/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

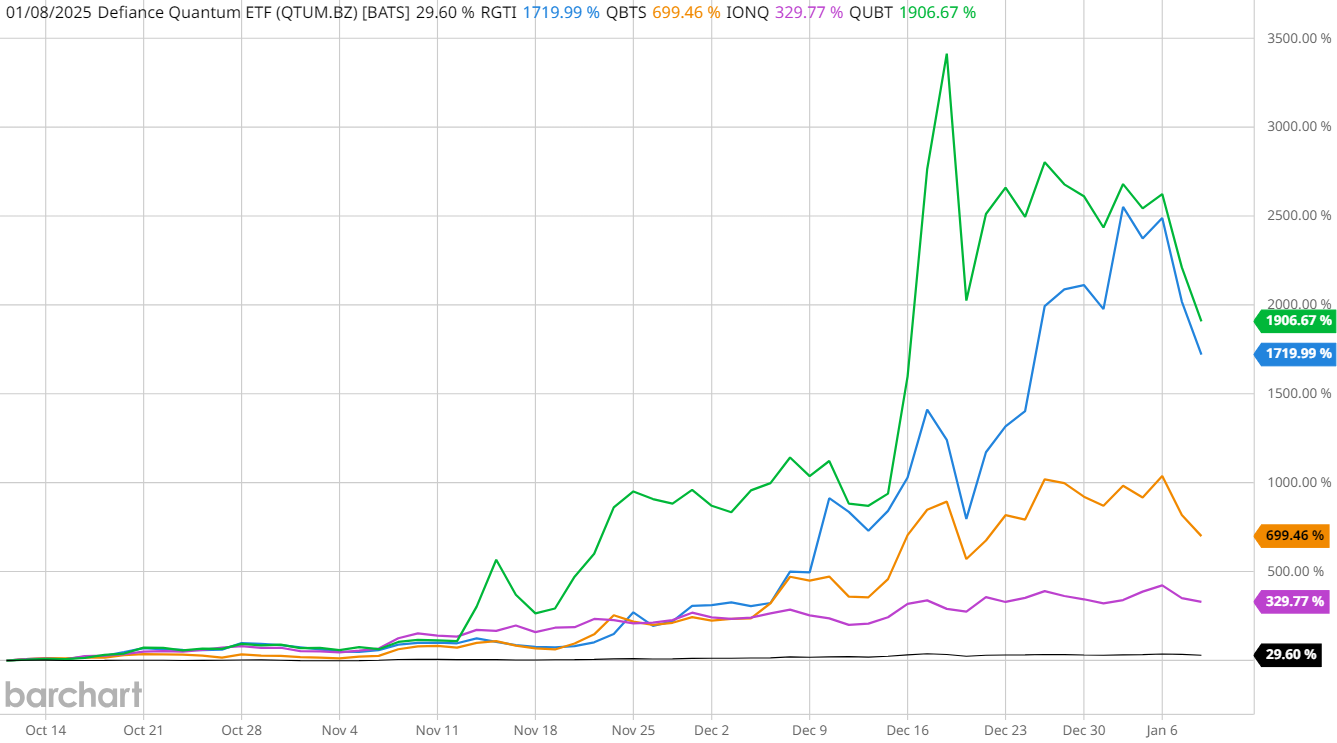

Quantum computing stocks like Rigetti Computing (RGTI), IonQ (IONQ), and D-Wave Quantum (QBTS) have emerged as the tech sector’s breakout stars recently, with these names getting a massive boost from a game-changing quantum breakthrough recently announced by Alphabet (GOOGL). However, these stocks are highly speculative in nature, as many companies in quantum computing are not yet profitable and rely heavily on future potential.

That riskier side of quantum computing stocks is being brought into focus today, as all of these Wall Street favorites are spiraling into the red ahead of the opening bell following comments from Nvidia’s CEO.

“If you said 15 years for very useful quantum computers, that would probably be on the early side,” commented CEO Jensen Huang at Nvidia’s (NVDA) analyst event. “If you said 30, it’s probably on the late side. But if you picked 20, I think a whole bunch of us would believe it.”

After Huang’s comment about the likely timeline for quantum computing’s utility, the Defiance Quantum ETF (QTUM) is down 2.9% in premarket trading, while RGTI has cratered 25%, QBTS is also down 25%, IONQ is 15.8% lower, and Quantum Computing (QUBT) has collapsed by 24%.

This drastic reaction to Huang’s comment underscores the risks associated with investing in quantum computing stocks, given the technology's nascent stage. Investors are advised to approach these stocks with caution, considering the long-term horizon and potential for significant volatility.

Despite the challenges, many investors and analysts remain optimistic about quantum computing's long-term potential to solve complex problems beyond classical computers' reach. However, the path to widespread commercial viability remains uncertain and fraught with risks.

Overall, while the promise of quantum computing is immense, careful consideration and a cautious investment approach are recommended. For those interested in the sector, diversified exposure through the QTUM fund may offer a more balanced risk-reward profile.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)