Industry Overview

The Zacks Automotive – Retail and Wholesale – Parts industry participants engage in various activities, including the retail, distribution and installation of vehicle components, equipment and accessories. These offerings include seat covers, antifreeze, engine additives, wiper blades, batteries, brake system parts, belts, chassis components, driveline parts, engine components and fuel pumps. Customers can choose between repairing their vehicles independently within the DIY market or relying on professional services through the do-it-for-me segment. The industry remains fiercely competitive and is undergoing transformative shifts driven by changing customer preferences and technological advancements.

Factors Influencing the Industry Outlook

Parts Replacement in Aging Vehicles: Over the past decade, the average age of vehicles in the United States has increased from 11.1 years to 12.6 years. As vehicles age, they demand more frequent maintenance and part replacements. This trend has driven consumers to invest in necessary parts replacements to keep their vehicles operational, thereby fueling demand for auto parts.

Weakness in DIY Segment: Industry participants are confronting notable challenges within the DIY segment, primarily due to restrained consumer spending driven by economic constraints. Many customers undertake vehicle repairs out of necessity rather than preference, despite the essential nature of most products in this market. This cautious consumer behavior continues to exert downward pressure on sales and adversely impacts gross margins. Moreover, companies anticipate limited prospects for recovery in this segment over the next 12 to 18 months.

High Capital Requirement: Auto part retailers are ramping up technological investments to enhance electronic catalog systems. This strategy may constrain their short-term cash flow. Additionally, they are allocating resources toward swift store expansions to position inventory closer to their customer base.

Zacks Industry Rank Paints a Glum Picture

The Zacks Auto Retail & Wholesale Parts industry is within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #157, which places it in the bottom 37% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates tepid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are getting optimistic about this group’s earnings growth potential. The industry’s earnings estimates for 2025 have contracted around 12.7% over the past year.

Before we present a few stocks that could still be on your watchlist, let’s take a look at the industry’s shareholder returns and current valuation first.

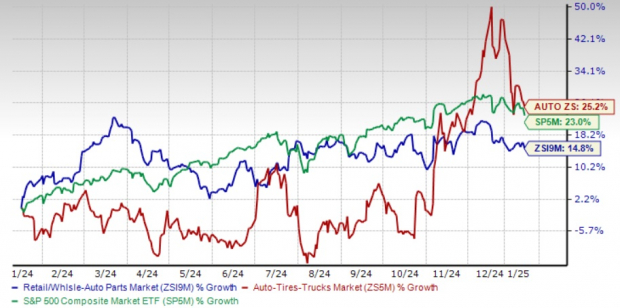

Industry Lags S&P 500 & Sector

The Zacks Auto Retail and Wholesale Parts industry has underperformed the Auto, Tires and Truck sector and the Zacks S&P 500 composite over the past year. The industry has soared 14.8% over this period compared with the sector and S&P 500’s growth of 25.2% and 23%, respectively.

One-Year Price Performance

Image Source: Zacks Investment Research

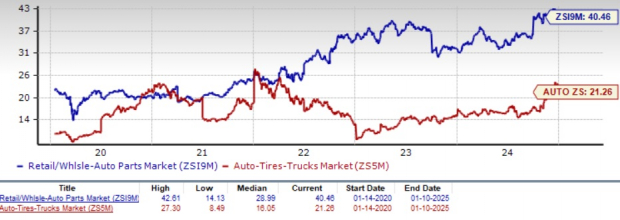

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA) ratio.

Based on the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 40.46X compared with the S&P 500’s 18.20X and the sector’s 21.26X.

Over the past five years, the industry has traded as high as 42.61X and as low as 14.13X, with the median being 28.99X, as the chart below shows.

EV/EBITDA Ratio (Past 5 Years)

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

2 Stocks to Consider

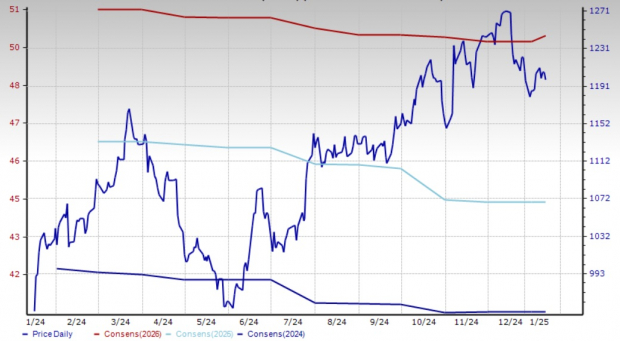

O’Reilly: It is a leading specialty retailer of automotive aftermarket parts, tools, supplies, equipment and accessories in the United States. The company completed the buyout of Mayasa Auto Parts in late 2019 to expand its footprint in Mexico. Currently, the company operates 78 stores in Mexico. O'Reilly also entered into Canada by acquiring Groupe Del Vasto in January 2024. This acquisition is set to drive future growth prospects. Following the completion of the Vast Auto buyout, O'Reilly has been operating 26 stores in Canada. The company has been generating record revenues for 31 consecutive years. The trend is likely to continue on the back of growth in the auto parts market, vehicle longevity, store expansion, a strong distribution network and a customer-centric business model.

ORLY currently carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for 2024 sales and EPS implies year-over-year growth of 5.24% and 6.19%, respectively. The Zacks Consensus Estimate for 2025 sales and EPS implies year-over-year growth of 5.34% and 9.06%, respectively.

Price & Consensus: ORLY

Image Source: Zacks Investment Research

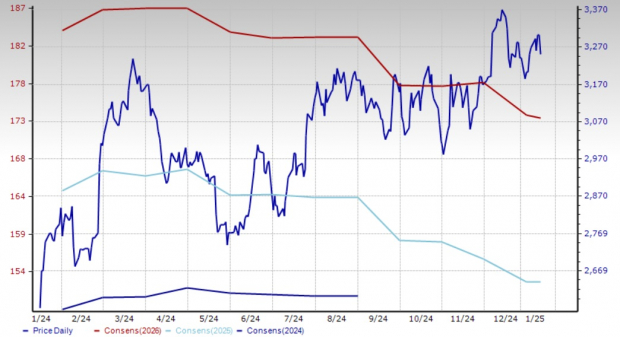

AutoZone: It is one of the leading specialty retailers and distributors of automotive replacement parts and accessories in the United States. It is focusing on increasing its market penetration via the expansion of mega hubs, which is set to boost its long-term prospects. With continued dedication to Mexico and Brazil, the company is set to ramp up store openings in these markets, aiming for as many as 200 annually by 2028, which is poised to significantly boost its future growth. The company’s omni-channel efforts to improve customer shopping experience are reaping profits. The ramp-up of e-commerce efforts, including ship-to-home next day, buy online, pick-up in stores and commercial customer ordering, are driving traffic to the company’s online site, helping the company deliver sizzling growth.

AZO currently carries a Zacks Rank #3. The Zacks Consensus Estimate for fiscal 2025 sales and EPS implies year-over-year growth of 1.63% and 4.76%, respectively. The Zacks Consensus Estimate for fiscal 2026 sales and EPS implies year-over-year growth of 5.32% and 13.22%, respectively.

Price & Consensus: AZO

Image Source: Zacks Investment Research

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O'Reilly Automotive, Inc. (ORLY): Free Stock Analysis Report

AutoZone, Inc. (AZO): Free Stock Analysis Report

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)