/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is expected to set fresh records this year, and hyperscalers refuse to cede an inch. They continue to funnel record capital into data centers and advanced computing, determined not to trail their rivals. Into this charged setting, D.A. Davidson has initiated coverage on Broadcom (AVGO).

Analyst Gil Luria argued that the company stands on a “shrinking iceberg” as hyperscalers increasingly favor customized accelerators. He acknowledged AI application-specific integrated circuits’ (ASICs) growing relevance yet questioned the durability of Broadcom’s long-term positioning in that market.

The firm warned that the largest customers could internalize more of the AI stack over the next few years. If hyperscalers design more tooling and silicon in-house, suppliers may feel margin pressure.

On that basis, D.A. Davidson concluded that Broadcom’s AI ASIC exposure does not merit a premium multiple versus leaders such as NVIDIA (NVDA) and assigned the stock a “Neutral” rating. So let us find out whether Broadcom truly stands on a shrinking iceberg or continues to build firmer ground beneath it.

About Broadcom Stock

Headquartered in Palo Alto, California, Broadcom is a global technology powerhouse that develops semiconductor devices and enterprise software. With a market cap of roughly $1.5 trillion, it develops networking chips, wireless and broadband components, storage and server solutions, cybersecurity tools, and cloud infrastructure platforms.

Over the past three months, the stock has slipped 2.55%, reflecting near-term pressure. Yet the broader trend tells a more positive story. Shares have advanced 9% over the past six months and rallied 43.28% across the past 52 weeks, underscoring sustained momentum beyond short-term volatility.

From a valuation standpoint, AVGO stock is currently trading at 38.08 times forward-adjusted earnings and 15.90 times sales, both signaling a premium multiple.

In addition, Broadcom has grown its dividends for 15 consecutive years. It pays an annual dividend of $2.60 per share, which equates to a 0.80% yield. The company paid its most recent dividend of $0.65 per share on Dec. 31, 2025, to shareholders of record as of Dec. 22, 2025.

Broadcom Surpasses Q4 Earnings

On Dec. 11, 2025, Broadcom reported fourth-quarter fiscal 2025 results, wherein revenue reached $18.02 billion, surpassing the $17.49 billion analyst estimate. Total revenue climbed 28.2% year-over-year (YOY) driven largely by a 74% surge in AI chip sales, which totaled $8.2 billion for the quarter.

Broadcom books its AI chip sales within the semiconductor solutions segment, which generated $11.07 billion in revenue, marking a 22% YOY increase. Its infrastructure software segment delivered similar strength, with revenue climbing 26% to $6.94 billion.

Adjusted EPS rose 37.3% YOY to $1.95, topping the $1.86 Street’s forecast. During the quarter, it also generated $7.703 billion in operating cash flow, spent $237 million on capital expenditures, and delivered $7.47 billion in free cash flow. Few companies convert revenue into liquidity so efficiently.

CEO Hock Tan expects AI chip sales in the current quarter to double YOY to $8.2 billion, spanning custom AI accelerators and networking semiconductors. Moreover, management has guided Q1 fiscal 2026 revenue to approximately $19.1 billion, implying 28% YOY growth.

On the other hand, analysts project Q1 fiscal year 2026 EPS to rise 19.3% YOY to $1.67. For the full fiscal year 2026, they expect the bottom line to climb 54.5% to $8.70. Looking ahead to fiscal 2027, they forecast a further 40.7% increase to $12.24.

What Do Analysts Expect for Broadcom Stock?

While D.A. Davidson maintains a Neutral rating and a $335 price target on AVGO, other analysts strike a far more confident tone. At Bernstein SocGen, analyst Stacy Rasgon reiterated an “Outperform” rating and set a $475 price target, emphasizing the company’s technological edge, disciplined XPU roadmap execution, and formidable supply chain scale.

Meanwhile, Blayne Curtis from Jefferies Financial Group reaffirmed his “Buy” rating and established a $500 price target. He has expressed confidence that Broadcom’s core fundamentals will continue to power outperformance.

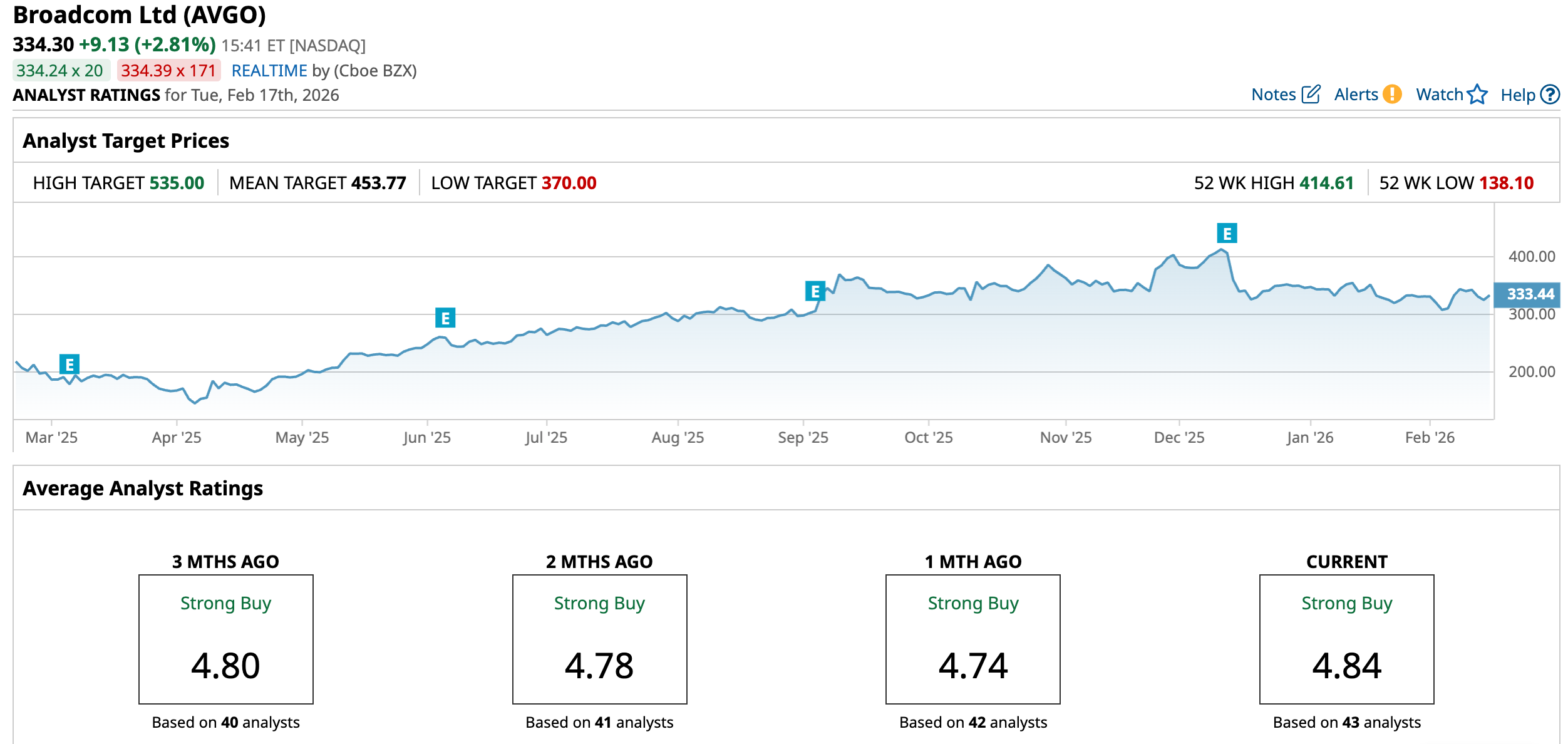

Wall Street currently assigns AVGO stock a “Strong Buy” overall rating. Among 43 analysts covering the stock, 38 recommend “Strong Buy,” three suggest “Moderate Buy,” and two call for “Hold.”

Nevertheless, the average price target of $453.77 represents potential upside of 35.7%. Meanwhile, the Street-high target of $535 suggests a gain of 60% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)