The Chemours Company CC has announced that it is developing a low global warming potential (GWP) refrigerant retrofit strategy for the automotive aftermarket to help support the global phaseout of higher GWP hydrofluorocarbon (HFC) refrigerants. The technical approach will allow car owners and service professionals with a simple retrofit process to safely and cost-effectively replace the legacy R-134a refrigerant in their existing vehicle with the widely used, low GWP Opteon YF refrigerant. Opteon YF was designed to replace R-134a in new mobile HVAC systems.

Customer satisfaction, safety and ease of use are always the highest objectives. Hence, it is developing a simple retrofit approach that draws on current safe servicing standards while offering a lower GWP refrigerant choice. Providing a fully integrated approach with matched performance and a reduced environmental footprint will benefit both the automobile industry and society as a whole.

As the use of Opteon YF grows in response to global climate targets and laws, Chemours has continued to collaborate with industry to encourage adoption. Creating a safe, easy and cost-effective retrofit strategy to aid in the transition to low GWP technology is an important step forward.

Opteon YF, which was developed more than a decade ago, has become the favored low GWP refrigerant among worldwide vehicle makers. Chemours anticipates its Opteon portfolio to eliminate an estimated 325 million tons of carbon dioxide equivalent by 2025. As global HFC phaseout activities accelerate, Opteon YF has been meeting GWP targets and performance criteria.

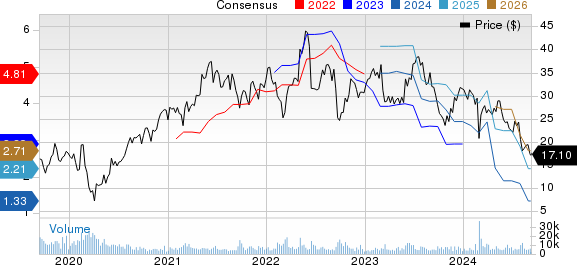

Shares of Chemours have lost 46.1% over the past year compared with a 9.7% decline of its industry.

Image Source: Zacks Investment Research

CC forecasts a low to mid-single-digit sequential decline in net sales for the third quarter due to the continued effects of the unplanned downtime at its Altamira, Mexico manufacturing site in Titanium Technologies during the second quarter. The downtick is also influenced by seasonal fluctuations in refrigerant demand and weaker Freon refrigerant pricing in Thermal & Specialized Solutions as well as a modest recovery in Advanced Performance Materials.

Despite these challenges, the company projects continued strong adoption of Opteon refrigerants, anticipating double-digit year-over-year growth, along with robust performance in the Performance Solutions portfolio.

In addition, the company expects a high-single-digit sequential decline in adjusted earnings before interest, taxes, depreciation and amortization for the third quarter, which reflects $15-$20 million in costs related to the unplanned shutdown at Altamira. However, corporate expenses are anticipated to fall sequentially as efforts around controls remediation continue, with the majority of these costs concentrated in the first half of the year.

Zacks Rank & Key Picks

CC currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO and Hawkins, Inc. HWKN.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.9%. The company's shares have soared 125.1% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Eldorado’s current-year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO, a Zacks Rank #1 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.3%. The company's shares have rallied roughly 80.5% in the past year.

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14, indicating a rise of 15.3% from year-ago levels. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days. HWKN, a Zacks Rank #1 stock, has rallied around 101% in the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS): Free Stock Analysis Report

Eldorado Gold Corporation (EGO): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

Hawkins, Inc. (HWKN): Free Stock Analysis Report