Marathon Digital Holdings, Inc. MARA stock is in a consolidation phase. It has declined 8% year to date but has gained 5% over the past six months. The stock has climbed 39% in the last three months, while it has dipped 8% in the past month.

Over the past three months, MARA has underperformed its competitors in the bitcoin-mining space. Riot Platforms, Inc. RIOT has gained 61% and HuT 8 Corp. HUT has rallied 127% over the same period.

Let’s analyze how MARA is doing to determine whether its current levels present a favorable entry point for investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Trump Victory Boosts Crypto Market Optimism and MARA

We believe the stock has upside potential following Donald Trump’s election victory, fueled by investor optimism about potential pro-digital asset policies under his administration. Trump's previous statements favoring deregulation and innovation in financial markets have sparked hopes for a more crypto-friendly regulatory environment, which could benefit companies like Marathon engaged in Bitcoin mining.

A supportive stance could reduce compliance hurdles, incentivizing further investments in the sector. The possibility of broader adoption of digital currencies under a less restrictive framework has bolstered confidence in cryptocurrency-related stocks, driving MARA's upward momentum and reinforcing its appeal to growth-focused investors.

MARA’s Strategic Expansion Drives Growth and Efficiency

MARA continues with its commitment to scaling operations and enhancing efficiencies. In the third quarter of 2024, the company increased its interconnect-approved capacity by 372 MW across three Ohio data centers, positioning itself for sustained mining expansion. MARA also acquired the Hopedale and Hannibal facilities for just $270,000 per MW, significantly below the industry average of $900,000 to $1.5 million per MW. Additionally, the company is developing a greenfield facility in Ohio, which is expected to add 150 MW of capacity.

These strategic expansions support MARA's growth and reduce reliance on third-party providers. By owning and operating 65% of its 1.5 GW compute capacity, the company aims to minimize operational risks and lower costs. This vertical integration aligns with MARA's objective to lead the digital asset industry while maintaining flexibility in energy sourcing and operational strategy.

MARA’s Balanced Strategy for Growth and Profitability

MARA adopts a dual approach to Bitcoin mining, combining revenue generation with strategic asset accumulation. By leveraging its expansive and energy-efficient mining operations, the company produces Bitcoin at lower costs, ensuring consistent revenue streams. MARA retains a significant portion of the Bitcoin it mines, positioning itself to capitalize on potential price appreciation over time.

This hybrid strategy balances immediate income from Bitcoin production with long-term growth potential tied to its holdings. This approach not only supports operational sustainability but also strengthens MARA’s financial flexibility, enhancing its appeal to investors seeking exposure to the cryptocurrency market.

MARA’s Robust Liquidity Position

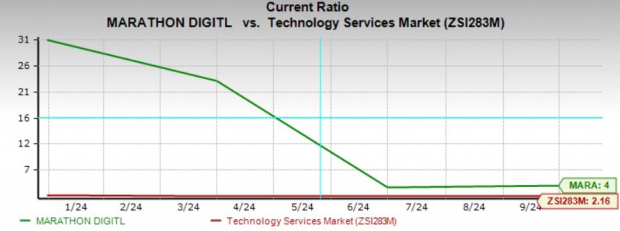

Marathon’s liquidity remains strong, with a current ratio of 4 against the industry average of 2.16. A current ratio above 1 indicates that the company is well-positioned to meet its obligations. The company’s strong liquidity position provides the financial flexibility to pursue growth opportunities and weather potential market fluctuations

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Top-Line Growth Prospects and Bottom-Line Challenges

The Zacks Consensus Estimate for Marathon’s 2024 revenues is $630.8 million, indicating a 62.8% growth from the year-ago quarter. Sales are expected to continue their upward trajectory, with a projected year-over-year increase of 53% in 2025.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Despite the strong revenue growth prospects, the company’s bottom line appears less optimistic. Marathon is expected to report a loss of 20 cents per share in 2024 against earnings of 17 cents in 2023. Loss in 2025 is expected to be around 51 cents. This suggests that while Marathon’s top line is growing, its profitability is under pressure, which could lead investors to take a more cautious approach.

Buy MARA Stock: Strong Growth Potential Ahead

MARA presents an intriguing buying opportunity, supported by its strategic growth initiatives and favorable market conditions. The stock’s recent consolidation phase provides a potential entry point for investors who are optimistic about the cryptocurrency sector. MARA's strategic expansions in Ohio, including low-cost acquisitions and increased capacity, position the company for long-term mining growth while reducing operational risks.

Additionally, Trump's pro-digital asset stance could foster a crypto-friendly regulatory environment, further boosting MARA's prospects. Although profitability pressures remain, the company’s robust liquidity and top-line growth projections highlight its resilience. MARA offers significant upside potential for growth-focused, risk-tolerant investors.

MARA currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marathon Digital Holdings, Inc. (MARA): Free Stock Analysis Report

Riot Platforms, Inc. (RIOT): Free Stock Analysis Report

Hut 8 Corp. (HUT): Free Stock Analysis Report

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)