Investing in the stock market today can be a bit concerning, given the S&P 500's elevated levels and many stocks trading at high valuations. The broad index is coming off a second straight year of gains in excess of 20%, leading some analysts to believe that a slowdown may be overdue for the market.

One way to reduce your risk is to periodically invest in stocks. Putting money every month into a diverse exchange-traded fund (ETF) can be an excellent way to ensure you aren't worried about timing the market while also putting yourself in a great position to grow your portfolio's balance over the long term.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

A top ETF you can invest in that has the potential to turn a $350 per month investment into $1 million over the long term is the iShares Russell 1000 Growth ETF (NYSEMKT:IWF). Here's a closer look at the fund and why it may be a no-brainer option for long-term investors.

The fund has a lot of diversification and charges low fees

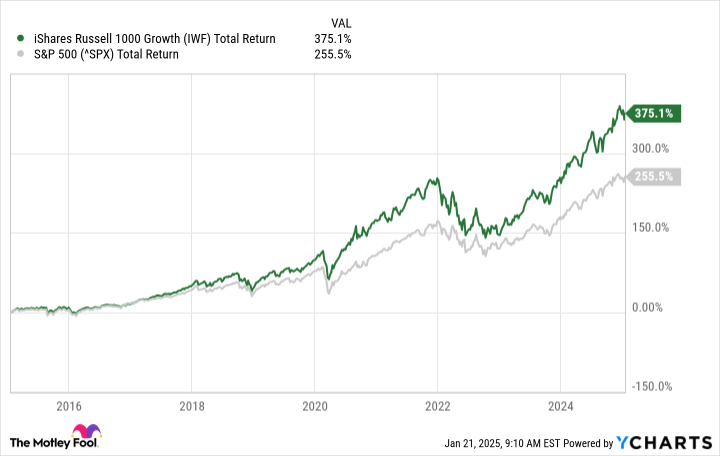

What's attractive about the iShares Russell 1000 Growth ETF is that it focuses on large and mid-cap stocks, which are likely to grow at faster rates than the market. It gives investors exposure to many of the best growth stocks available. Historically, this has been a solid, market-beating investment to hang on to.

IWF Total Return Level data by YCharts

While the tech sector is the largest sector in the fund's portfolio, accounting for just under 48% of the ETF's holdings, consumer discretionary stocks also make up 16%, followed by communication stocks at 14%, and both financials and healthcare stocks each account for around 7%. There are other, smaller sectors as well, which is why the fund can make for a good and diverse investment to hang on to. Its largest holding, Apple, represents 11% of the total portfolio. In total, there are around 400 stocks in the ETF.

Another feature of the ETF that makes it suitable for the long haul is that it charges an expense ratio of just 0.19%. That's a modest rate, which will ensure a big chunk of the gains you accumulate won't go to cover fees.

How the fund can make you a future millionaire

If you're investing $350 each month into this ETF, it can potentially turn into at least $1 million over the very long haul. Assuming you invest this amount regularly, here's how the value of your holdings may look over the long haul, assuming a 9% annual growth rate.

| Portfolio balance assuming a $350/month investment and a 9% annual return | |

|---|---|

| Year | Investment Value |

| 20 | $233,760 |

| 25 | $392,393 |

| 30 | $640,760 |

| 35 | $1,029,625 |

Chart by author.

You can see the significant effect compounding can have on your portfolio's balance, particularly as it becomes larger. While it may take 20 years for your holdings to reach a value of more than $233,000, between the years of 25 and 35, your investment value could grow by over $637,000.

The Russell 1000 Growth ETF is a great place to invest every month

By making investing part of your regular monthly routine, you can simplify the process, which can increase the likelihood that you stick to it. Without having to analyze stocks each month and just putting money into the Russell 1000 Growth ETF, you can ensure you're getting exposure to top growth stocks and investing your money in a way that gives you plenty of diversification and keeps your risk low over the long term.

While it can take a long time for a $350/month investment to grow to $1 million, achieving higher annual returns or investing more (perhaps a lump sum) can lead to larger returns. But by investing as much as you can, you'll be putting yourself on a path to creating a much brighter financial future.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $369,816!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,191!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $527,206!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 21, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

/Lululemon%20Athletica%20inc_%20leggings%20by-%20Sorbis%20via%20Shutterstock.jpg)

/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Tada%20Images%20via%20Shutterstock.jpg)