Growth stocks are companies projected to expand at a greater pace than the overall stock market. These stocks can provide the potential for massive wealth gain through capital appreciation, but they can also be very risky because of the developing nature of the company.

With the U.S. economy pacing for an economic “soft landing,” based on recent data points, and Fed officials continuing to signal that interest rate cuts are on the agenda for this year, it should be a supportive environment for growth stocks in 2024. For investors looking to add exposure, let’s take a look at 2 growth stocks below $5 with huge upside potential, according to analysts.

1. Blade Air Mobility Stock

Blade Air Mobility (BLDE) is an American aviation company providing cost- and time-efficient solutions to congested ground routes. The company operates via two segments: in its passenger segment, it provides by-the-seat and charter flights in various locations in the U.S. and abroad; and in the medical segment, the company provides air facilities for organ transport using helicopters, jets, turboprops, and ground vehicles.

BLDE shares have lagged the market over the past 52 weeks, down more than 37% over this time frame. However, the stock has added 34% in the past three months alone, boosted by a positive earnings reaction.

Blade Air Mobility reported its Q3 results in early November, where it posted stellar revenue growth of 56% YoY to a record $71.4 million, beating estimate by 6.7%. The company reported net income of $787,000, marking its first quarterly profit, and broke even on a per-share basis - topping expectations for a loss.

The results were driven by revenue growth across its business divisions, as MediMobility Organ Transport revenue rose 65% to $33.4 million, and Passenger revenue climbed 50% to $20.4 million, thanks in part to acquisition and strategic improvements in Europe.

BLDE is reasonably valued, with the price/sales ratio of 0.99 representing a discount to the industrials sector median of 1.43. Plus, the company's forward revenue growth is projected at 56.43% - well above the sector median of 7.52%.

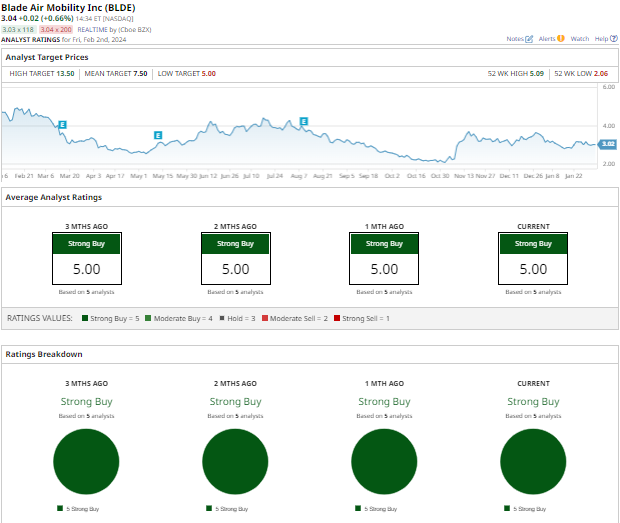

Blade Air Mobility’s stock has a consensus “Strong Buy” rating among analysts, with the mean price target of $7.50 signifying a potential upside of 149% to current levels. All 5 analysts covering the stock have given it a “Strong Buy” rating.

2. High Tide Stock

High Tide Inc. (HITI) is a cannabis retailer focused on the distribution and selling of cannabis-related items, such as lifestyle products and smoking accessories. The company operates in two segments: retail and wholesale. As the largest revenue-generating Canadian cannabis company, High Tide’s portfolio includes a number of brands, including Canna Cabana, Fastendr, Grasscity, Smoke Cartel, Daily High Club, Famous Brandz, and many others.

High Tide stock is up 9.2% year-to-date already, but still trades 22% below its 52-week high.

The company released its Q4 results on Jan. 29, with revenue up 37% YoY to $487.7 million, and an annual revenue run rate of $510 million. Adjusted earnings per share of $0.02 beat expectations for a loss of $0.03 per share.

High Tide generated free cash flow of $5.7 million in Q4, with same-store sales increasing 13% YoY. Its Cabana ELITE paid membership grew at a record 367% YoY to a total of 28,000 active members.

The cannabis stock has a price/sales ratio of 0.34 compared to the sector median of 3.99, signaling the shares are cheap at current levels. With forward revenue growth projected at 20.33% vs. a sector median of 8.80%, HITI is attractively priced relative to its growth prospects.

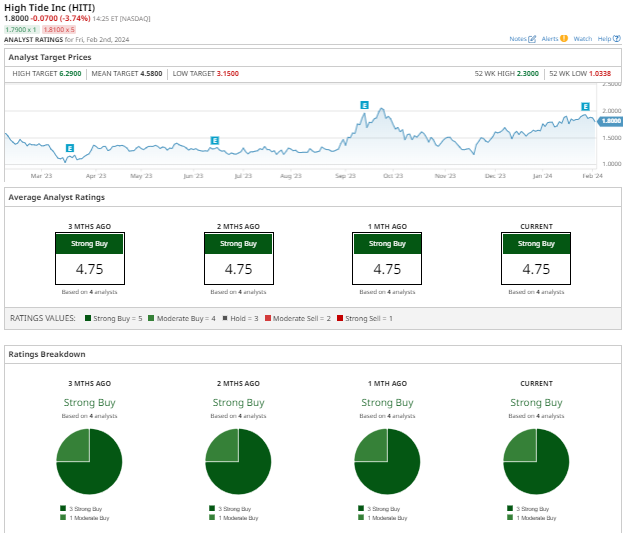

High Tide has a consensus “Strong Buy” amongst analysts, with the mean price target of $4.58 pointing to expected upside potential of 155.8% from current levels. Of the 4 analysts tracking the stock, 3 have a “Strong Buy” rating and 1 has a “Moderate Buy” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)