February WASDE Recap

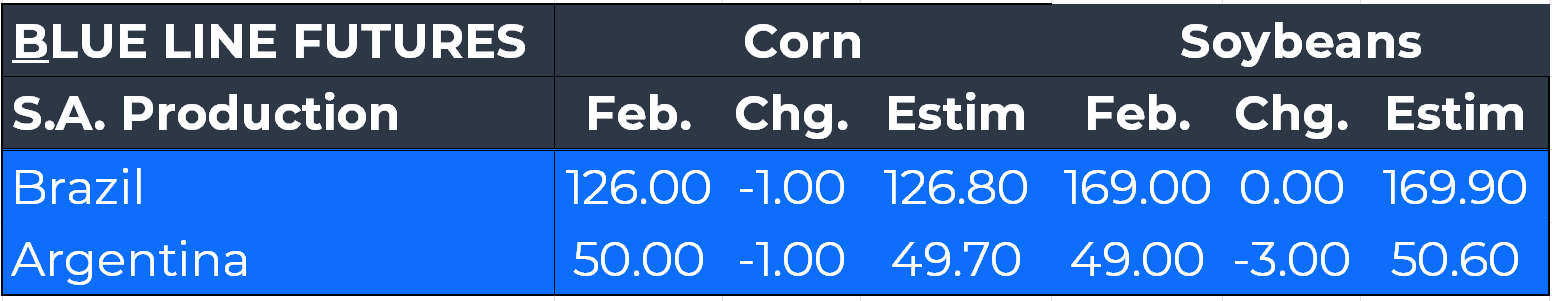

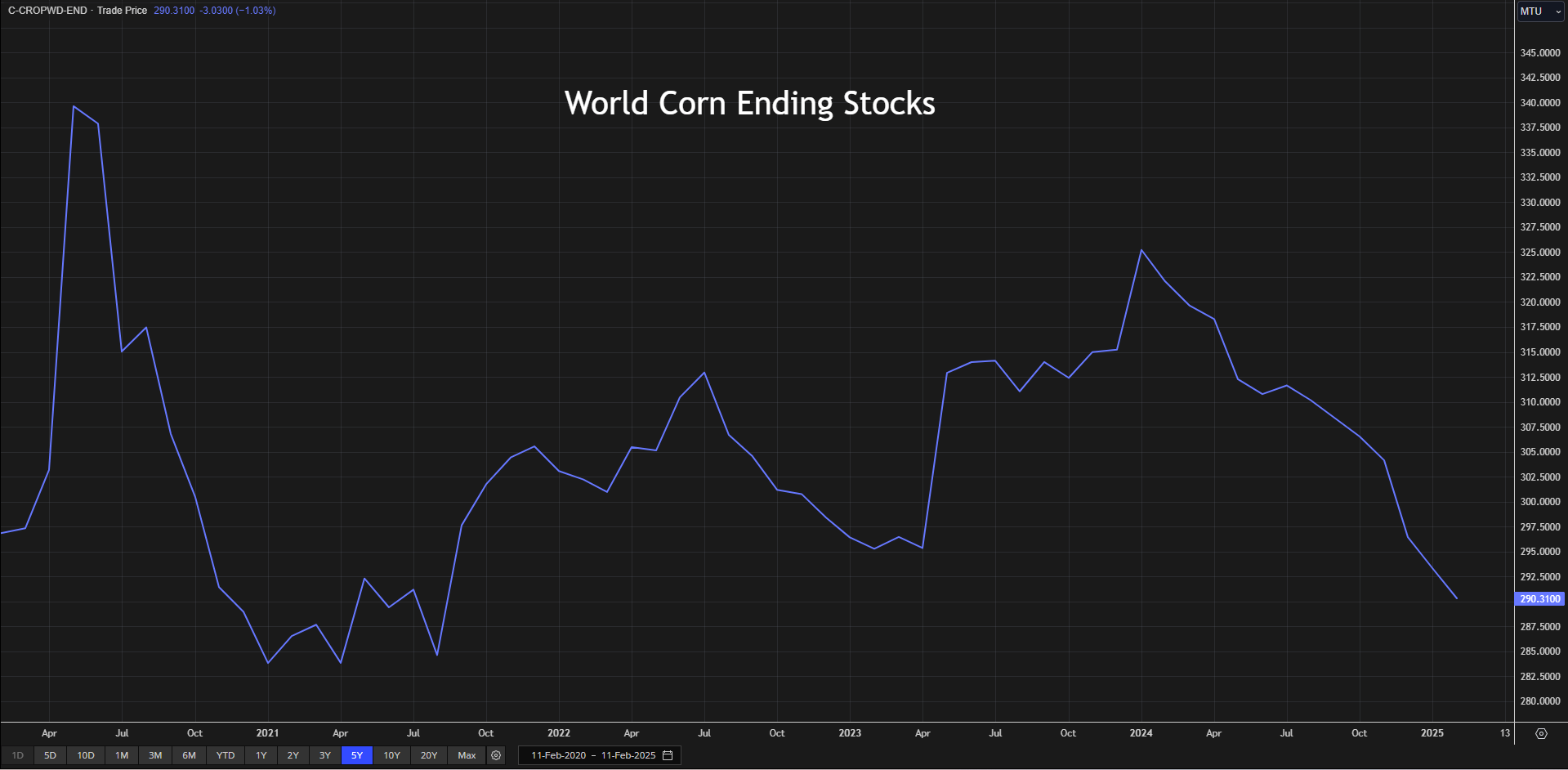

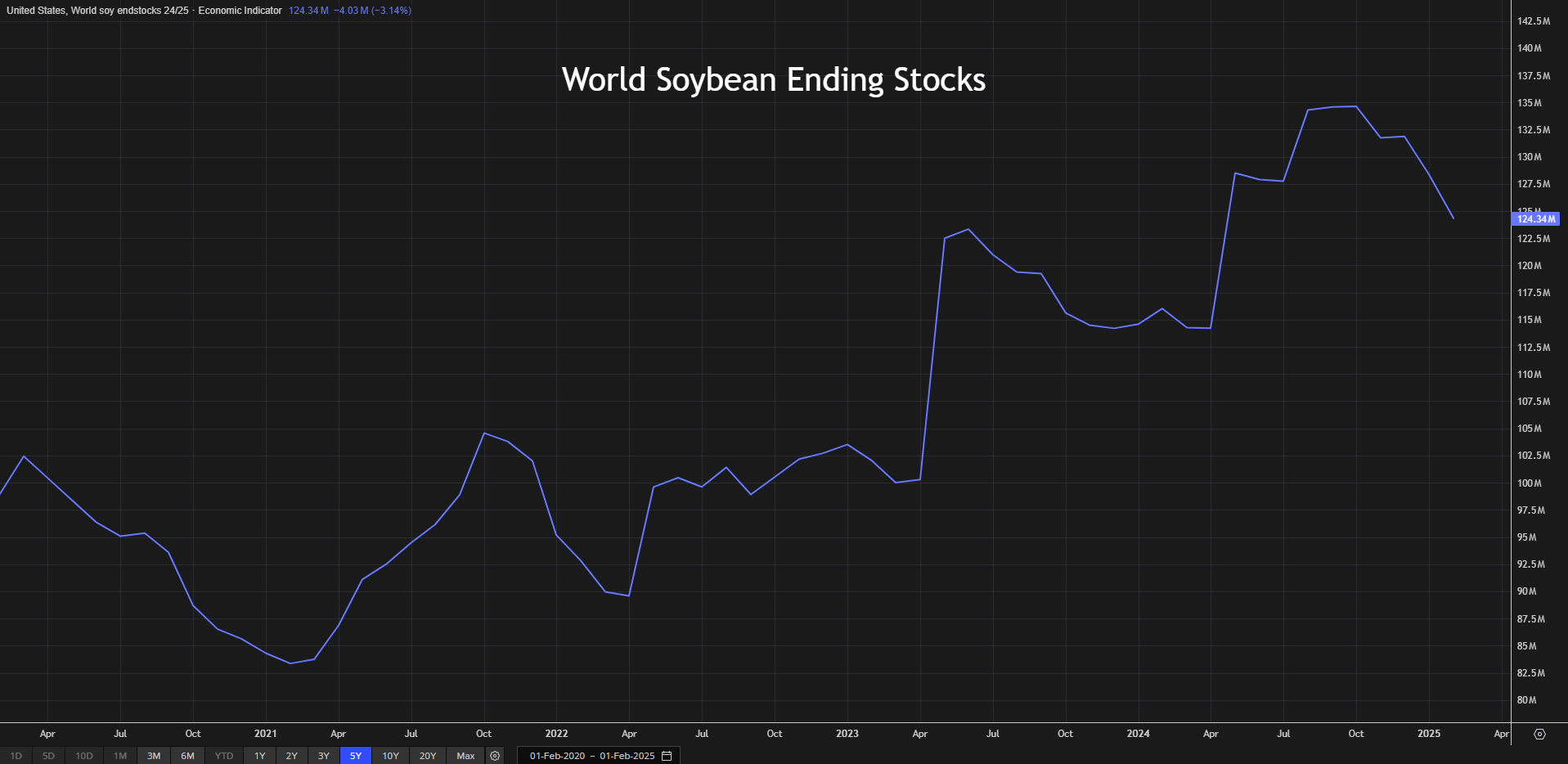

Front-month grain futures closed lower following Tuesday’s relatively non-exciting WASDE report. However, when looking under the hood, grain bulls can get excited about a few anecdotes. Global corn ending stocks were reported at multi-year lows, and South American production estimates for corn and soybeans were lowered. Lastly, the domestic wheat balance sheet tightened, with domestic use jumping 4 million bushels, resulting in a 4 million bu slash to ending stocks.

Corn

The domestic corn balance sheet was completely unchanged, which served as a bit of a bearish surprise as traders anticipated domestic ending stocks to come in between 1.526 bil bu. South American corn production was notched lower due to the dryness observed in Argentina and the delayed planting progress for second-crop corn. While it remains early, the Brazilian planting pace is becoming a more significant risk factor by the week. The net result of the global balance sheet alterations was a 3 million ton reduction to world ending stocks, which are now just 290.3 MMT. It’s worth noting that this is the 8th time in the last 10 years that USDA has opted to cut global ending corn stocks.

Soybeans

Much like corn, USDA punted on altering the domestic soybean balance sheets. They also decided to kick the can down the road on the Brazilian soybean crop despite Patria Agronegocios slashing their Brazilian production estimates to 165.87 MMT from 167.94 MMT last month. It’s on-brand for the USDA to remain steadfast in their estimates, as Brazilian production estimates have varied tremendously depending on the contributor. The production cuts for Argentina were significant and were primarily responsible for the 4 MMT reduction in global ending stocks to 124.34 MMT - well below the 127.79 pre-report estimate.

Wheat

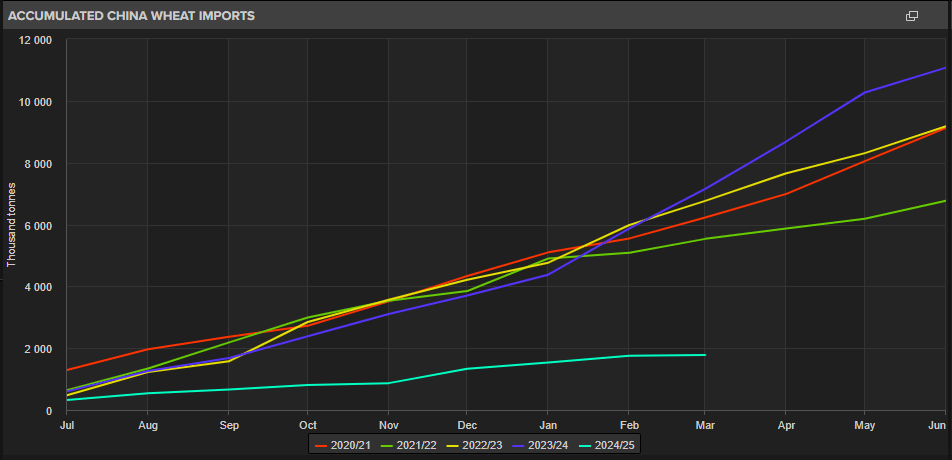

Everything continues coming up aces for wheat. Although the domestic use changes were nominal, it’s another feather in the cap of the bull camp. Domestic food use was boosted by 4 mil bu to 970, translating to a 4 mil bu cut in U.S. ending stocks at 794 mil bu. Global wheat consumption estimates were increased mainly due to the poor EU crop. However, global trade was slashed by 3 MMT due to China’s slowest import pace in the last 5 years. In the instance that China decides to come back to the import market, it would be a major catalyst for wheat prices. Over the past few years, China has played a major role in the wheat trade, and their absence is noticed. Any renewed activity there would be felt almost immediately as global stocks remain tight.

Enjoy the benefits of Blue Line Futures

Open an account with Blue Line Futures and you will gain access to our daily commodity commentary, free desktop/mobile trading platforms, 24-hour trade desk, and more!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)