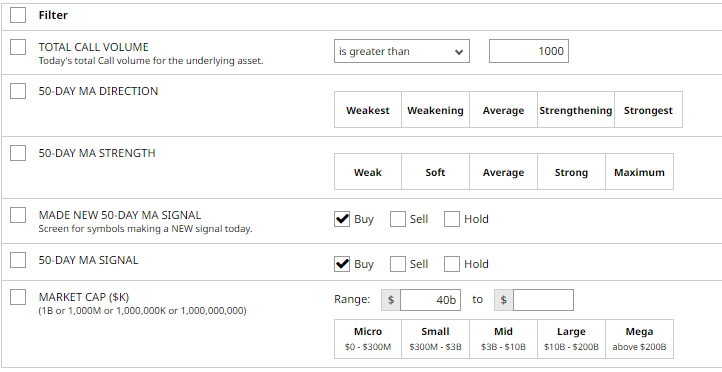

Today, we are using some moving average filters to find bullish stocks and then looking at a couple of different trade ideas.

First the stock scanner:

Which produces these results:

Now that we have some bullish stock candidates, let’s analyze three different option ideas.

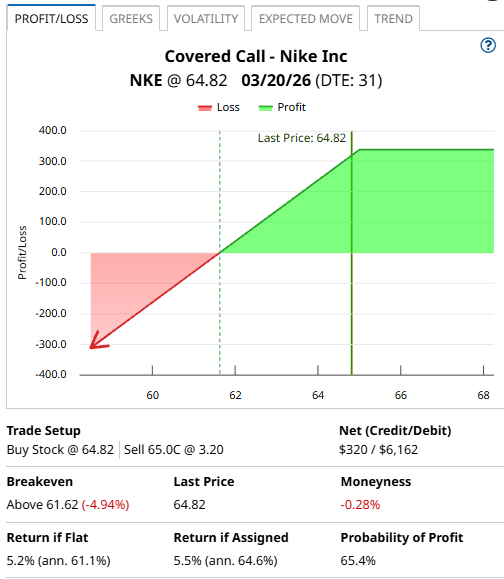

Nike Covered Call

The first trade we will look at is a Covered Call on Nike (NKE).

First, let’s run our covered call screener:

Let’s evaluate the first NKE covered call example. Buying 100 shares of NKE would cost around $6,482. The March 20, $65 strike call option was trading yesterday for around $3.20, generating $320 in premium per contract for covered call sellers.

Selling the call option generates an income of 5.2% in 31 days, equalling around 61.1% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of $65?

If NKE closes above $65 on the expiration date, the shares will be called away at $65, leaving the trader with a total profit of $338 (gain on the shares plus the $320 option premium received). That equates to a 5.5% return, which is 64.6% on an annualized basis.

Nvidia Bull Put Spread

A bull put spread is a defined risk option strategy that profits if the stock closes above the short strike at expiry.

To execute a bull put spread an investor would sell an out-of-the-money put and then buy a further out-of-the-money put.

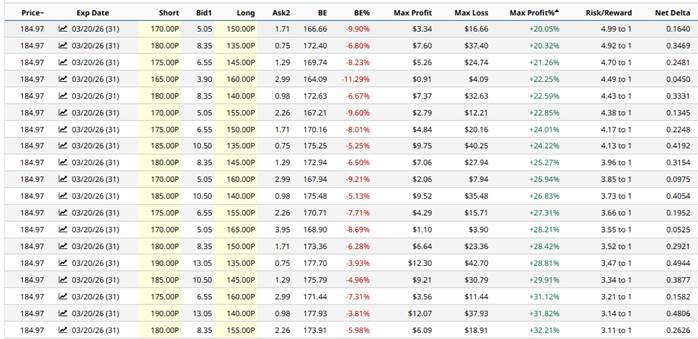

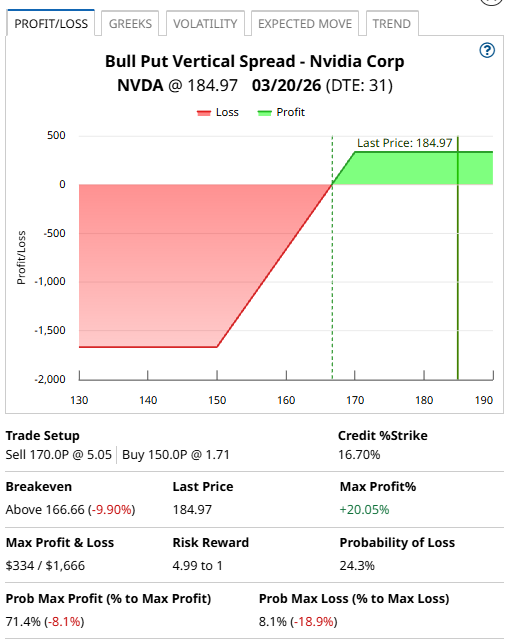

Running the Barchart Bull Put Spread Screener shows these results for Nvidia (NVDA):

Let’s use the first line item as an example. This bull put spread trade involves selling the March 20 expiry $170 strike put and buying the $150 strike put.

Selling this spread results in a credit of around $3.34 or $334 per contract. That is also the maximum possible gain on the trade. The maximum potential loss can be calculated by taking the spread width, less the premium received and multiplying by 100. That give us:

20 – 3.34 x 100 = $1,666.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 20.05%.

The probability of the trade being successful is 75.7%, although this is just an estimate.

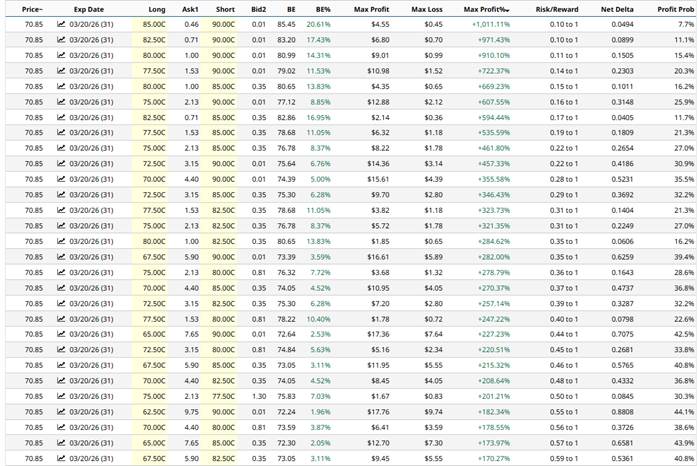

For Delta Airlines (DAL), let’s look at the bull call spread screener.

Delta Airlines Holdings Bull Call Spread

Here are the results of the bull call spread screener:

A bull call spread is created through buying a call and then selling a further out-of-the-money call.

Selling the further out-of-the-money call reduces the cost of the trade but also limits the upside.

A bull call spread is a risk defined trade, so you always know the worst-case scenario. Bull call spreads are positive delta (bullish) and positive vega (benefit from a rise in implied volatility).

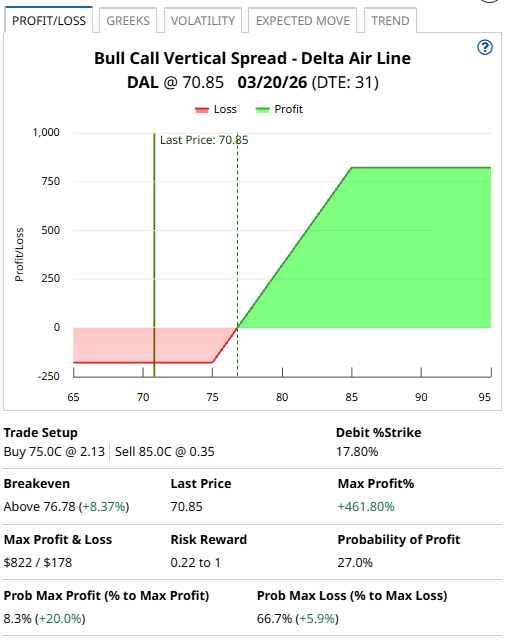

The trade I’m looking at involves buying the March 20 expiration, $75-strike call and selling the $85-strike call.

The trade cost would be $178 (difference in the option prices multiplied by 100), and the maximum potential profit would be $822 (difference in strike prices, multiplied by 100 less the premium paid).

This trade has a max profit potential of 461.80% and a probability of profit of 27.0%.

Conclusion

There you have three different bullish trade ideas on three different stocks. Remember to always manage risk and have stop losses in place.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster had a position in: NVDA , NKE . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)