Check out our Ag Market Update & South American WeatherOutlook with Empire Weather!

Looming tariff threats erased early-week gains across the grain markets this week. Early Friday, Reuters falsely reported that tariffs on imports from Canada and Mexico would be delayed until March 1st, but the White House reiterated that tariffs would take effect starting February 1st. Tariffs aren’t new news, but they may impact corn and soybean prices in the short term – especially if Mexico implements retaliatory tariffs on U.S. corn. Mexico is the largest buyer of U.S. corn and remains at a record pace thus far in ‘24/’25. A disruption in that trade would be a boon for corn prices. Soybeans should be less affected as China is typically dormant in January and February and completely shut down this week for their New Year celebrations. U.S. soybean exports typically wane as we enter February, so any Chinese business won during the month while Brazilian ports are sidelined should support soybean prices. Last but certainly not least, wheat looks strong. Wheat’s blowout export sales report is emblematic of the revival in the global wheat trade. Over the past few weeks, we’ve seen large buyers like Egypt re-enter the market while global stocks dwindle at 7-year lows.

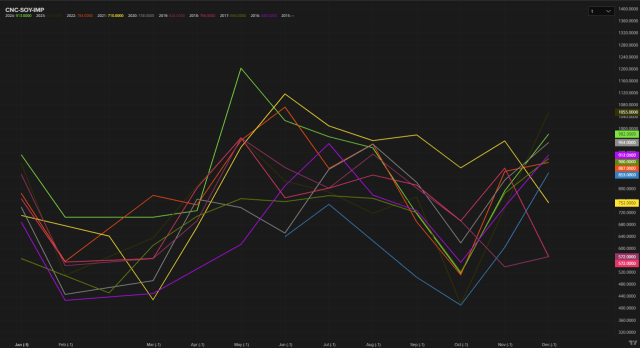

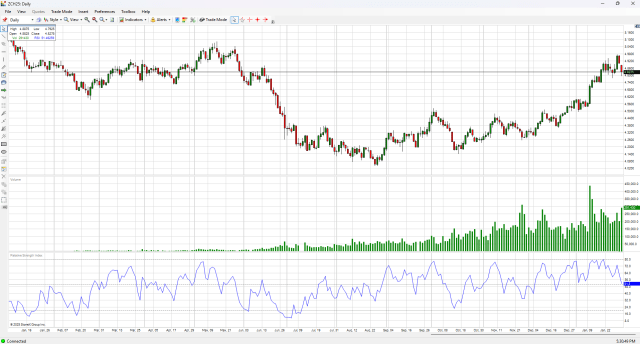

Corn

Corn Futures Market Overview

March corn futures failed to break through the psychologically significant 500 handle on their first test this week, but there remains room for optimism. For the week, March corn settled at 483, down 3 ¾ of a cent. Prices rallied sharply on Tuesday and Wednesday, and saw March corn trade up to 497 before receding on Thursday and Friday on tariff fears. Friday’s gap-and-run lower resulted in corn settling below our pivot pocket between 487-488, but we still defended the previous swing low, and RSI is back in neutral territory at 51.5, which may provide some support. While we may retest 3-star support between 477 ¾-479 ¾ before moving higher, there are fundamental reasons why corn may continue to rally.

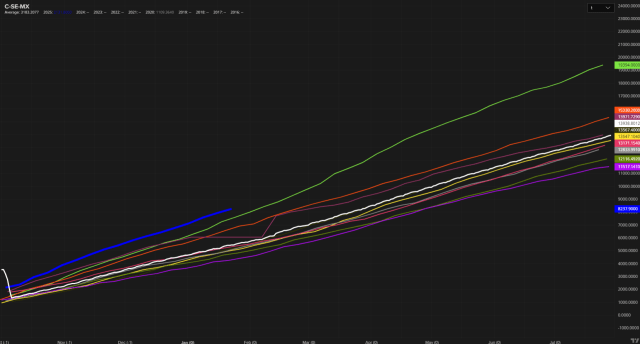

Corn Moneyflow Overview

Implementation of tariffs will likely induce some long-liquidation on behalf of managed funds next week. Again, the tariffs have been known for some time, but the implementation be cause enough for managed money to take some risk off the table in corn. Managed money is now approaching record net-long territory holding 350,721 contracts between futures & options. Meanwhile, commercials expanded their net-short position to 324,689 contracts between futures & options, likely due to the swath of farmer selling over the course of the past three weeks. If long liquidation materializes, it will likely see a drop in prices fairly quickly before stabilizing. For our Blue Line Ag Hedge clients, we’ve looked to protect against this by using protective puts on the spring and summer contracts for unpriced 2024 bushels. If you’re in need of marketing assistance, call our trade desk at (312) 278-0500, and request information on Blue Line Ag Hedge.

Read the full article here: https://bluelinefutures.com/2025/01/31/weekly-grain-market-recap-12/

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)