Globalstar, Inc. GSAT reported fourth-quarter 2024 loss of 42 cents per share, wider than the loss of 14 cents in the year-ago quarter. The Zacks Consensus Estimate was pegged at a loss of 5 cents.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Revenues of $61.2 million surpassed the Zacks Consensus Estimate by 2.1%. The top line rose 16.7% year over year. This revenue growth was driven by a solid increase in service revenues.

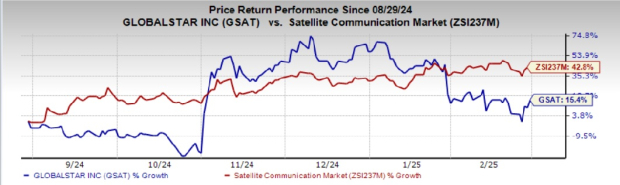

Shares of GSAT declined approximately 12% in the pre-market trading on Feb. 28, 2025. In the past six months, shares of the company have soared 15.4% compared with the Zacks Satellite and Communication industry's growth of 42.8%.

Image Source: Zacks Investment Research

GSAT’s Performance in Details

Service revenues (94.3% of total revenues) were up 17.8% year over year to $57.7 million. The $8.7 million increase in service revenues was primarily attributed to higher wholesale capacity services. This growth stemmed from fees earned through certain expanded services initiated in 2024, which are expected to continue under the Updated Service Agreements.

Subscriber equipment revenues (5.7% of total revenues) climbed 1.1% year over year to $3.5 million. Additionally, Commercial Internet of Things (IoT) grew 8% during the quarter, fueled by an increase in both average subscribers and average revenue per user (ARPU). The company is pleased with the continued adoption of its IoT services.

Globalstar executed an updated services agreement with its wholesale capacity customer, including plans for a new satellite constellation, expanded ground infrastructure and increased global MSS licensing under the "Expanded MSS Network." The company retains 100% of all terrestrial, MSS and other revenues, allocating 85% of network capacity for customer satellite services while reserving 15% for direct MSS customers.

Also, the company partnered with Parsons Corporation for public sector and defense applications, successfully demonstrating Parsons’ software-defined satellite communications using its LEO satellite constellation. Initiated in early 2024, this first-of-its-kind proof of concept in North America enables mission-critical solutions for radio frequency-congested environments.

On Feb. 26, 2025, Globalstar introduced an advanced two-way satellite IoT solution using its low Earth orbit (LEO) satellite constellation. This groundbreaking technology ensures delivery, low-latency messaging and reliable and global command-and-control capabilities across various industries, including fleet tracking, asset monitoring, disaster communications, vessel tracking, precision farming and pipeline telemetry. Globalstar’s RM200M module is the first satellite module to feature integrated GNSS, Bluetooth, an accelerometer and an application processor, enabling advanced two-way communication.

On Jan. 7, 2025, Globalstar and Peiker Holding GmbH joined forces to secure the future of vehicle communication and safety. The initiative combines Globalstar’s expertise in satellite-based communication with Peiker’s specialization in automotive telematics and emergency services to unveil a robust solution that augments safety and connectivity for the automotive sector.

Globalstar secured a 15-year renewal of its blanket mobile earth terminal authorization from the FCC, allowing continued operation of various mobile earth terminals with U.S. and French-licensed NGSO satellites across the United States and its territories.

Operating Details of GSAT

Loss from operations for the fourth quarter of 2024 was $4.2 million, a significant improvement from a loss of $12.0 million in the year-ago quarter, driven by higher revenues, partially offset by a slight increase in operating expenses.

Operating expenses totaled $65.4 million, up 2% year over year. Higher service costs, mainly due to product development and network operations, were partially offset by lower stock-based compensation.

Adjusted EBITDA rose 21% to $30.4 million from $25.1 million in the fourth quarter of 2023. This growth was driven by an $8.8 million revenue increase, partially offset by a $3.5 million rise in operating expenses.

GSAT’s Balance Sheet & Cash Flow

As of Dec. 31, 2024, cash and cash equivalents amounted to $391.2 million compared with $56.7 million as of Dec. 31, 2023.

As of December 31, 2024, long-term debt was $476.8 million, up from $325.7 million in 2023.

In 2024, net cash flows from operations came to $439.2 million.

GSAT’s Outlook

Globalstar reaffirms its financial outlook for 2025, expecting total revenues to range between $260 million and $285 million. The Zacks Consensus Estimate for 2025 revenues is pegged at $278.2 million.

The company anticipates maintaining an adjusted EBITDA margin of approximately 50%.

Zacks Rank of GSAT

Globalstar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Recent Performance of Other Companies in Satellite and Communication Space

Iridium Communications IRDM reported an EPS of 32 cents for the fourth quarter of 2024, beating the Zacks Consensus Estimate by 94%. The bottom line compared favorably with the prior quarter's figure of 30 cents per share.

In the past year, IRDM shares have gained 10.9%.

Gilat Satellite Networks Ltd. GILT reported fourth-quarter 2024 adjusted EPS of 15 cents compared with 11 cents a year ago. The bottom line beat the Zacks Consensus Estimate by 7.14%.

Shares of GILT have increased 22.3% in the past year.

EchoStar Corporation SATS reported fourth-quarter 2024 non-GAAP earnings of $1.23 per share compared with $1.21 in the prior-year quarter. The bottom line surpassed the Zacks Consensus Estimate by 296%.

Shares of SATS have surged 132% in the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EchoStar Corporation (SATS): Free Stock Analysis Report

Iridium Communications Inc (IRDM): Free Stock Analysis Report

Gilat Satellite Networks Ltd. (GILT): Free Stock Analysis Report

Globalstar, Inc. (GSAT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)