WTI Crude Oil Futures (March)

Yesterday’s Settlement: 73.32, up +1.00 [+1.38%]

WTI Crude oil futures posted another strong rally yesterday on Gaza ceasefire fears and supply concerns. Also, Trump’s orders to implement tariffs on steel and aluminum products can be interpreted as a direct shot at Canada.

The ramp of Middle-Eastern tensions is something to be eyed closely, as “war” premium is just getting built back into this market.

The reduction of Russian and Iranian barrels (reportedly) available on the export market continues to underpin crude strength as Asian buyers are forced to seek other, non-discounted cargoes in the marketplace.

Today, futures are lower by -0.80 [-1.06%] to 72.54

Last night’s API report printed bearish which helped to put a lid on the recent momentum. The API report was as follows [thousand bbls]:

Crude: +9,000

Gasoline: -2,500

Distillates: -600

Estimates for today’s EIA report are as follows [thousand bbls]:

Crude: +2,305

Gasoline: +1,210

Distillates: -2,250

Refinery Utilization: +0.20%

OPEC released their monthly market outlook this morning where they kept demand estimates for 2025 and 2026 unchanged. The group also warned that Donald Trump’s trade actions would likely cause market volatility. Trump urged the group twice last week to raise production but the group is signaling they are in no hurry to appease the President.

At 7:30 CST, U.S. CPI data for January was released and came in sharply higher than expected. The CPI print is driving a notable risk-off reaction in markets today.

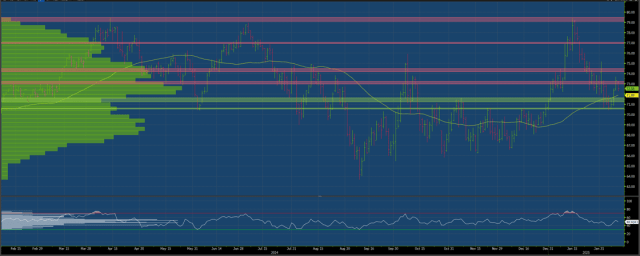

Technical Analysis:

Crude posted another impressive rally yesterday and settled above another three star level for the second day in a row. Headlines have driven price below this major three-star resistance zone of 72.97-73.24*** this morning but there’s a lot of trading left in the day.

Momentum has been exceptionally strong this week in Crude Oil, markets may need a day or two to catch a breather. Bullish catalysts are underpinning the markets and inflation flows may be coming into commodities. We remain cautiously bullish as headline risk continues to present significant risks to positions in the background

Want to stay informed about energy markets?

Subscribe to our daily Energy Update for essential insights into Crude Oil and more. Get expert technical analysis, proprietary trading levels, and actionable market biases delivered straight to your inbox. Sign up now for free futures market research from Blue Line Futures!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)