McDonald's Corp (MCD) posted good results for 2023, despite critics' complaints about comp sales. The fast-food company kept its very high free cash flow margins - 28.5% in 2023. As a result, MCD stock could be worth as much as 20% more at $340 per share based on analysts' sales estimates for 2024.

Moreover, existing shareholders can enhance their 2.25% dividend yield with extra income by shorting near-term expiry out-of-the-money (OTM) put options. More on that below.

Free Cash Flow Margins Maintained

McDonald's said its Q4 comp sales (i.e., like-for-like sales for stores open 12 months) rose 9% globally, and total revenue was up 10% to $25.493 billion.

McDonald's is one of the few companies that also reports its free cash flow (FCF) for the year. It said that the 2023 FCF was $7.255 billion (see page 9 of its earnings release), up 32.2% from the $5.488 billion it generated in 2022.

In other words, even though sales rose 10%, its cash flow profitability rose 32%. That is the very definition of operating leverage. It means that the company has figured out how to squeeze a massive amount of cash out of sales.

That can be seen in its FCF margins. For example, dividing the $7.26 billion in 2023 FCF by $25.49 billion in sales shows that its FCF margin was 28.5%. That is close to the 28.8% FCF margin it made last quarter over the trailing 12 months (TTM). This can be seen by dividing $7.195 billion in TTM FCF last quarter by the TTM $25.01 billion in sales using figures from Seeking Alpha.

In other words, we can expect McDonald's will keep converting about 28.5% of sales going forward into FCF. For example, analysts forecast $26.84 billion in sales this year. That implies FCF could rise to $7.65 billion (i.e., 28.5% x $26.84 billion). This will lead us to a price target.

Price Target for MCD Stock

For example, using MCD stock's present dividend yield of 2.25% implies that its market cap could rise to about $340 billion (i.e., $7.65b / 0.025 = $340 billion). That is the same as multiplying the $7.65 billion in forecast FCF by 44.4x (i.e., the inverse of 0.0225).

But, let's use a more conservative FCF yield metric of 3.0% (i.e., multiplying FCF by 33.3x). That shows that its market cap would be $255 billion.

This is about 20% higher than its present $213 billion market cap. It implies that MCD stock could be worth 20% more at $340 per share (i.e., 1.20 x $283.93 price today).

Other analysts project higher prices as well. For example, the average of 33 analysts reviewed by Anachart.com shows that their average price target is $326.97 per share. That is 14.34% higher than yesterday's close.

Moreover, AnaChart shows that 81% of analysts have buy ratings on the stock after yesterday's results. AnaChart has charts that compare analysts' target prices to the stock's performance. For example, Nick Setyan of Wedbush has consistently done well projecting the stock price and his target price is now $310 per share, well over today's price.

Sell Short OMT Puts for Extra Income

Existing shareholders are presently making a 2.25% dividend yield. They can enhance that yield by relatively safely selling out-of-the-money (OTM) put options (i.e., well below today's price) in nearby expiration periods.

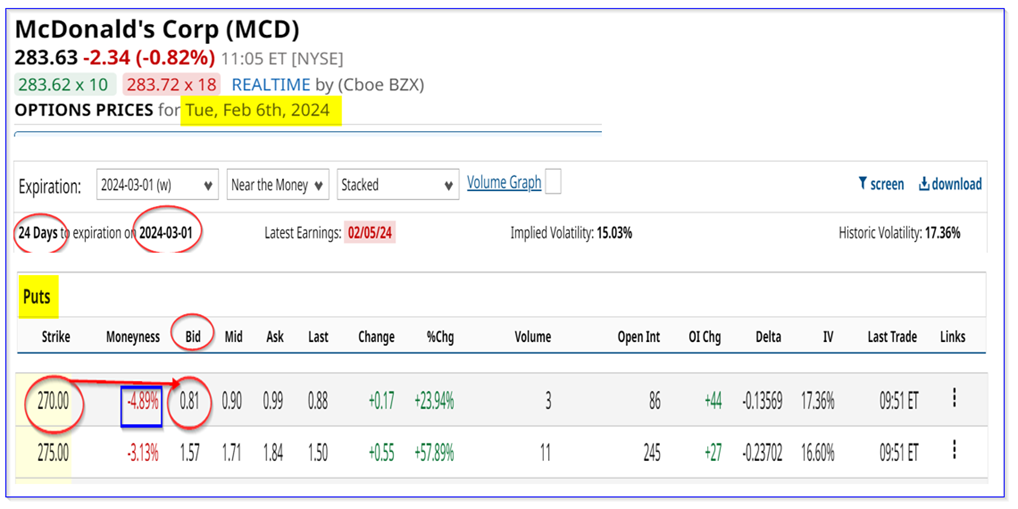

Here is an example. Look at the March 1 expiration option chain, which is about 3 weeks from now. It shows that the $270 strike price, which is almost 4.9% below today's price, sells for 81 cents on the bid side.

That means that any investor who secures $27,000 with their brokerage can enter an order to “Sell to Open” this put and then collect $81. This is because every put contract assumes that 100 shares are potentially exercised. So 100 shares x $270 strike price equals $27,000 in potential purchase obligation to the short seller.

But that also means the short seller makes an immediate income of 0.30% (i.e., $81/$27,000). If this trade can be repeated 4x times during the next 12 weeks, the investor makes $324. That represents a yield of 1.2% per quarter in additional income to an MCD investor.

The only downside is that should the stock fall to $270 the $27K will be used to automatically MCD stock at $270. That could potentially result in an unrealized capital loss, depending on how far MCD stock falls. But the downside is limited by the stock's dividend yield, as well as our assessment that it is likely worth $340 per share. In addition, the investor could always sell covered calls using these newly acquired shares, thereby eliminating some of the unrealized loss.

That means this play is a good potential way to make extra income for the long-term MCD shareholders. The upside in MCD stock makes this play worth holding on or even buying more shares at lower put prices (if the short play is exercised).

More Stock Market News from Barchart

- Stocks Waver on Lower Bond Yields and Mixed Corporate Earnings

- Markets Today: Stocks Fluctuate After Mixed Earnings Results

- Options Insight: Exploring Opportunities in Low Implied Volatility Stocks

- Stock Index Futures Mixed as Investors Await More Corporate Earnings and Fed Speak

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)