/ARK%20Invest%20logo%20by%20ChrisStock82%20via%20Shutterstock.jpg)

The famous investor Cathie Wood is renowned for choosing companies focused on disruptive innovation, meaning companies that have the potential to change how industries work over the long term. So when her fund, ARK Invest (ARKK), adds or dumps shares, investors notice. Last week, ARK Invest added 210k shares of a healthcare tech company called Tempus AI (TEM). Wood has made repeated purchases of the stock, signaling her confidence in this rising AI bet. Tempus AI now holds 5.17% weightage in the ARK Innovation ETF and 8.3% weightage in the ARK Genomic Revolution ETF.

Should you follow Wood’s steps and buy this early-stage AI opportunity in healthcare?

About Tempus AI

Valued at $9.24 billion, Tempus AI is a mid-cap healthcare tech company that collects and analyzes massive volumes of medical data using artificial intelligence (AI). The company then extracts patterns and insights from the data, which includes DNA and genetic information, lab test results, medical records, family history, imaging, and clinical outcomes, to assist clinicians in selecting personalized treatment for the patient.

A Strong Growth Year Driven by Diagnostics and Data

Recently, Tempus announced its preliminary and unaudited fourth quarter and full year results, which highlighted substantial growth across its key businesses. For the fourth quarter, the company reported revenue of $367 million, an increase of 83% year-over-year (YOY). Diagnostics revenue of about $266 million rose 121% YOY, with a 21% increase in oncology volumes and a 23% increase in hereditary volumes. Furthermore, data and applications revenue rose 25% to $100 million, while Insights (data licensing) grew roughly 68%.

For the full year, revenue of $1.27 billion increased 83% YOY, including roughly 30% organic growth besides Ambry. Diagnostics revenue of about $955 million rose 111% YOY, driven by oncology volume growth of roughly 26%. Additionally, hereditary testing growth of around 29% also contributed to the increase. Data and applications revenue of $316 million grew 31% YOY, supported by 38% growth in Insights.

CEO Eric Lefkofsky described 2025 as an exceptional year, noting accelerating genomics volume growth. With AI embedded across its offerings, Tempus enters 2026 with both primary segments showing accelerating growth and increasing financial leverage from its platform model. Tempus will report its fourth quarter and full-year earnings on Feb. 24.

Tempus is not just a diagnostics company but a tech platform advancing precision medicine through AI. It further strengthened its AI strategy with the announcement of a collaboration with Median Technologies to integrate the company’s AI-powered lung cancer screening tool, eyonis LCS, into the Tempus Pixel platform. By integrating AI-driven screening into this FDA-cleared Pixel platform, Tempus hopes to assist physicians in detecting the disease early, prioritizing high-risk patients, and improving diagnostic decision-making without complicating existing workflows.

What Does Wall Street Say About Tempus AI?

Wall Street sentiment around Tempus AI remains bullish with an overall “Moderate Buy” rating. Recently, Canaccord Genuity analyst Kyle Mikson, CFA, maintained his “Buy” rating on the stock, citing robust growth in oncology and hereditary diagnostics volumes and accelerating expansion in the Insights business. Mikson expects Tempus to be EBITDA positive in 2025 and projects roughly $1.59 billion in revenue in 2026, supporting a credible path toward sustained profitability. The analyst maintains an $80 price target.

Separately, H.C. Wainwright also reiterated a “Buy” rating with an $89 price target, reflecting continued confidence in Tempus AI’s long-term growth prospects in AI-enabled precision medicine.

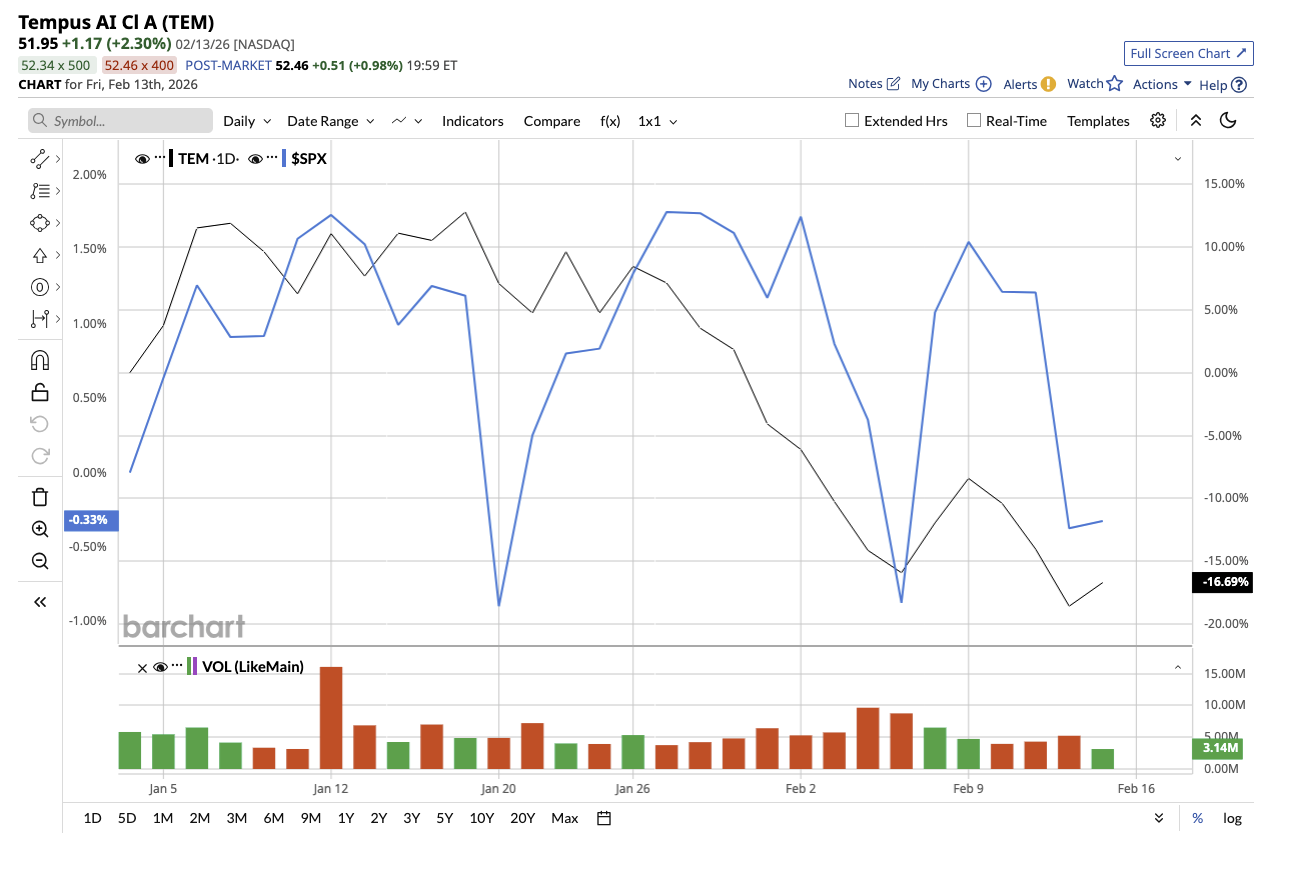

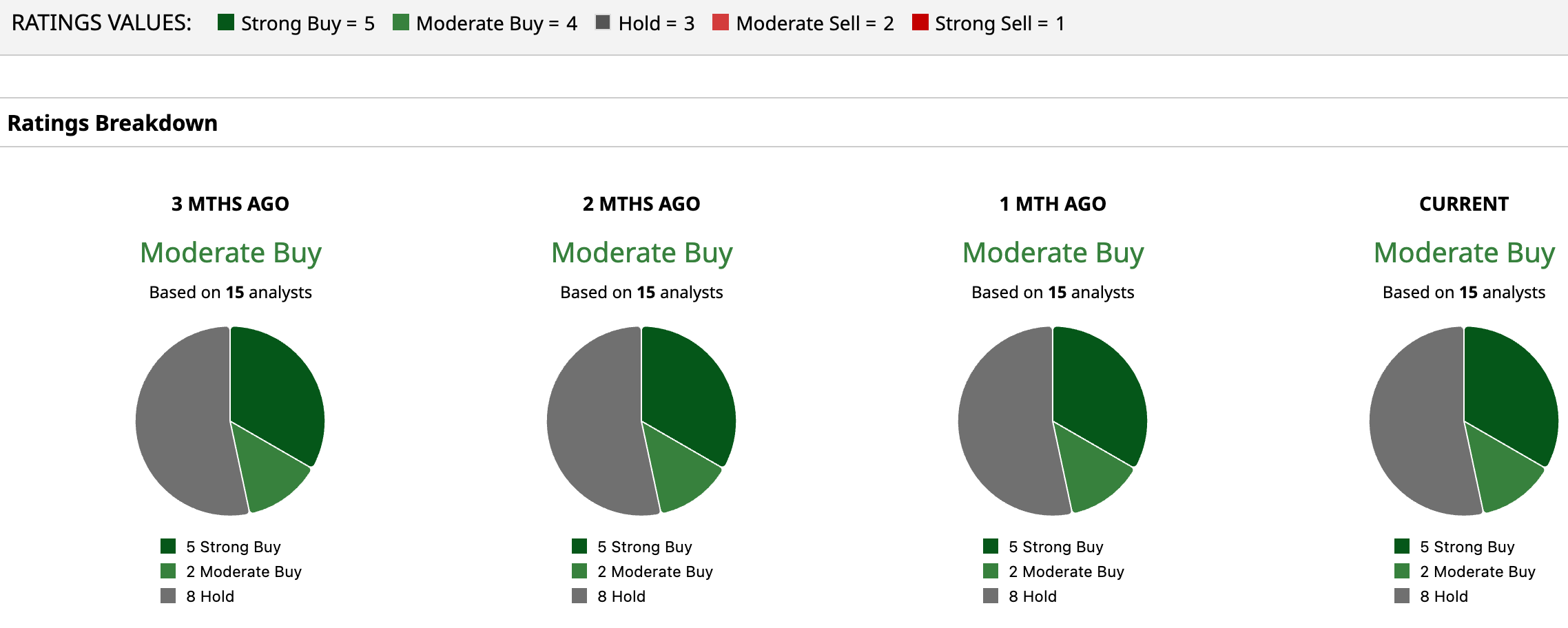

While Tempus stock is down 10.9% so far this year, analysts see potential upside of 66.8% from current levels if it hits its average price target of $87.92. Plus, the high price target of $105 implies the stock could surge by as much as 99% over the next year.

Among the 15 analysts covering the company, five give it a “Strong Buy” rating, two recommend a “Moderate Buy,” and eight suggest holding.

Why Wood Chose Tempus?

It doesn’t come as a surprise that Cathie Wood made repeated purchases in Tempus AI stock. Tempus captures two major Wood’s investment themes — disruptive innovation in healthcare and AI. Genomics and AI together could significantly improve outcomes and reduce healthcare costs. The market for this might be massive, providing Tempus a long-term competitive edge. Tempus’ growth profile is undeniably strong.

While Wood sees long-term potential in Tempus, like most growth stocks, it carries risks. Tempus is investing heavily in AI infrastructure, data collection, and research partnerships, which will increase costs in the short term. It could be a long road to profitability, resulting in short-term volatility in the stock.

For investors who are ready to endure this volatility in exchange for long-term innovation exposure, Tempus could be an attractive AI healthcare investment.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)