/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Famed short investor and now artificial intelligence (AI) bear Michael Burry can claim that his stance was vindicated, at least for the short while. Two of his most high-profile targets have been chip major Nvidia (NVDA) and AI-driven data analytics platform Palantir (PLTR). Since Nov. 4, when Burry's significant short positions were made public through a U.S. Securities and Exchange Commission (SEC) filing, NVDA stock is down roughly 8% and PLTR stock is down an even more substantial 31%.

In a recent Substack post, Burry again aimed at the Alex Karp-led company, leading to a 5% fall in PLTR stock in the Feb 12. trading session. Burry highlighted how the technical setup of the stock (a head and shoulders pattern, which denotes a bearish reversal) positions it for downside in the short term. However, that was primarily the Palantir-specific point he made for a fall in the company's share price. Burry also went on about his previous assertions regarding the AI bubble and that the companies involved in AI are inflating earnings.

DISA Approval Flies in the Face of Burry

Palantir shareholders could not be bothered about this much, as the company recently received an important authorization from the Defense Information Systems Agency (DISA). The authorization involved the extension of Palantir Federal Cloud Service Forward Impact Level 5 and Impact Level 6 Provisional Authorizations for on-premises and edge deployments. This essentially allows the Department of War (formerly the Department of Defense) to run Palantir’s full stack (Gotham, Foundry, AIP) on its own internal physical servers, which is a requirement for many legacy defense systems.

Why is this a win for Palantir? Well, Palantir has essentially decoupled its high-security software from specific hardware. The government can now buy any server and immediately run Palantir on it because the software is already "pre-approved" by DISA.

Commenting on the development, President and CTO of Palantir USG Akash Jain said, "We’re proud to continue our work with DISA to give the U.S. Government the flexibility to bring cutting-edge technology wherever the mission demands. This opens the door for true multivendor architectures at the edge, bringing best-of-breed commercial technology to critical national security missions with unprecedented speed.”

Palantir is also creating another moat by strategically pivoting from labor-dependent human integration to automated, AI-driven deployment architectures, fundamentally altering its margin profile. By replacing human-capital-intensive engineers with autonomous digital counterparts, the firm is successfully transitioning its business model from a low-margin professional services orientation toward a high-margin, pure-play software paradigm. This evolution facilitates a self-sustaining ecosystem characterized by the ability to execute enterprise-wide transformations at near-zero marginal cost, thereby significantly strengthening the company's competitive advantage through superior operational scalability.

Meanwhile, PLTR stock is up just 11% over the past year. However, on a five-year basis, the stock has rocketed by 350%, becoming a bona fide wealth creator for investors. No amount of controversies or bearish talk has been able to derail the $313 billion Palantir juggernaut. But, having said that, is Palantir stock a screaming buy right now? Let's take a closer look.

Palantir's Financials Are Going Gangbusters

There is no evidence of Palantir's growth more stark than its financials. The company measures its financial efficacy by the “Rule of 40,” which implies that a company is in a decent place if the combination of its revenue growth and operating margin crosses 40%. For Palantir, in the most recent quarter, that measure stood at 127%.

Smashing revenue and earnings estimates in the fourth quarter, Palantir reported revenue of $1.41 billion. This marked a yearly growth rate of 70%, with earnings jumping by an even sharper 78% in the same period to $0.25 per share. Operating margin, the other component of the “Rule of 40” metric, stood at 57%, higher than the previous year's figure of 45%.

Commercial revenue continues to close the gap with the firm's U.S. government revenue, too. While U.S. commercial revenue for the quarter came in at $507 million, up 137% year-over-year (YOY), U.S. government revenue for the quarter stood at $570 million, up 66% YOY. Total contract value of deals closed in Q4 2025 soared by 138% from the prior year to $4.26 billion, reflecting continued demand visibility and growing acceptance of the company's offerings.

Cash flows also remained solid. Net cash from operating activities increased by 69% YOY and adjusted free cash flow grew by 53% YOY to $777.3 million and $791.4 million, respectively. Overall, Palantir closed the quarter with a cash balance of $1.42 billion, with short-term debt of just $45.86 million on its books.

For the next quarter, Palantir expects revenue to be in the range of $1.532 billion to $1.536 billion. For the full year, revenue is expected to be between $7.182 billion to $7.198 billion. Notably, the midpoint for Q1 would represent a yearly rise of more than 140% while the midpoint of the 2026 expected figure would imply a growth rate of 60%.

However, one glaring blemish about PLTR stock is its valuation, as it continues to trade at astronomical levels. The forward price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) ratios of 122.8, 68.7, and 186.4 times are all considerably above the sector medians. Even the forward PEG ratio, which takes into account the company's superlative growth, is at 2.48 versus the sector median of 1.5.

Analyst Opinion

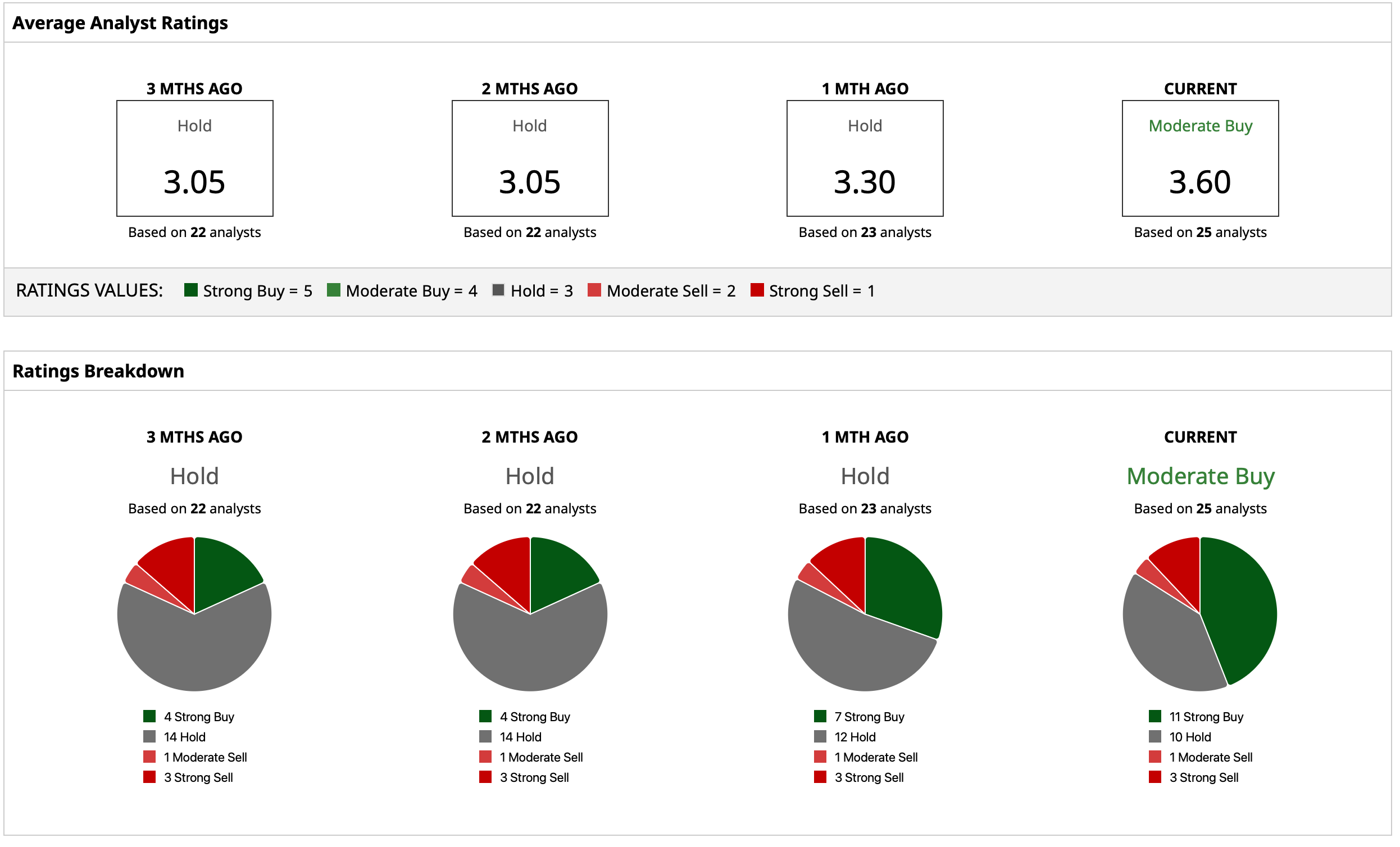

Analysts give Palantir stock a consensus “Moderate Buy” rating, with a mean target price of $200.43. That indicates potential upside of about 53% from current levels. Out of 25 analysts covering the stock, 12 have a “Strong Buy” rating, 10 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)