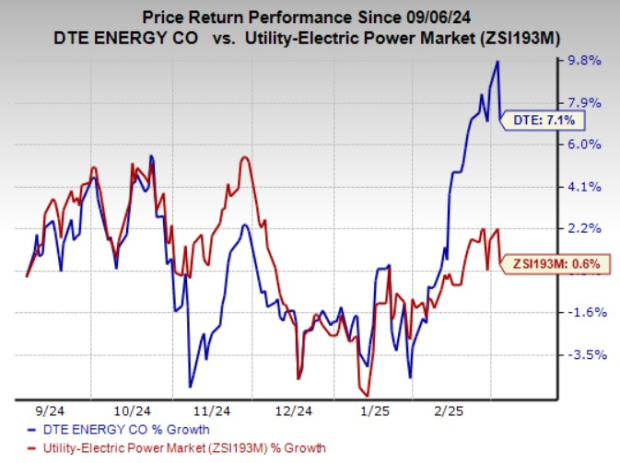

In the past six months, shares of DTE have rallied 7.1% compared with the industry’s growth of 0.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are CMS Energy Corporation CMS, CenterPoint Energy CNP and NiSource Inc. NI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CMS’ long-term (three to five years) earnings growth rate is 7.7%. The company delivered an average earnings surprise of 4.76% in the last four quarters.

CNP’s long-term earnings growth rate is 7.1%. The company delivered an average earnings surprise of 0.76% in the last four quarters.

NiSource’s long-term earnings growth rate is 8.2%. The company delivered an average earnings surprise of 23.02% in the last four quarters.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

CMS Energy Corporation (CMS): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)