Disappointing results for A-Mark Precious Metals' AMRK fiscal second quarter makes its stock one to avoid after releasing its Q2 report last Friday.

Operating as a full-service precious metals trading company, A-Mark has been vulnerable to a weaker business environment with reduced demand and higher operating costs impacting its profitability. Considering such, AMRK lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

A-Mark’s Disappointing Q2 Results

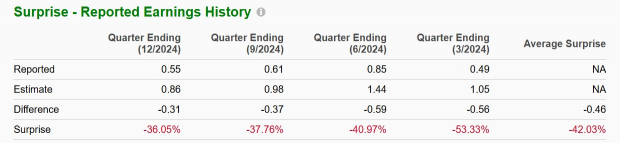

A-Mark's Q2 EPS of $0.55 dropped from $0.90 per share in the comparative quarter and missed expectations of $0.86 by -36%. This was despite Q2 sales of $2.74 billion rising from $2.07 billion in the prior period and edging estimates of $2.66 billion.

Still, the company’s operating efficiency has to be called into question as A-Mark has missed earnings expectations for six consecutive quarters with an average EPS surprise of -42.03% in its last four quarterly reports.

Image Source: Zacks Investment Research

A-Marks Misleading Valuation

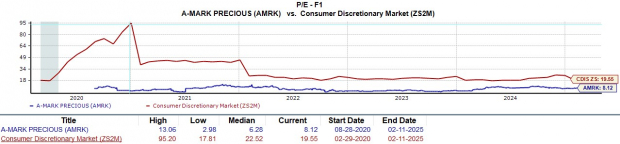

A-Mark's stock could be a value trap for investors who aren’t keeping up with the company’s financial performance and blindly rely on its valuation with AMRK at a “cheap” 8.1X forward earnings multiple.

Image Source: Zacks Investment Research

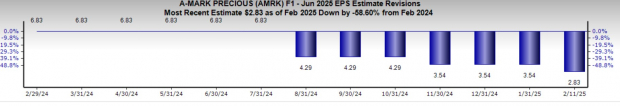

Taking away from A-Mark's P/E discount relative to the consumer discretionary sector is that its fiscal 2025 EPS estimates have noticeably declined over the last seven months after dropping 20% in the last week to $2.83 from $3.54.

Image Source: Zacks Investment Research

Bottom Line

Harvesting gold, silver, and platinum, A-Mark’s operations may be appealing down the line but for now, it may be best to avoid AMRK. To that point, A-Mark needs to show it can get back on track in regards to reaching its earnings potential as declining EPS estimates point to more downside risk ahead.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A-Mark Precious Metals, Inc. (AMRK): Free Stock Analysis Report

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)