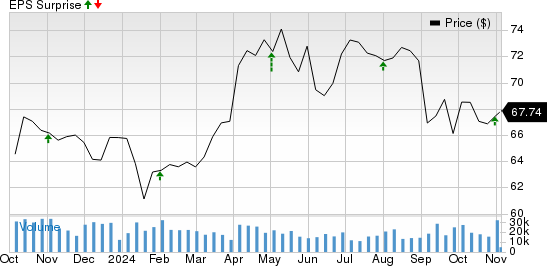

Europe’s largest oil company, Shell plc SHEL, reported third-quarter 2024 earnings per ADS (on a current cost of supplies basis, excluding items — the market’s preferred measure) of $1.92. The bottom line came in well above the Zacks Consensus Estimate of $1.72 and improved from the year-earlier quarter’s earnings of $1.86 per American Depositary Share (ADS), backed by strong production and higher LNG sales.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

However, Shell’s revenues of $72.5 billion were down from $78 billion in third-quarter 2023 and missed the consensus mark of $84.6 billion. This was primarily due to weaker commodity prices and a significant drop in the Chemicals and Products’ performance.

Meanwhile, Shell repurchased $3.5 billion of shares in the third quarter. The London-based company expects another $3.5 billion worth of repurchases for the fourth quarter.

Financial Performance

As of Sept. 30, 2024, the Zacks Rank #3 (Hold) company had $42.3 billion in cash and $76.6 billion in debt (including short-term debt). Net debt-to-capitalization was approximately 15.7%, down from 17.3% a year ago.

You can see the complete list of today’s Zacks #1 Rank stocks here.

During the quarter under review, Shell generated cash flow from operations of $14.7 billion, returned $2.2 billion to its shareholders through dividends and spent $4.7 billion on capital projects.

The company’s cash flow from operations increased 19% from the year-earlier level. Meanwhile, the group raked in $10.8 billion in free cash flow during the third quarter compared to $7.5 billion a year ago.

Guidance

Shell expects fourth-quarter 2024 upstream volumes of 1,750-1,950 MBOE/d, while Integrated Gas production is expected between 900 MBOE/d and 960 MBOE/d. The company also foresees marketing sales volumes of 2,550-3,050 thousand barrels per day and refinery utilization in the range of 75-83%.

Important Energy Earnings So Far

While we have discussed Shell’s third-quarter results in detail, let’s take a look at some other key integrated energy reports of this season.

One of the largest energy companies in the world, ExxonMobil XOM, reported third-quarter 2024 earnings per share of $1.92 (excluding identified items), which beat the Zacks Consensus Estimate of $1.91. The bottom line, however, declined from the year-ago level of $2.27. Better-than-expected quarterly earnings were primarily driven by record-high liquids production volumes in the upstream segment and increased contributions from the Chemical Products segment, partially offset by lower commodity price realizations and weaker refining margins.

ExxonMobil reported a cash flow of $17.7 billion from operations and asset divestments. The company’s capital and exploration spending amounted to $7.16 billion. Total cash and cash equivalents were $26.9 billion, and long-term debt totaled $36.9 billion.

Smaller rival Chevron CVX reported adjusted third-quarter earnings per share of $2.51, beating the Zacks Consensus Estimate of $2.47. The outperformance stemmed from higher-than-expected U.S. production in the company’s key upstream segment, as volume from the Permian Basin reached an all-time high. The unit’s domestic output of 1,605 thousand oil-equivalent barrels per day (MBOE/d) came in slightly above the consensus mark of 1,602 MBOE/d.

CVX recorded $9.7 billion in cash flow from operations, the same as the year-ago period, as a drop in earnings and a one-time outgo was somewhat offset by higher dividends from equity affiliates and lower working capital. Chevron’s free cash flow for the quarter was $5.6 billion.

European biggie BP plc BP reported third-quarter 2024 adjusted earnings of 83 cents per ADS on a replacement-cost basis, excluding non-operating items. The figure beat the Zacks Consensus Estimate of 78 cents. The outperformance can be primarily attributed to higher liquids production and stronger retail fuel margins.

BP’s organic capital expenditure in the reported quarter totaled $4.3 billion. The company registered a total capital spending of $4.5 billion for the quarter. Its net debt was $24.3 billion at the end of the third quarter. Also, the firm announced a gearing of 23.3% in the third quarter.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL): Free Stock Analysis Report

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)