/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

Infosys (INFY) stock opened higher on Feb. 17, after the company announced a strategic partnership with Anthropic, an artificial intelligence (AI) giant behind the Claude family of LLMs. According to the press release, this partnership will focus on developing advanced AI agents for highly regulated industries, including telecommunications, financial services, and manufacturing.

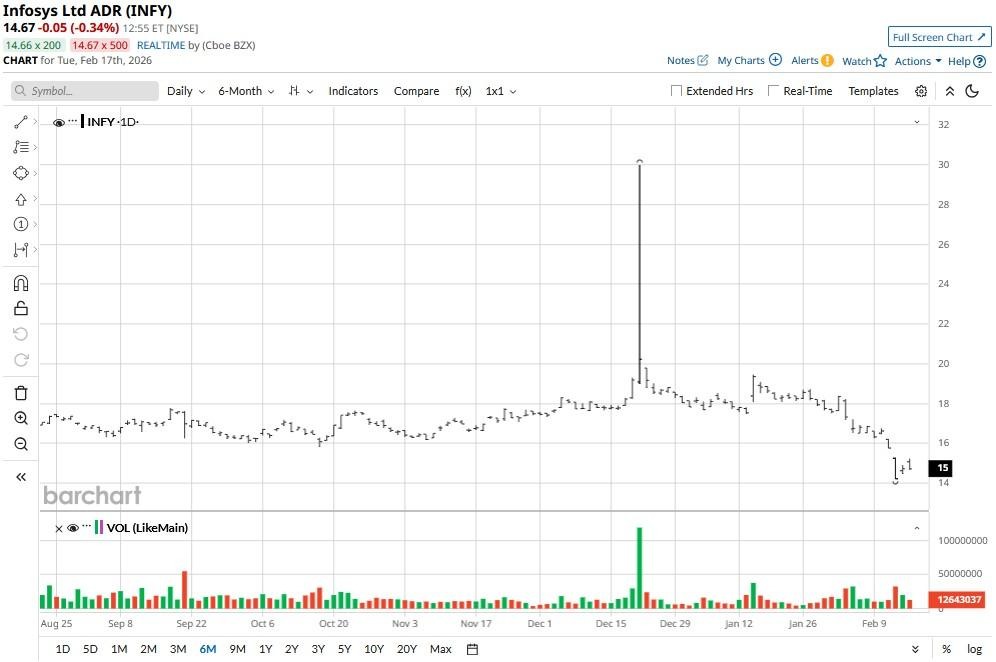

Despite today’s news, Infosys stock remains down some 8% versus its year-to-date high.

Does Anthropic Deal Warrants Buying Infosys Stock?

The Anthropic announcement is majorly positive for INFY stock, as it signals the firm’s transition from a service provider to an AI orchestrator.

By launching a dedicated Anthropic Center of Excellence, Infosys is positioning itself to capture high-margin agentic AI projects that require both frontier models and deep domain expertise.

Teaming up with the San Francisco-headquartered AI specialist directly addresses investor fear that generative artificial intelligence would cannibalize traditional IT outsourcing.

It demonstrates how Infosys can use tools like Claude Code to accelerate software delivery and modernize legacy systems, effectively turning an existential threat into a revenue driver.

Note that INFY’s relative strength index (14-day) currently sits at 31, indicating upward pressure could sustain in the near term.

INFY Shares Aren’t Expensive to Own in 2026

Long-term investors should consider loading up on Infosys stock also because it’s currently trading at a compelling valuation.

Following a sector-wide correction, INFY is going for a forward price-to-earnings (P/E) multiple of about 18x, significantly below its five-year peak.

Infosys offers a massive $11.7 billion large-deal pipeline and already drives about 5.5% of its sales from artificial intelligence services, which make its stock even more attractive in 2026.

According to Barchart, options traders also currently see potential upside in INFY to nearly $17 by mid-April, meaning its share price could climb another 15% within the next two months.

What’s the Consensus Rating on Infosys?

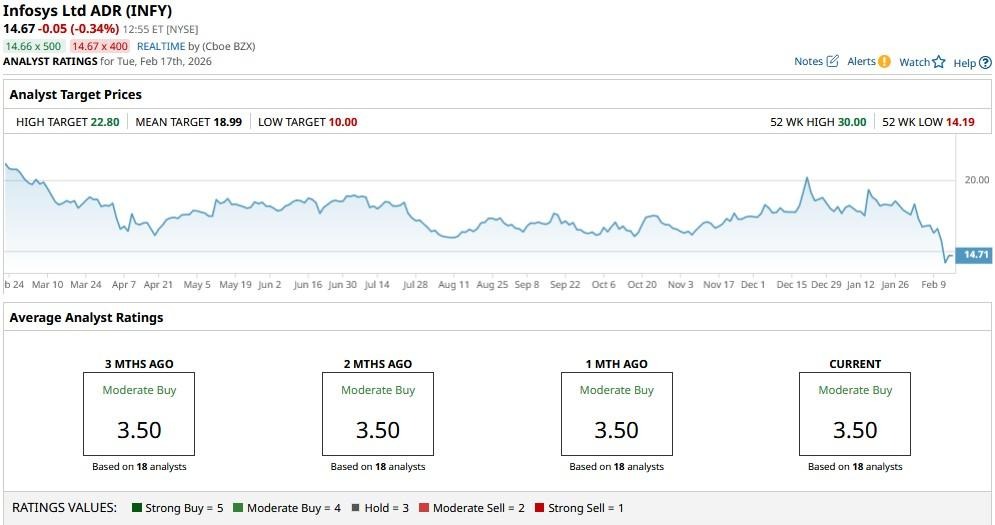

Interestingly, Wall Street analysts are even more constructive on Bengaluru-headquartered Infosys than derivatives data.

The consensus rating on INFY shares remains at “Moderate Buy,” with the mean target of roughly $19 suggesting they could rally as much as 27% from current levels through the end of 2026.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)