In my January 9, 2026, Barchart report on the soft commodities sector, I concluded with the following:

Commodity cyclicality also suggests that prices rise to levels where production increases, inventories build, demand decreases, and prices turn lower. In 2025, the soft commodity sector, excluding world sugar and cotton, experienced cyclical effects. Time will tell if cotton and sugar prices can recover in 2026, but cyclicality favors the upside.

The continuous ICE cotton futures contract fell 6.04% in 2025, closing last year at 64.27 cents per pound. So far, cotton prices have not recovered, and were just over 62 cents in February 2026.

Cotton’s bear market continues

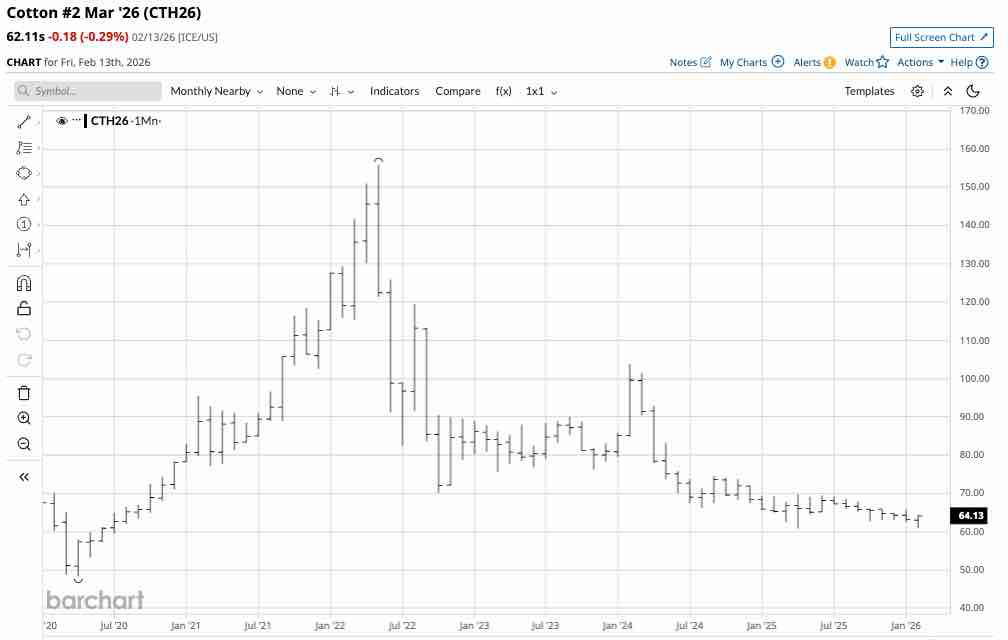

ICE cotton futures have made lower highs and lower lows since the price reached a high of $1.5595 per pound in May 2022.

The monthly chart shows a bearish pattern in the cotton futures market, with prices not trading above $1 per pound since March 2024. Cotton fell to its most recent low of 60.90 cents per pound in February 2026, and at just over 64 cents for May 2026 delivery, the price is within striking distance of that low and remains in a bearish trend.

Cotton is close to a critical technical support level

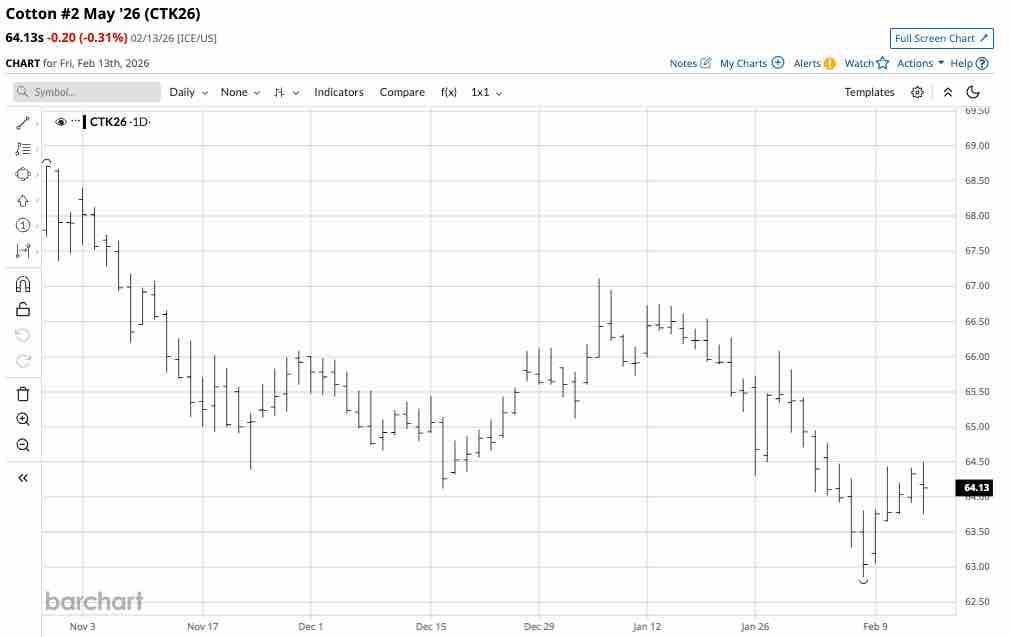

As ICE March cotton futures roll into May, price action remains negative, with cotton near the technical support level on the May contract.

The daily May cotton futures chart shows that technical support is at the February 6, 2026, low of 62.86 cents per pound. While cotton futures bounced over 64 cents on Friday, February 13, they remain near the support level. Below 62.86, critical support is at the continuous contract low of 60.90 cents per pound.

The February WASDE report was not bullish

The U.S. Department of Agriculture released its February World Agricultural Supply and Demand Estimates Report on February 10, which told the cotton market:

While U.S. exports fell by 200,000 bales and the WASDE raised ending U.S. inventories by the same amount, global inventories rose by approximately 630,000 bales due to increased production from China and South Africa and lower world exports. The WASDE report provided no reasons for cotton prices to rally over the coming weeks.

Cotton open interest has jumped

Open interest is the total number of open long and short positions in a futures market. The total open interest in the ICE cotton futures closed 2025 at 303,722 contracts and rose 27.2% to a record high of 386,418 contracts on February 4, 2026. At over 344,600 contracts on February 13, the open interest in cotton futures remains elevated.

Rising open interest while the price is declining tends to be a bearish confirmation of the current trend. However, it also reflects increased hedging and the potential of rising short positions in the cotton futures market.

I remain cautiously bullish on the fluffy soft commodity- Seasonality and limited downside risk

Each crop year is a new adventure in agricultural markets, and cotton is no exception. Cotton tends to reach seasonal highs in spring and early summer, when uncertainty about crop growing conditions peaks. Cotton futures’ high in 2022 occurred in May, and the lower peak in 2024 occurred in February, with the crop year on the horizon.

Commodity cyclicality suggests that prices fall to levels where production slows, inventories begin to decline, consumption increases at lower prices, and they find bottoms. Therefore, at 60 cents per pound, cotton could be near a cyclical low, with limited downside price risk. I remain a scale-down buyer of cotton futures in the current environment as the weather in key growing areas, including China, India, Brazil, the United States, Australia, and Pakistan, will determine the path of cotton prices.

The only route for a risk position in cotton is the ICE cotton futures. Each contract contains 50,000 pounds. At 64 cents per pound, the contract value is $32,000. The ICE exchange’s original margin requirement for cotton is $1,254. A market participant can control $32,000 worth of cotton futures for a 3.92% down payment. If equity falls below $1,140 per contract, the exchange requires maintenance margin payments.

Cotton offers value at the current price level, but that does not mean prices will not fall to new lows. In April 2020, the global pandemic caused prices to reach a 48.35 low, and in late 2008, they reached 39.23 cents per pound. However, in the current inflationary environment, with production costs rising and the U.S. dollar’s value declining, I believe cotton prices will hold around 60 cents per pound. Commodity cyclicality and seasonality increase the odds of a recovery rally over the coming weeks and months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)