Booz Allen Hamilton Holding Corporation BAH stock has had an impressive run in the year-to-date period. Shares of the company have gained 29.1%, outperforming the 24.6% rally of the industry and the 22.5% rise of the Zacks S&P 500 composite.

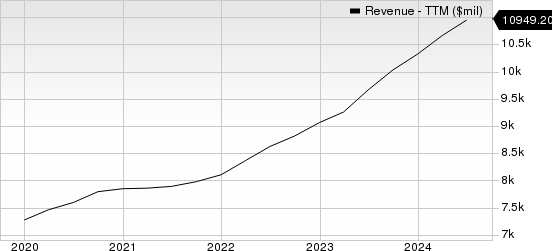

BAH’s revenues are anticipated to increase 10.8% and 6.7% year over year in 2024 and 2025, respectively. Earnings are estimated to rise 8.6% in 2024 and 12% in 2025. The company has an expected long-term (three to five years) earnings per share growth rate of 11.6%.

Factors That Auger Well for BAH

Booz Allen Hamilton’s VoLT strategy focuses on integrating velocity, leadership and technology in the transformation process. On the velocity front, BAH is concerned with increasing innovation, and is using mergers, acquisitions and partnerships to strengthen its market position and cater to clients. The leadership front deals with strategies to utilize leadership in identifying client requirements and scaling businesses rapidly. In the world of technology, BAH focuses on developing and expanding next-generation tech and solutions.

BAH’s solutions business creates differentiated business models and sales channels, boosts client acquisition, and improves the opportunities to generate revenues. Differentiation is achieved in the talent market to ensure quality talent from diverse disciplines is hired and retained. Such strategies enable the company to win highly technical and vital contracts for its federal government business.

The company has a large addressable market as it serves the U.S. government, which is one of the world’s largest consumers of technology and management consulting services. According to the Congressional Budget Office and the U.S. Department of the Treasury, the U.S. government has spent $6.1 trillion in fiscal 2023. The company’s revenues are set to grow, given that 98% of its top line is generated from agencies or the department of the U.S. government.

Booz AllenHamilton's current ratio (a measure of liquidity) at the end of first-quarter fiscal 2025 was at 1.56, higher than the year-ago quarter’s 1.21. A current ratio of more than 1 often indicates that the company will easily pay off its short-term obligations.

Risks Faced by Booz Allen Hamilton

BAH is witnessing an increase in operating expenses and costs.These operating expenses and costs increased 9.5% year over year in fiscal 2024, 14.8% in fiscal 2023 and 8.1% in fiscal 2022. The consistent rise in costs and expenses is expected to keep the bottom line under pressure, going forward.

Booz Allen Hamilton operates in a highly competitive industry.The company competes with a vast network of U.S. government contractors, including large defense contractors, diversified service providers and small businesses. A new entrant into the markets that Booz Allen Hamilton serves poses a great threat to the company as well.

Zacks Rank & Stocks to Consider

BAH carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks from the broader Zacks Business Services sector are Docusign DOCU and Parsons PSN, each flaunting a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Docusign has a long-term earnings growth expectation of 9.3%. DOCU delivered a trailing four-quarter earnings surprise of 18.3%, on average.

Parsons has a long-term earnings growth expectation of 16.1%. PSN delivered a trailing four-quarter earnings surprise of 16.2%, on average.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Booz Allen Hamilton Holding Corporation (BAH): Free Stock Analysis Report

Docusign Inc. (DOCU): Free Stock Analysis Report

Parsons Corporation (PSN): Free Stock Analysis Report

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)