Shares of auto parts retailer Advance Auto Parts (NYSE:AAP) declined by 23.9% in February, according to data provided by S&P Global Market Intelligence. The decline came mainly after the company issued disappointing fourth-quarter 2024 earnings and 2025 guidance.

Advance Auto Parts reverses again

This stock has been a value proposition for over a decade, and the fundamental value case remains the same. All the company needs to do is improve its operational metrics to be comparable to its peers, such as O'Reilly Automotive or AutoZone, and the stock should appreciate handsomely. Case closed.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

But it's a case that's turned out to be more of a Pandora's box for investors, management teams, numerous directors on the board, activist hedge funds like Starboard Value and, more lately, Third Point and Saddle Point.

None of them seem to have fundamentally improved matters, and the latest results saw management reiterating strategic priorities that have been made, in one form or other, by Advance Auto Parts management for a decade -- the need to source products strategically, enhance parts availability, consolidate distribution centers, and "bring parts to market faster."

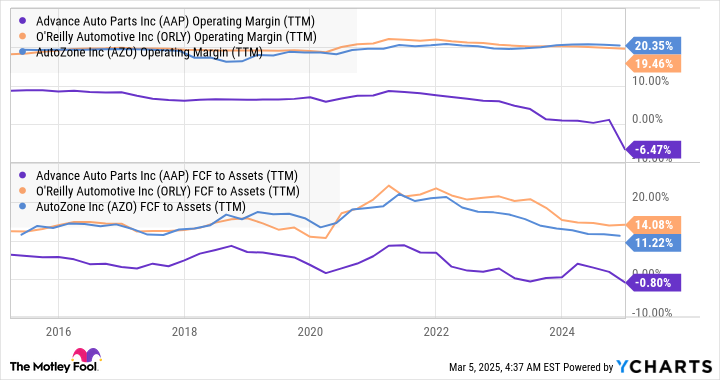

These priorities speak to the necessities of auto parts retailing: getting necessary parts into the stores so owners/professionals can reliably pick them up when they need to service their cars quickly. Unfortunately, Advance Auto continues to lag behind its peers in doing this, which is why its margins and free cash flow generated from assets continue to lag.

AAP Operating Margin (TTM) data by YCharts

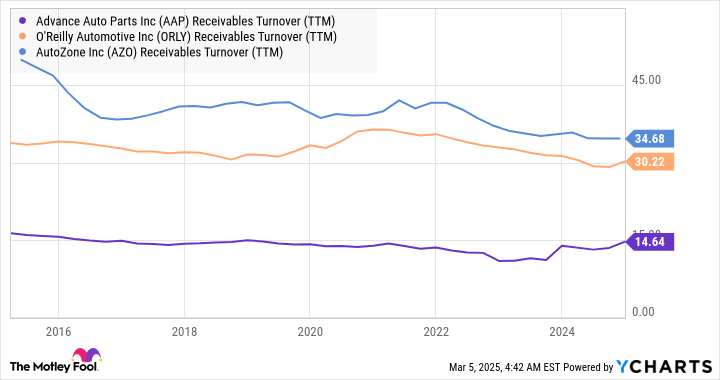

Speaking of cash flow, Advance Auto also continues to lag its peers in terms of receivables turnover (net credit sales/accounts receivable) --a metric that measures a company's efficiency at collecting cash from customers.

AAP Receivables Turnover (TTM) data by YCharts

The 2025 outlook

As such, when investors see a fourth-quarter operating loss of $99.4 million, same-store sales declining 1% year over year, and full-year 2025 guidance that calls for same-store sales growth of just 0.5%-1.5%, adjustable operating income margin from continuing operations of 2%-3%, and a cash outflow of $25 million to $85 million, it's understandable that they sold the stock off.

Advance Auto Parts may well be a value opportunity in waiting. Still, investors will want to see clear evidence of improvement in some of the metrics discussed above before buying in.

Should you invest $1,000 in Advance Auto Parts right now?

Before you buy stock in Advance Auto Parts, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advance Auto Parts wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $699,020!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)