Macro Crosscurrents Reshape the Energy Landscape

Crude oil, often tracked by products such as the United States Oil Fund, reflects the performance of West Texas Intermediate and serves as a benchmark for global energy pricing. As a globally traded commodity, crude is primarily driven by supply and demand dynamics, geopolitical developments, OPEC production policy, U.S. shale output, refinery demand, and broader macroeconomic conditions. Interest rate policy, currency strength, and global growth expectations also influence capital flows into and out of energy markets.

In late 2025, macro headwinds weighed on the complex. Slowing global growth expectations, particularly in major importing regions, combined with persistent supply from non-OPEC producers, created a heavier tone. Inventory builds and a stronger U.S. dollar further capped upside momentum.

More recently, the narrative has shifted toward escalating geopolitical risk centered on unrest inside Iran. Widespread protests driven by economic strain and political tensions have raised concerns about internal stability, while rhetoric surrounding potential intervention by the United States or Israel has amplified fears of broader regional conflict. The market is particularly sensitive to any scenario that could threaten production, export infrastructure, or shipping routes tied to Iranian crude. Even in the absence of an actual supply disruption, the possibility of escalation has introduced a geopolitical risk premium into prices.

What the Market Has Done

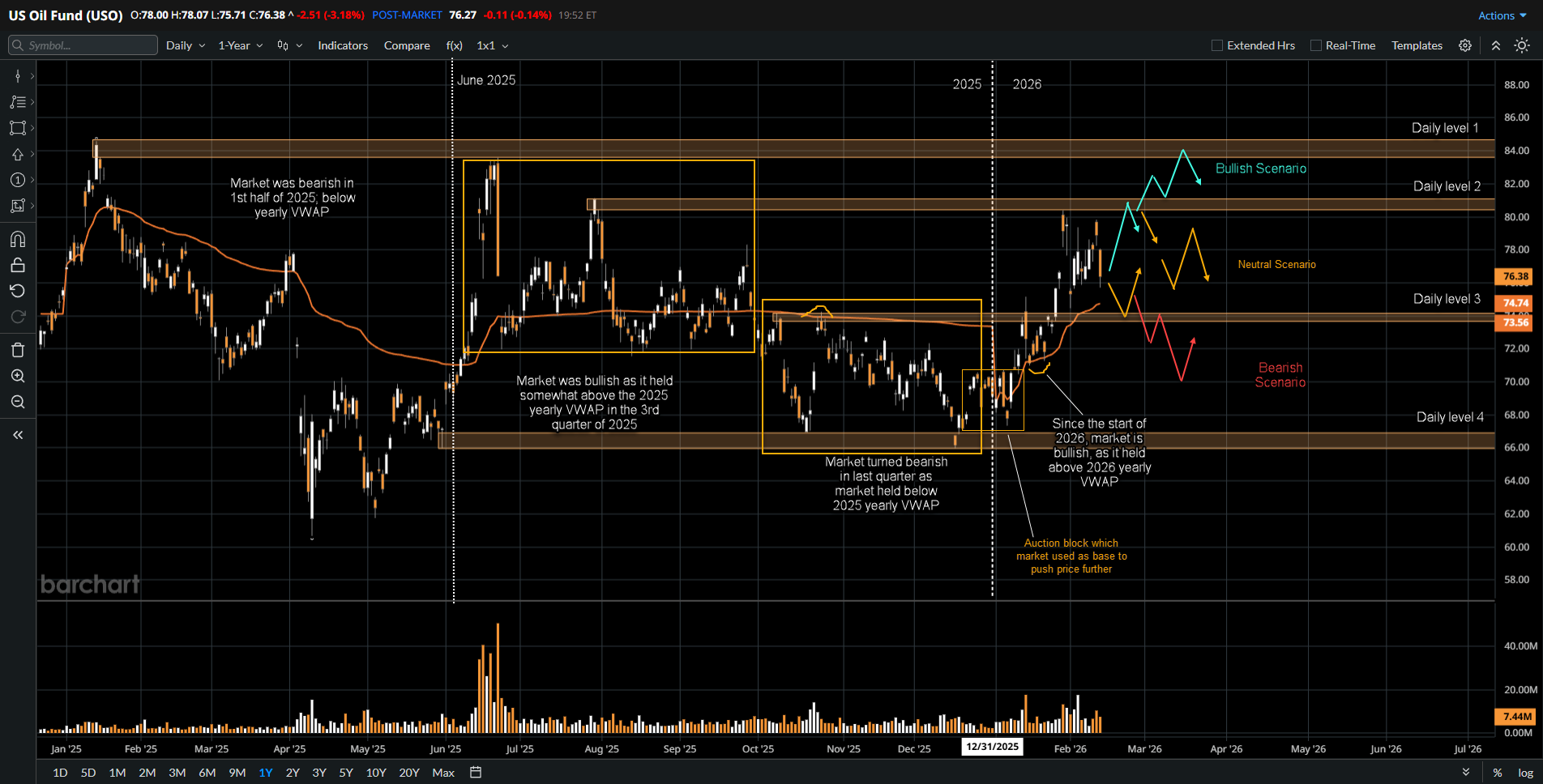

- The market was sideways, chopping through the 2025 yearly VWAP multiple times, signaling balance and lack of directional conviction throughout much of the year.

- In the last quarter of 2025, the market was slightly bearish as it held below the 2025 yearly VWAP. This period coincided with weaker than expected manufacturing data out of China, including continued contraction in official PMI readings, which reinforced concerns about slowing industrial demand for crude. At the same time, U.S. crude inventories reported by the Energy Information Administration posted several consecutive weekly builds, signaling adequate near-term supply. Additionally, production from United States shale basins remained resilient despite lower prices, offsetting voluntary output restraint from OPEC+. These developments kept rallies capped and encouraged responsive selling above value, reinforcing the slightly bearish tone below the 2025 yearly VWAP.

- In the recent month, the market has rallied above 74.00 (Daily level 3), where sellers were previously defending during the last quarter of 2025. Price has since held firmly above the 2026 yearly VWAP. Technically, the market shifted from repeated rejection below value to sustained acceptance above it, with shallow pullbacks and responsive buying supporting higher levels. Ongoing tensions in the Middle East have provided a supportive macro backdrop, reinforcing this constructive shift in tone.

- In the past week, the market has gone sideways with overlapping daily ranges, indicating short term balance and a lack of expansion in either direction as participants evaluate the next catalyst. This pause in momentum followed headlines suggesting renewed diplomatic backchannel discussions between the United States and Iran regarding sanctions relief and regional de-escalation. Public remarks from officials on both sides signaling openness to dialogue helped temper immediate fears of supply disruption, cooling the geopolitical risk premium that had fueled the prior rally. As a result, price action has compressed into balance rather than extending higher.

What to Expect in the Coming Weeks

Key levels to monitor are 74 and 80 (Daily level 3 and Daily level 2).

Neutral Scenario

- If the market does not pick up velocity and volume near the edges mentioned, expect a rotation within the present range between 80 and 74.

- Expect choppy and balanced price action as the auction continues to seek fair value within this established range.

Bullish Scenario

- If bids step up within the present range and the market holds above the 2026 yearly VWAP, a move up to 80 is likely where responsive sellers are expected.

- If price accepts above 80 with sustained participation, the next upside objective is the 84 area (Daily level 1).

Bearish Scenario

- If buyers do not defend the 74 area (Daily level 3), or at the 2026 yearly VWAP, expect a move down to 70, which marks the auction block where buyers previously initiated the move higher.

- If buyers do not step up near 70, further downside rotation toward 66.5 (Daily level 4), becomes increasingly probable.

Conclusion

Crude oil now sits at a technically and fundamentally sensitive juncture. Holding above the 2026 yearly VWAP and above 74.00 keeps the intermediate structure constructive, particularly after the market absorbed prior resistance and shifted into value acceptance higher. At the same time, the cooling of geopolitical rhetoric following reported dialogue between the United States and Iran has reduced immediate upside urgency, reinforcing the current rotational tone between 74 and 80.

If diplomatic efforts stall or tensions re escalate, the geopolitical premium could quickly reprice higher and open the path toward 80 and potentially 84. Conversely, continued de escalation rhetoric combined with stable supply could invite deeper rotations toward 70 and 66.5. The interaction between price, the 2026 yearly VWAP, and the key daily levels will reveal whether this is consolidation before continuation or distribution before retracement.

For traders looking to express views in energy markets, futures offer a more precise and capital efficient alternative to ETFs like USO. Futures provide centralized pricing, deep liquidity, and transparent execution that exchange traded products cannot always match. EdgeClear delivers direct access to global futures markets with trader focused platforms built for serious market participation. Learn more at edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional, if necessary, before engaging in futures or derivatives trading.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)