/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

There is an element of nervousness within the technology sector. The factor of stretched valuations is a potential concern. J.P. Morgan, however, cites “fears of advances in artificial intelligence disrupting the industry” as a reason for the recent pullback in software stocks. The financial company's strategist also believes that some correction is a good opportunity to buy some technology stocks.

With that in mind, Cloudflare (NET) stock is one name that’s worth considering. NET stock has been relatively subdued in the last 52 weeks with returns of 7%. Amidst this consolidation, there seems to be positive news flow for the company.

NET stock rallied by 5% on the back of Q4 results beating Wall Street estimates. The company also issued a healthy guidance as artificial intelligence adoption “fuels demand for its networking and security tools.” With the possibility of robust top-line growth, Cloudflare might just be a significant value creator in 2026.

About Cloudflare Stock

Headquartered in San Francisco, Cloudflare is a cloud service provider to businesses globally. With an objective of protecting the open internet, the company provides integrated cloud-based security solutions for public cloud, private cloud, on-premises, software-as-a-service (SaaS) applications, and Internet of Things (IoT) devices. Cloudflare claims to be blocking 215 billion cyber threats per day.

For FY25, Cloudflare reported revenue of $2.2 billion, with 51% of revenue coming from outside the United States. The company has a healthy track record with the top line growing at a CAGR of 38% between FY20 and FY25.

NET stock has, however, witnessed a correction of 6% in the last six months. With an optimistic growth outlook, it’s likely that the trend will reverse.

AI Adoption-Driven Growth

For 2026, Cloudflare estimates that the total addressable market for its services is $196 billion. This implies ample headroom for growth in the next few years. As of FY25, Cloudflare reported a cash buffer of $4.1 billion. Additionally, the company has an undrawn credit facility of $400 million. With a robust liquidity buffer, Cloudflare is positioned to invest in innovation and potential acquisitions. In January 2026, acquired Human Native, “an AI data marketplace that connects creators and AI developers.”

Rising AI agent stars running on Cloudflare's services are also driving NET stock higher. OpenClaw (formerly Moltbot, and before that known as “Clawd” before “Claude” owners Anthropic's legal team had something to say about that) has skyrocketed in popularity in the tech world. The AI agent can notably also be run using Cloudflare Workers as middleware, which, in short, lessens the hardware requirements to run the AI agent locally.

For FY26, the company has guided for revenue of $2.79 billion (mid-range of guidance). This would imply a year-on-year (YoY) growth of 28%. The key reason for the robust guidance is the acceleration of AI-driven demand. At the same time, Cloudflare has witnessed healthy growth in large customer cohorts.

From the perspective of value creation, Cloudflare reported a free cash flow margin of 12% in FY25. According to the company’s long-term operating model, FCF margin is likely to swell to 25% in the coming years. This would imply robust cash flows for investment in growth and shareholder value creation. Cloudflare estimates that the TAM will expand to $231 billion by 2028. The financial flexibility positions the company to benefit from the big opportunity.

What Do Analysts Say About NET Stock?

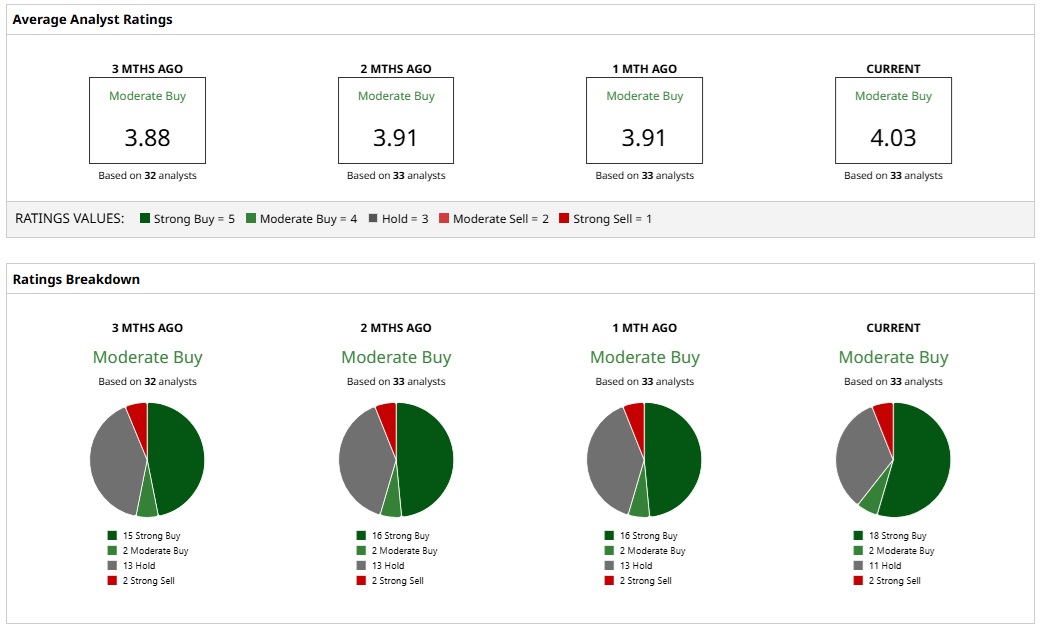

Given the ratings of 33 analysts, NET stock is a consensus “Moderate Buy.” While 18 analysts assign a “Strong Buy” rating to NET, two and 11 analysts opine that the stock is a “Moderate Buy” and “Hold,” respectively. Further, two analysts have a bearish “Strong Sell” rating.

Based on these opinions, NET stock has a mean price target of $241.24 currently, implying an upside potential of 28% from current levels. Further, the most bullish price target of $300 suggests that NET could rise as much as 59% from here.

Earlier this month, BTIG upgraded NET stock to “Buy” from “Neutral.” A key factor for this upgrade is the view that Cloudflare can “conservatively sustain high 20’s revenue growth” through 2028.

Analyst estimates also point to earnings growth of 109.3% and 600% for FY26 and FY27, respectively. Considering the growth outlook, it’s likely that NET stock will trend higher from current levels.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)