Happy Valentine’s Day market watchers!

If you’re selling cattle at these historic highs, be sure to spend some of that on your partner this weekend or you might need to find a new gate opener…

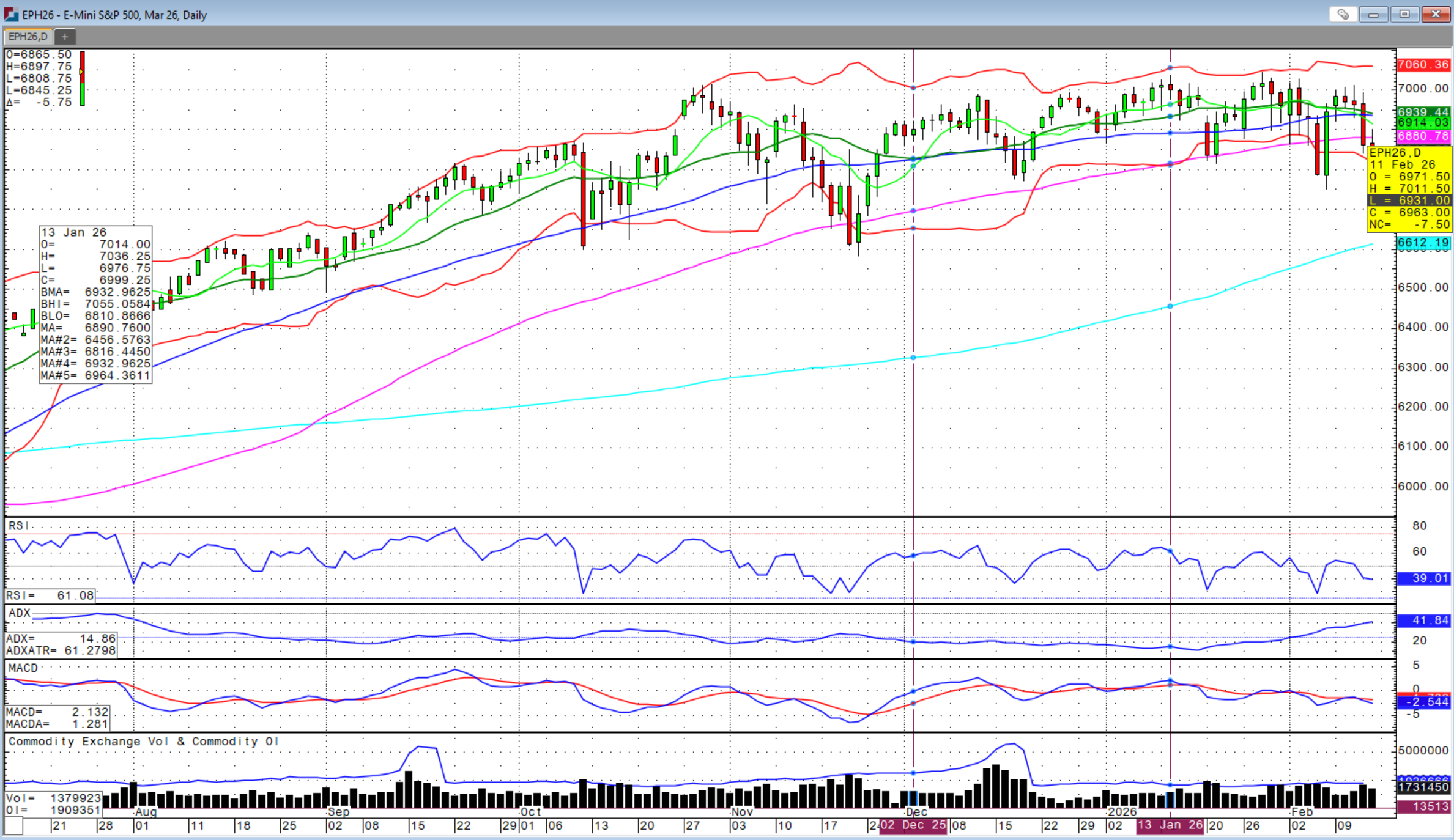

Overall, it was a choppy affair across all markets this week with concerns about the heated AI trade being overdone, rising geopolitical tensions and volatile US domestic politics leading to the potential for another government shutdown this weekend.

There was also a slew of economic reports, including the January jobs report that was delayed from last Friday. For the first month of the year, US payrolls beat Wall Street expectations, adding 130,000 jobs versus only 55,000 jobs expected. This dropped unemployment to 4.3 percent. Healthcare led job creations with 82,000 positions.

Despite this jobs surprise, there is increasing worry that AI is sending shockwaves throughout the economy that efficiency gains could lead to fewer employees and hardware “capacity” needed with productivity increases. This thesis has been established but continues to evolve as features progress and trickle down throughout the real economy.

After a close in the Dow Jones above 50,000 last week, we saw fresh highs again this week along with another print above 7,000 for the S&P 500 before some profit taking on Thursday and Friday.

The January CPI data was released on Friday morning and showed the fight against higher inflation continues to make progress with a decline to 2.4 percent, down from 2.7 percent in December. The decline in energy prices, a calculated and intentional move by the Trump Administration, has helped lead the charge in softer inflation while other parts of the economy continue to see upward price pressure. This recent print provides more options for the Federal Reserve in their efforts to bring US inflation down to the 2.0 percent target.

The recent rally in the US dollar index stalled this week, plunging on Monday and trading in a tight, sideways range through the rest of the week. The lower inflation read on Friday edged the US dollar lower, trading in the mid-96’s. If the US dollar can break down below the 96.0-level, we could see another boost to the commodity complex.

The rally in wheat and soybeans this week was helped by the weaker US dollar that has supported US corn and wheat exports as well as money flows back into commodities and the news that Presidents’ Trump and Xi have supposedly agreed to an extended trade truce that could see Beijing buy more US soybeans.

Rains in the Southern Plains this weekend stalled the short-covering, wheat rally on Friday and we will have to see how the trade reopens on Monday evening after the market digests the welcome moisture in an area where drought has been spreading.

With the Brazilian soybean crop continuing to increase that the USDA confirmed in its monthly reports released on Monday with a raise to 180.0 million metric tons, the market continues to believe that soybean futures should trade higher. Brazil soybean harvest is ongoing, but remains slightly behind average. While we saw some profit taking on Friday, soybeans came back off session lows into the close and look to have more upside. This is improving the economics for soybeans in the battle-for-acres debate seen in the corn-to-soybean price ratio.

In the monthly USDA Supply and Demand reports, the 2025/26 US corn ending stocks were lowered to 2.127 billion bushels while a slight increase was expected. For soybeans, ending stocks of 350 million bushels were unchanged from last month versus a slight increase expected. For wheat, there was an increase in ending stocks to 931 million bushels while a decrease to 915 million bushels was expected.

For the rest of the South American production, the USDA left Brazil corn as well as Argentine corn and soybeans unchanged from last month. Brazil’s 1st crop corn harvest remains marginally behind average as does its safrinha corn crop planting. Heat and dryness in Argentina have helped support the row crop complex as of late, but wetter weather is in the forecast. Argentine wheat production and exports were increased.

Globally, the USDA cut corn ending stocks more than expected to 289.0 million metric tons, while increasing soybean ending stocks, but exactly in line with trade expectations at 125.5 million metric tons. World wheat ending stocks were also cut more than expected to 277.5 million metric tons.

Note that US markets are closed on Monday for President’s Day. Energy and metals futures will continue to trade. Grain markets will reopen on Monday evening at 7 PM CDT.

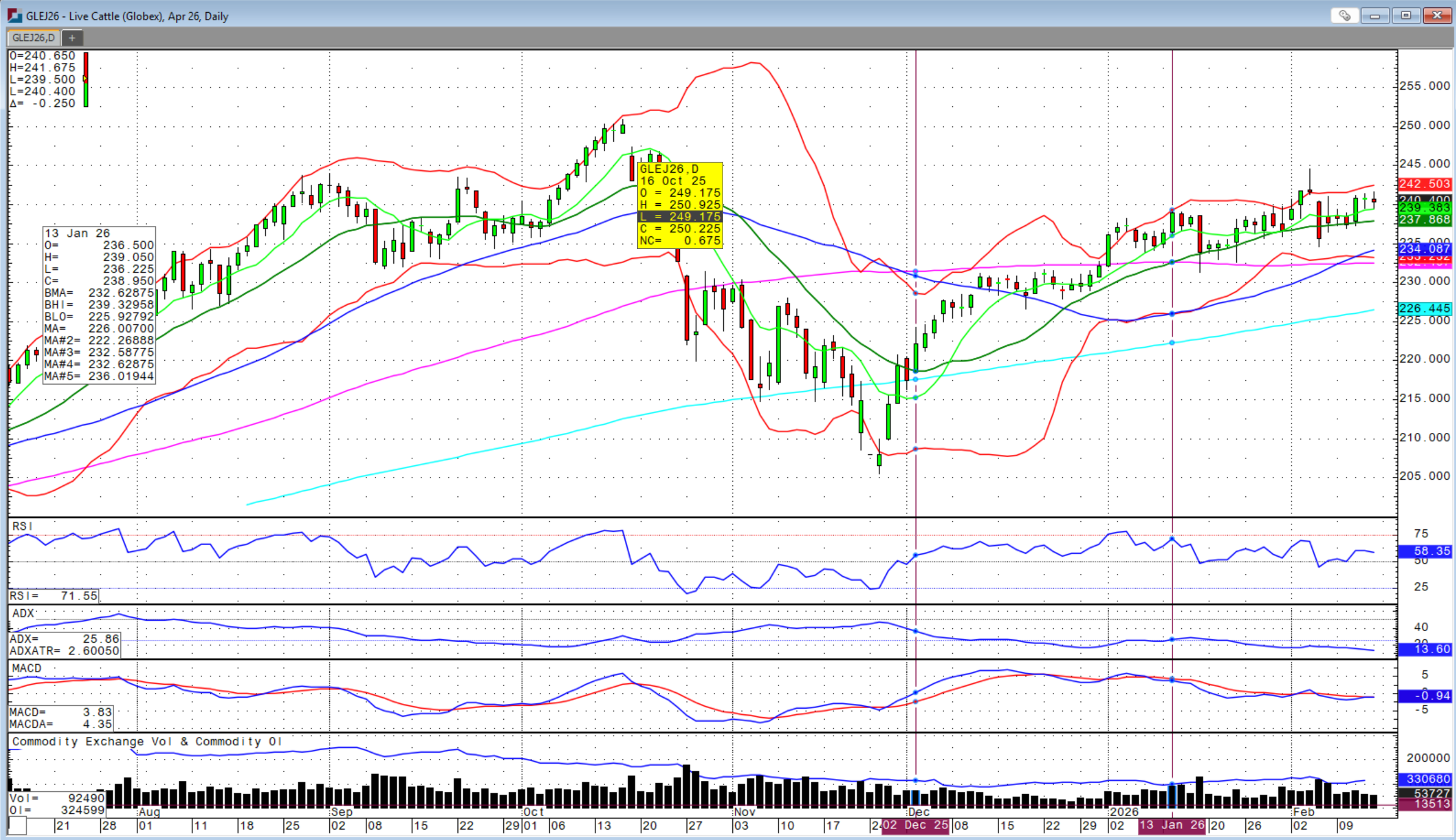

The cattle complex has been eerily quiet in the last week with more direction needed despite further confirmation of tight supply fundamentals from recent USDA reports. Fed cattle cash trade after the close on Friday made new highs topping out at $249 per cwt in Kansas and $248 in Texas! That is impressive and what is needed to get feeder cattle prices to begin to pencil for protection on Live cattle futures. If you’re buying feeders in today’s market environment, $270 is needed for fed cattle to make it work.

However, the cash markets for feeders remain on fire, suggesting there is plenty betting on that level to be realized. The chart gaps above continue to remain unfilled. After these fed cash prices paid on Friday, we could see markets head towards those gaps next week. We will have to reassess the broader market environment at the time those gaps fill to gauge where we may go next.

While it is possible that we head for new highs, the affordability push in political rhetoric is likely to pick up as we inch towards next month’s Mid-term election primaries and beef will likely be brought up again.

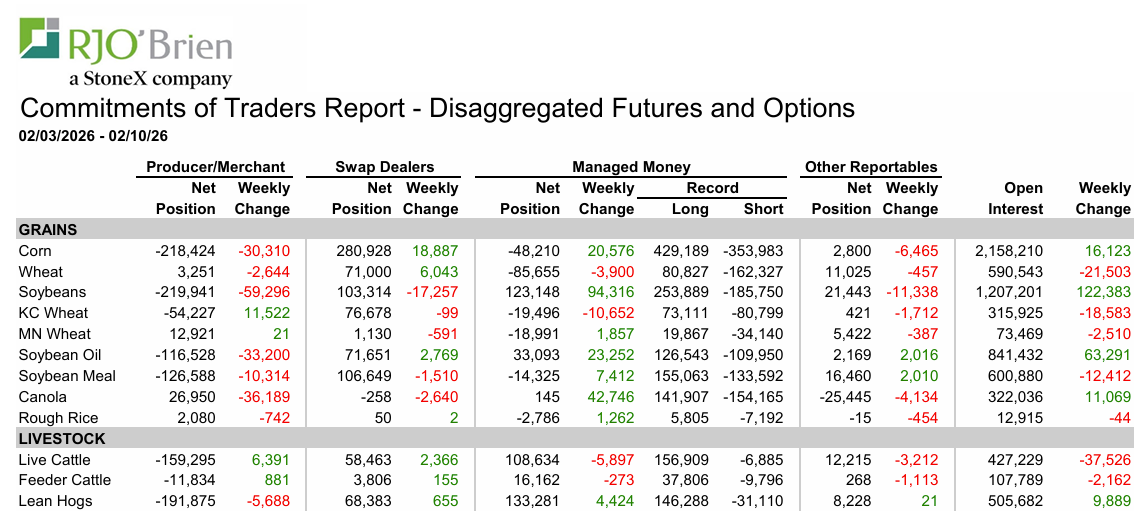

Just be aware that market liquidation can take place even amid bullish fundamentals. Friday’s CFTC report continues to show a large net long position among managed funds in Feeder and Live cattle contracts although well off the record net longs. If we can break out of this recent sideways trading pattern next week, I believe we will see those chart gaps filled. Watch this market closely next week and be ready to react should we see new headlines develop that could spoil the party.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)