/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Earnings season is more than just a calendar event for investors. It is when investors get clarity on how companies are really performing and where money is likely to move next. And in a market still trying to price the relentless pace of artificial intelligence (AI)-led disruption, volatility has become a daily reality. That’s why each quarterly report now carries extra weight, often shaping sentiment far beyond the results themselves.

Over the next few weeks, several U.S. companies are set to release quarterly results, but all eyes are on the titans steering the AI revolution. Alphabet (GOOG) (GOOGL), the Google parent, is scheduled to report fourth-quarter results on Wed., Feb. 4. The company is not only releasing numbers but also offering an update on its AI momentum.

Analysts currently project EPS of roughly $2.58, up about 20% year-over-year (YOY), and revenue near $111.45 billion, a 15.5% climb. Beyond the top line, investors will be listening for insights on Gemini AI, cloud growth, and how Google’s expanding AI stack is being monetized. Management’s commentary on capital expenditures will also be key, as Alphabet continues to ramp AI-related investments while emphasizing efficiency through its in-house TPUs.

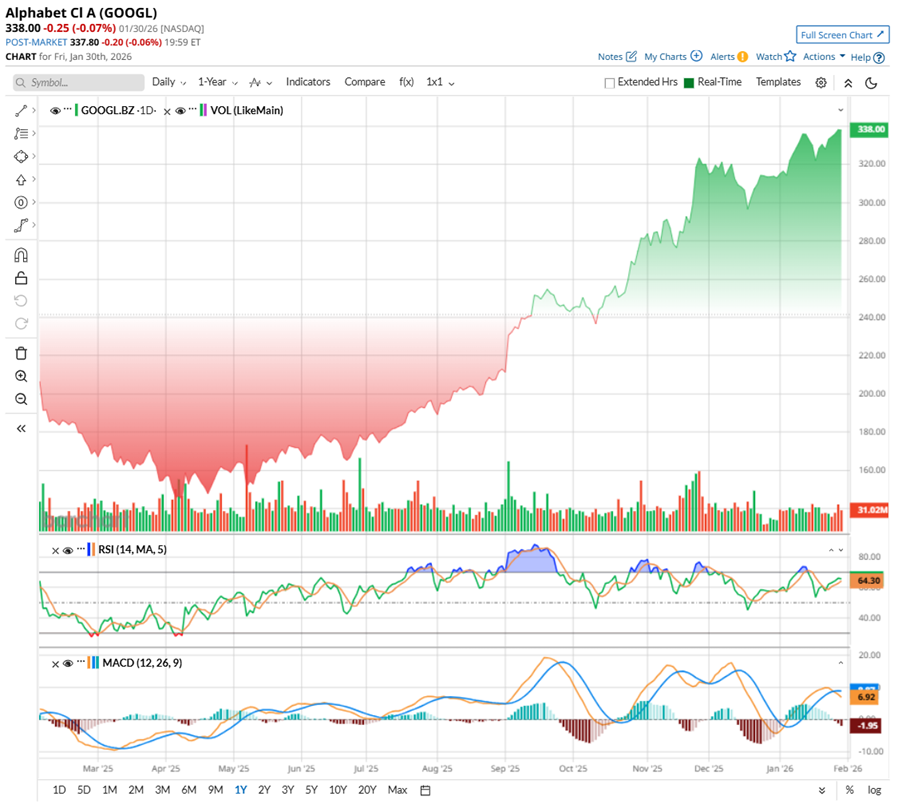

After a 81.72% stock surge over the past six months alone, and 9% gains already in 2026, the upcoming earnings report could prove crucial in determining whether that momentum has further room to run.

About Alphabet Stock

Alphabet has long moved past the need for introductions in global technology circles. Now one of Silicon Valley’s most influential enterprises, the company continues to scale with intent. Boasting a market capitalization of $4.1 trillion and based in California, Google-parent Alphabet stretches well beyond search – into AI, cloud infrastructure, autonomous mobility via Waymo, and frontier research at DeepMind. Its Gemini models underscore its push to shape next-generation intelligence, not merely participate in it.

Not long ago, Alphabet’s shares were trading under a cloud of doubt. Investors questioned whether the company was moving fast enough in an AI arms race that seemed to reward speed and spectacle. That skepticism has steadily faded. Over the past few months, GOOGL has rebuilt momentum, pushing to a 52-week high at $342.29 on Jan. 29 and reasserting itself as a leader rather than a follower. Shares are up 68.46% over the past year, with gains of 22.23% in the last three months alone and another 3.13% added in just the past five days. In early 2026, the stock has already positioned itself as one of the stronger performers within the “Magnificent Seven.”

The MACD oscillator shows the cooling momentum after a strong January run. The MACD line has slipped below the signal line, while the histogram has turned slightly negative. This suggests short-term bullish momentum has eased, pointing to a pause in the trend rather than a sharp reversal, as buyers and sellers reassess direction.

A Closer Look at Alphabet’s Stellar Q3 Report

Alphabet’s third-quarter earnings report, released on Oct. 29, showed a business still firmly in control of its core franchises, while steadily scaling what could become its next major growth engine. Total revenue rose 16% YOY to $102.3 billion, comfortably ahead of Wall Street’s expectations, reflecting broad-based execution across the portfolio.

Google Services grew 14% annually to $87.1 billion in revenue. Search once again did the heavy lifting, with revenue rising 14.6% to $56.6 billion, reinforcing Google’s position as the default gateway to the internet. Advertising followed closely, climbing 12.6% to $74.2 billion, a notable achievement in a macro environment where marketers remain selective but continue to value Google’s reach, data, and measurable returns.

But Google Cloud was the standout performer, with its revenue growing by 34% YOY to $15.2 billion, driven by accelerating AI workloads and enterprise digital transformation. The pace of growth underscored Cloud’s evolution from a supporting act into a core pillar of Alphabet’s long-term strategy.

Profitability remained healthy. Operating income grew to $31.2 billion, producing a 30.5% operating margin. Excluding a $3.5 billion European Commission antitrust fine, margins would have been closer to 34%, pointing to tighter cost discipline beneath the company’s vast scale. EPS surged 35.4% annually to $2.87, handily beating expectations and highlighting strong operating leverage.

Plus, AI is no longer a side story at Alphabet. Management pointed to its full-stack strategy, with Gemini models handling nearly seven billion tokens a minute. The Gemini app now counts 650 million monthly active users, while Cloud’s $155 billion backlog signals durable demand ahead.

As Alphabet heads into its Q4 earnings release on Wednesday, after the closing bell, the focus will not just be on the number but also be firmly on how aggressively the company continues to invest in its future. Management has already set expectations, guiding for fiscal 2025 capital expenditures in the $91 billion to $93 billion range, signaling a full-speed push into AI capacity, data centers, and next-generation computing. Meanwhile, Wall Street analysts tracking Alphabet estimate fiscal 2025 EPS to grow by 31.5% to $10.57, followed by a 4.6% increase to $11.06 in fiscal 2026.

What Do Analysts Expect for Alphabet Stock?

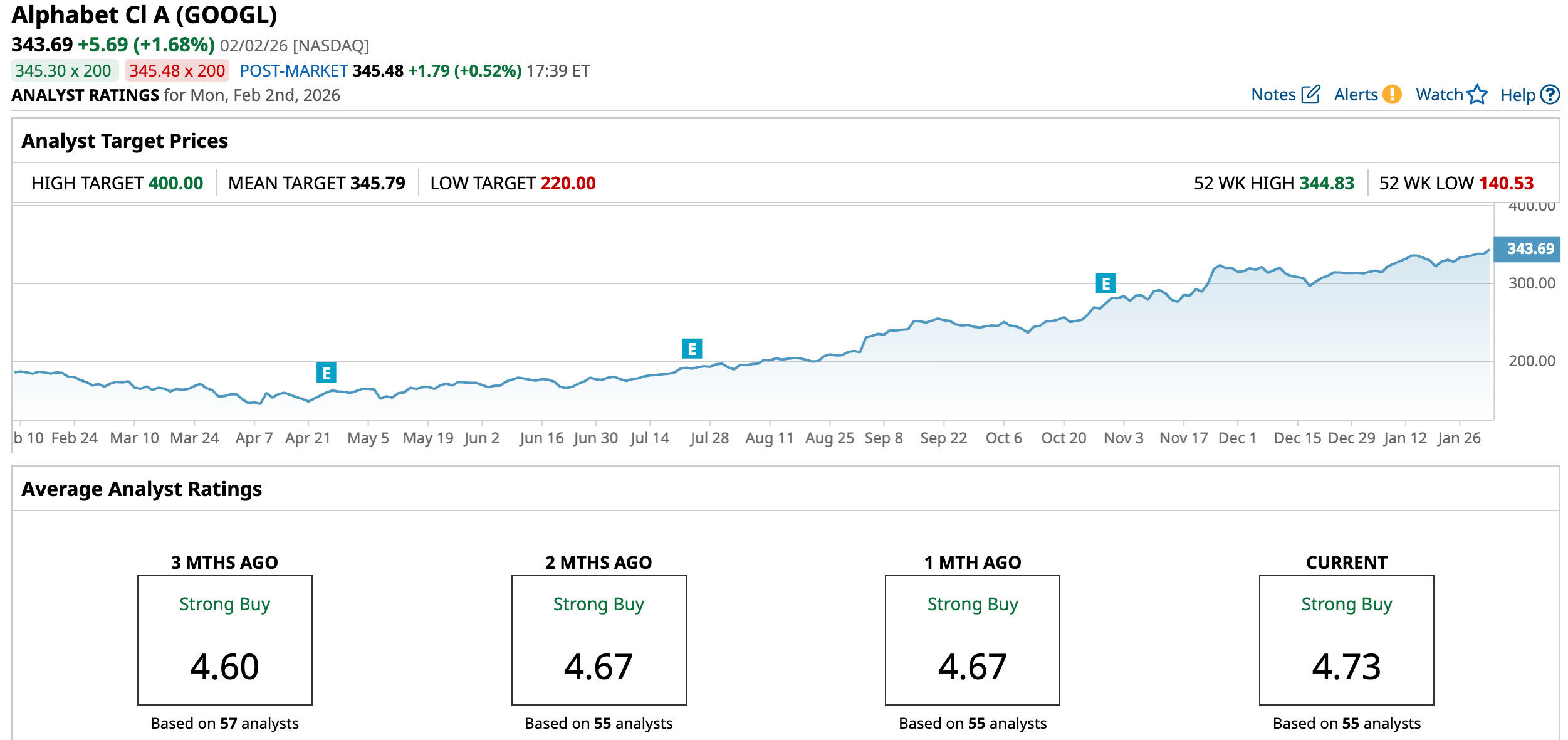

Recently, Roth/MKM has grown more confident in Alphabet’s outlook. The brokerage firm lifted its price target on GOOGL to $365 from $310 and reiterated a “Buy” rating ahead of Q4 earnings. Analysts see multiple catalysts lining up in early 2026, from TPU partnerships and Waymo city launches to Gemini app milestones and potential Gemini 4.0 updates, with global events later in the year helping support growth.

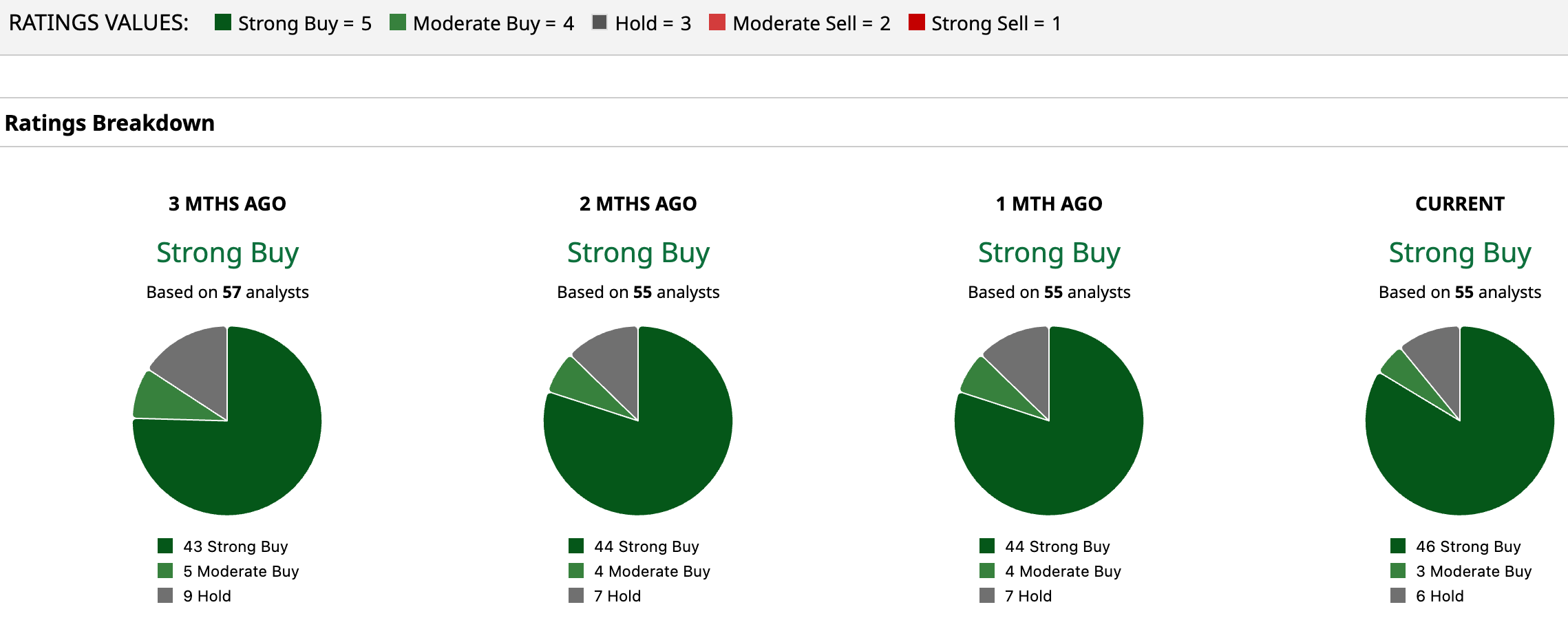

Analysts monitoring GOOGL are bullish, with consensus leaning heavily toward a “Strong Buy.” Out of 55 analysts, 46 recommend a “Strong Buy,” three suggest a “Moderate Buy,” and six are playing it safe with a “Hold” rating. The average price target of $345.79 suggests a mere 0.61% upside potential from here. Meanwhile, the Street-high target of $400 suggests GOOGL stock could rise 16.4%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)