/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

Snowflake's (SNOW) $200 million deal with OpenAI, in tandem with SNOW's existing alliance with another huge artificial intelligence (AI) startup — Anthropic — is likely to enable SNOW to take significant, needle-moving revenue away from the cloud-infrastructure units of Amazon (AMZN) and Microsoft (MSFT).

Consequently, SNOW's growth, which is already quite rapid, looks poised to accelerate meaningfully in the medium- to long-term, and growth investors looking for an up-and-coming AI play should consider buying SNOW, despite its current hefty valuation.

About Snowflake Stock

Snowflake's cloud-based platform enables large companies and government entities to store their data in one centralized location, analyze all of their information using AI and other tools, and develop data applications.

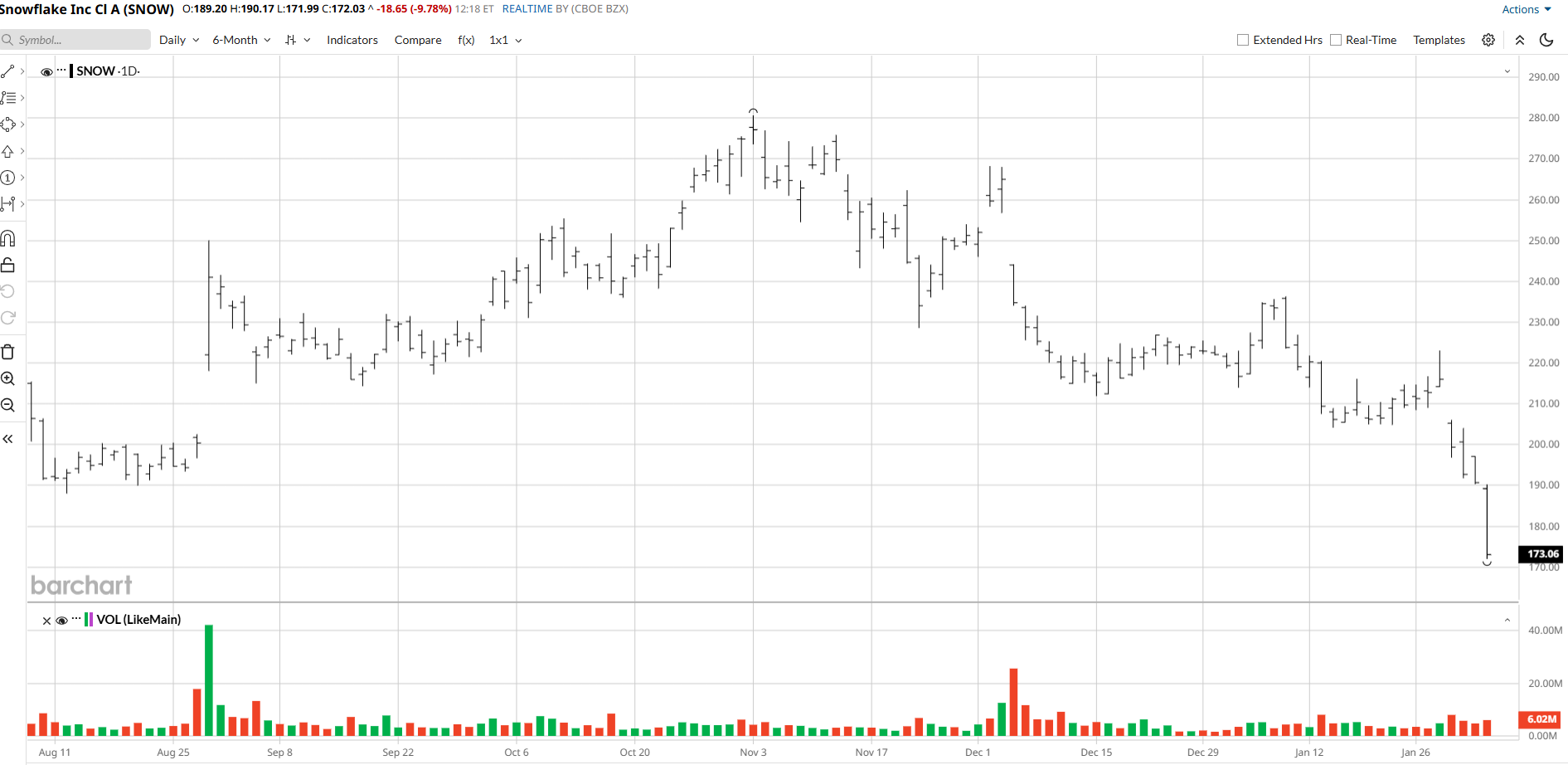

Currently changing hands at a market capitalization of $65.9 billion, the company's price-to-sales (P/S) ratio is 18.8x, while its price-to-book ratio is 32x.

In the firm's October quarter, its sales rose to $1.2 billion, up 5.9% versus the same period a year earlier. Its operating cash flow increased 45% year-over-year to $440.79 million.

SNOW's Deal With OpenAI

In a deal announced on Feb. 2, Snowflake agreed to invest as much as $200 million to provide OpenAI's models to its customers via SNOW's Cortex AI offering.

"Snowflake is committing up to $200 million to purchase access to OpenAI's frontier models and ChatGPT Enterprise over the course of the multi-year agreement," said Baris Gultekin, Snowflake's vice president of AI.

The Potential Implications of the Deal for SNOW Stock

As a result of the agreement, Snowflake's large corporate and government customers will be able to utilize OpenAI's technology directly on Snowflake's systems. Previously, customers could query OpenAI's models on Microsoft's cloud-infrastructure platform, Azure.

By launching a partnership with OpenAI, Snowflake, which utilizes a consumption-based pricing system, will benefit directly every time its customers use the technology. Moreover, once the company's customers get used to accessing OpenAI through Snowflake, they will probably be significantly be more likely to purchase other AI services and infrastructure from the company.

Over the medium-term, Snowflake, given the many large customers that store huge amounts of data on its servers, will likely be well-positioned to take significant AI market share from Microsoft's Azure and Amazon's AWS.

The AI offerings of AWS and Azure have been among the main reasons that the platforms have grown so rapidly in recent years and become such large, flourishing businesses. If SNOW is able to take even 10% of their AI market share, its financial results will get a big boost.

What's more, if the market starts to look at SNOW as more of an AI stock, it may become significantly more positive toward the name.

Valuation and the Bottom Line on SNOW Stock

Snowflake's P/S ratio of 18.8x is quite high. But analysts on average expect its revenue to jump 28% this year and another 24% in 2027. The company's deals with OpenAI and Anthropic should cause that growth to accelerate to meaningfully higher levels, making SNOW appealing for many growth investors even at its current, high valuation.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)