Latin American e-commerce and fintech company MercadoLibre (NASDAQ:MELI) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 41.5% year on year to $5.07 billion. It made a GAAP profit of $10.48 per share, improving from its profit of $5.12 per share in the same quarter last year.

Is now the time to buy MercadoLibre? Find out by accessing our full research report, it's free.

MercadoLibre (MELI) Q2 CY2024 Highlights:

- Revenue: $5.07 billion vs analyst estimates of $4.68 billion (8.3% beat)

- EPS: $10.48 vs analyst estimates of $8.48 (23.6% beat)

- Gross Margin (GAAP): 46.6%, down from 52.3% in the same quarter last year

- Free Cash Flow of $1.70 billion, up 24.7% from the previous quarter

- Market Capitalization: $84.61 billion

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

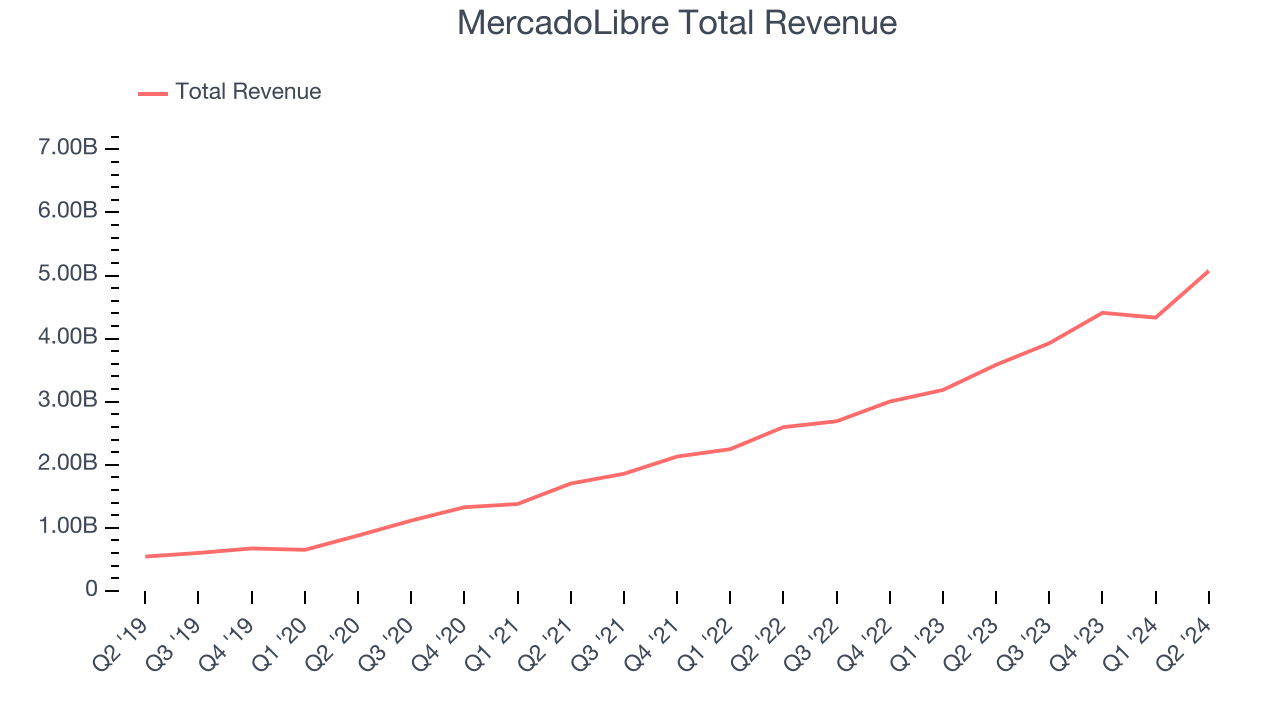

Sales Growth

MercadoLibre's revenue growth over the last three years has been impressive, averaging 48.2% annually. This quarter, MercadoLibre beat analysts' estimates and reported impressive 41.5% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 20.8% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Key Takeaways from MercadoLibre's Q2 Results

We were impressed by how significantly MercadoLibre blew past analysts' revenue expectations this quarter thanks to its better-than-anticipated GMV growth. We were also glad its EPS beat Wall Street's estimates, and the company noted some of its investments from prior quarters are starting to pay off and solidify its leadership position. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock traded up 8.5% to $1,740 immediately following the results.

MercadoLibre may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)