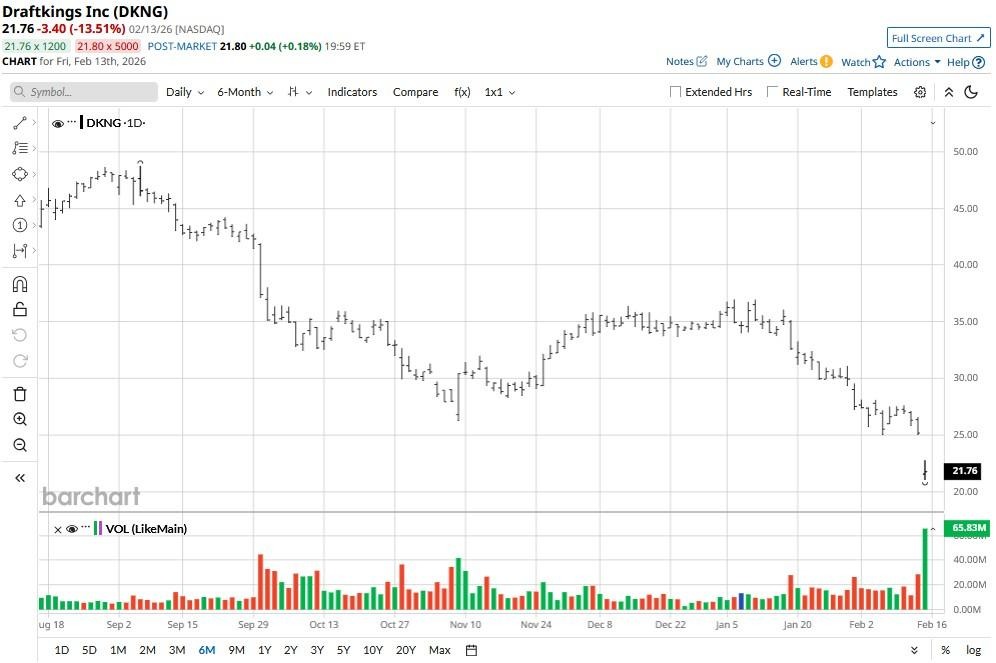

DraftKings (DKNG) says record performance in Q4 helped it report its first-ever annual profit in 2025. Shares still crashed 13% late last week as investors reacted to its lukewarm guidance for the full year.

The post-earnings slump pushed DKNG’s relative strength index (14-day) deep into the “oversold” territory, making it exciting for investors on the lookout for a bargain.

Down some 40% year-to-date, DraftKings stock is now trading at 22x forward earnings, which Jefferies dubbed a “buying opportunity” for long-term investors in its latest research note.

Why Does Jefferies Remain Bullish on DraftKings Stock?

In its earnings release, DraftKings shared that user growth remained flat at 4.8 million in the fourth quarter, while its 2026 revenue guidance fell $0.4 million short of consensus as well.

Still, Jefferies analysts believe the outlook will prove rather conservative given it doesn’t account for the firm’s venture into prediction markets.

DKNG’s chief executive Jason Robins echoed that sentiment on the earnings call calling prediction markets a “massive, incremental opportunity” for the Nasdaq-listed firm.

It will help the company “acquire millions of customers” – driving DKNG stock price up notably over time.

How High Could DKNG Shares Fly in 2026?

Jefferies experts favor buying DraftKings shares also because a swing to $136 million in Q4 net income “demonstrates the underlying strength of its core business.”

According to them, the demand for sports wagering isn’t decelerating in the U.S., and DraftKings is strongly positioned to remain a leader in that fast-growing market.

In a post-earnings report, the investment firm maintained its “Buy” rating on DKNG with a $46 price target signaling potential for the stock to more than double by the end of 2026.

And options traders seem to agree. Derivatives contracts expiring June 18 currently have the upper price set at about $27, indicating DraftKings could rally over 22% within the next four months.

DraftKings Remains a Buy-Rated Stock

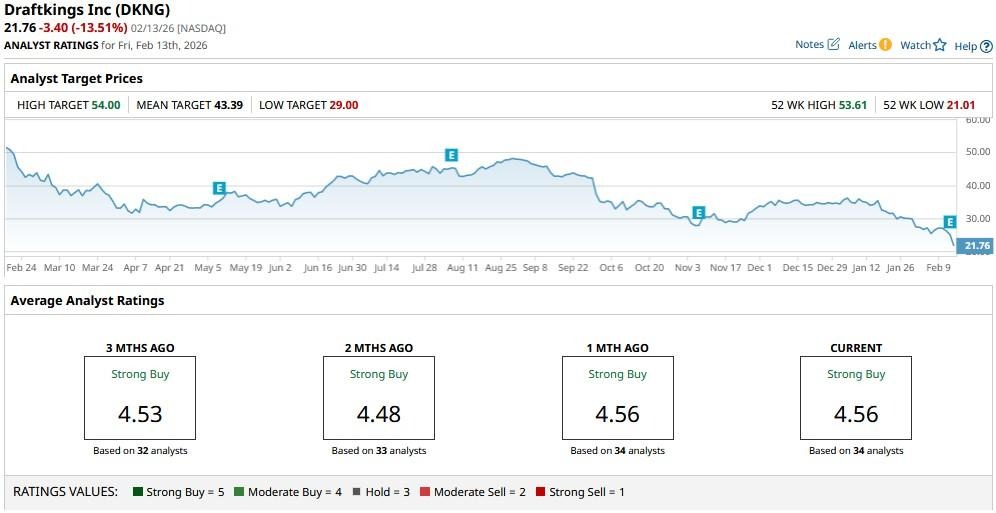

DraftKings’ conservative guidance hasn’t deterred other Wall Street firms either.

The consensus rating on DKNG shares remains at “Strong Buy” with the mean target of about $43 suggesting they could rally more than 100% from here by year-end.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)