Ameren Corporation AEE reported third-quarter 2024 adjusted earnings of $1.87 per share, which missed the Zacks Consensus Estimate of $1.91 by 2.1%.

The company posted GAAP earnings of $1.70 per share compared with $1.87 per share in the third quarter of 2023.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

AEE’s Total Revenues

Total revenues came in at $2.17 billion in the reported quarter, up 5.5% year over year. However, revenues missed the Zacks Consensus Estimate of $2.21 billion by 1.6%.

Highlights of the Release

Ameren’s total electricity sales volumes decreased 2.8% to 18,565 million kilowatt-hours (kWh) compared with 19,098 million kWh in the year-ago period. Gas volumes rose 7.4% to 29 million dekatherms from the prior-year period’s level.

Total operating expenses were $1.59 billion, up 9.8% year over year.

The company’s interest expenses in the third quarter totaled $173 million compared with the prior-year quarter’s $152 million.

AEE’s Segmental Results

The Ameren Missouri segment reported adjusted earnings of $415 million. This unit reported GAAP earnings of $381 million.

The Ameren Illinois Electric Distribution segment reported earnings of $56 million in the third quarter compared with $66 million a year ago. The decline was due to a lower allowed return on equity for 2024 under the new multi-year rate plan.

The Ameren Illinois Natural Gas segment reported a loss of $10 million in the third quarter compared with a loss of $5 million a year ago. The year-over-year decline can be attributed to the adverse impacts of rate design from new delivery service rates effective Nov. 28, 2023.

The Ameren Transmission segment reported adjusted earnings of $90 million. It reported GAAP earnings of $100 million compared with $86 million in the prior-year period. The improvement was driven by increased earnings from infrastructure investments.

AEE’s Financial Condition

Ameren reported cash and cash equivalents of $17 million as of Sept. 30, 2024 compared with $25 million at the end of 2023.

As of Sept. 30, 2024, the long-term debt totaled $16.42 billion compared with $15.12 billion as of Dec. 31, 2023.

As of Sept. 30, 2024, the cash flow from operating activities amounted to $1.95 billion compared with $2.03 billion a year ago.

AEE’s Guidance

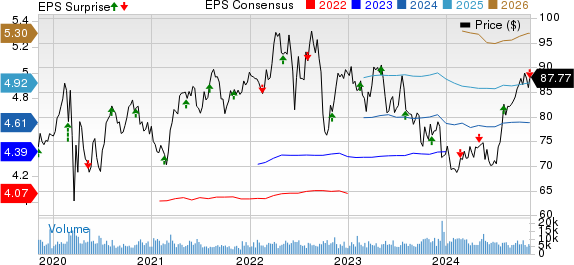

Ameren lowered its 2024 GAAP earnings guidance. It now expects to generate GAAP earnings per share (EPS) in the range of $4.34-$4.48 compared with the previous range of $4.52-$4.72.

The company expects its 2024 adjusted earnings in the range of $4.55-$4.69. The Zacks Consensus Estimate for 2024 earnings is pegged at $4.61 per share, which lies just below the midpoint of the company’s guided range.

AEE’s Zacks Rank

Ameren currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

Edison International EIX reported third-quarter adjusted earnings of $1.51 per share, which surpassed the Zacks Consensus Estimate of $1.39 by 8.6%. The bottom line increased 9.4% from $1.38 in the year-ago quarter.

EIX's operating revenues totaled $5.20 billion, which beat the consensus estimate of $4.76 billion by 9.4%. The top line increased 10.6% from the year-ago quarter’s figure of $4.70 billion.

FirstEnergy FE reported third-quarter 2024 operating earnings of 85 cents per share, which lagged the Zacks Consensus Estimate of 95 cents by 6.6%. The bottom line decreased 3.4% from the year-ago figure of 88 cents per share.

FE’s operating revenues totaled $3.73 billion, which missed the consensus estimate of $3.98 billion by 6.4%. However, the top line increased 6.9% from $3.48 billion reported in the year-ago quarter.

CenterPoint Energy, Inc. CNP reported third-quarter adjusted earnings of 31 cents per share, which missed the Zacks Consensus Estimate of 36 cents by 13.9%. The bottom line also deteriorated 22.5% from the year-ago figure.

CNP’s revenues totaled $1.86 billion, which missed the consensus estimate of $1.88 billion by 1.2%. The top line was also 0.2% lower than the year-ago figure.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE): Free Stock Analysis Report

Edison International (EIX): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report