Until recently, many Walgreens Boots Alliance (NASDAQ:WBA) investors were desperately hungry for good news to boost the company's languishing stock price. On Dec. 10 they got some, in the form of a news report detailing a potential buyout deal. That gave the shares a bit of a bump, but overall, investors remain cautious.

Should they be so guarded, or is this an opportunity to snap up an underappreciated stock at a serious discount?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Going private with a private equity player?

That Dec. 11 report was published by The Wall Street Journal, which wrote that Walgreens management is in discussions with private equity firm Sycamore Partners to take itself private. Typically, a go-private deal prices the company undergoing the transformation at a premium.

The financial newspaper implied that there is some urgency to these talks. Citing unidentified "people familiar with the matter," it wrote that the two sides might complete a deal early next year.

Neither Walgreens nor Sycamore has yet officially commented on the article.

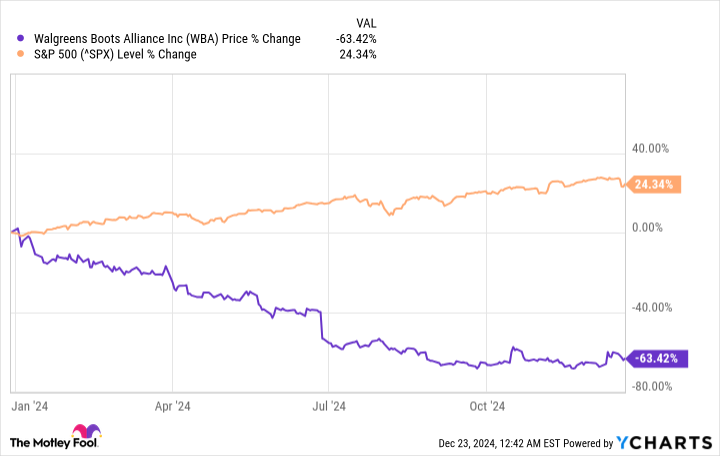

Taking itself off the stock market would eliminate the pressure Walgreens's management surely feels from shareholders, who have seen the value of their holdings wither. Despite the fairly minor price bump from the apparent buyout discussion news, the pharmacy chain operator's stock has largely been a big downer this year.

Data by YCharts.

Walgreens is currently coping with several challenges to its business and not handling them all that well. It has the problem many other traditional businesses share, in that it's still a heavily brick-and-mortar operator in an environment where the retail apocalypse continues to claim casualties.

In March, Amazon launched same-day delivery for medications, and several months later, Walmart announced it would pilot a similar service. Having one mighty retailer trying to poach your business is a tough situation; having to contend with a potential two exponentially worsens the problem.

On top of that, the power of pharmacy benefit managers (PBMs) has negatively affected Walgreens' profit margin. PBMs have quite effectively managed to shave drug prices for both health insurance providers and businesses.

Don't try to catch this one

Walgreens has taken steps to rationalize its business, but these feel like a case of too little, too late. In the summer, management announced plans to shut scores of underperforming stores and to reduce its investment in primary-care company VillageMD. Yet it's not as if these outlets just started to post weak results. The push into the care segment was never particularly well thought out even at the outset.

Given the company's apparent zeal to take itself private and the tarnished value of its brand, I'd imagine that even if it does reach a deal with Sycamore, its premium wouldn't be impressively high. It's hard for an eager seller to fetch an attractive price from an opportunistic buyer.

For me, this is a falling-knife situation, and I wouldn't hold out hope for a big price pop when a deal is agreed to -- assuming, of course, that one happens at all. I think it's best to leave Walgreens stock well alone.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)