Secondhand luxury marketplace The RealReal (NASDAQ: REAL) fell short of analysts' expectations in Q2 FY2023, with revenue down 15.3% year on year to $130.9 million. Next quarter's outlook also missed expectations with revenue guided to $125 million at the midpoint, or 5.07% below analysts' estimates. The RealReal made a GAAP loss of $41.3 million, improving from its loss of $53.2 million in the same quarter last year.

Is now the time to buy The RealReal? Find out by accessing our full research report, it's free.

The RealReal (REAL) Q2 FY2023 Highlights:

- Revenue: $130.9 million vs analyst estimates of $131.8 million (0.69% miss)

- EPS (non-GAAP): -$0.30 vs analyst estimates of -$0.36

- Revenue Guidance for Q3 2023 is $125 million at the midpoint, below analyst estimates of $131.7 million

- The company reconfirmed revenue guidance for the full year of $550 million at the midpoint

- Free Cash Flow was -$41.8 million compared to -$46.4 million in the previous quarter

- Gross Margin (GAAP): 65.9%, up from 56.8% in the same quarter last year

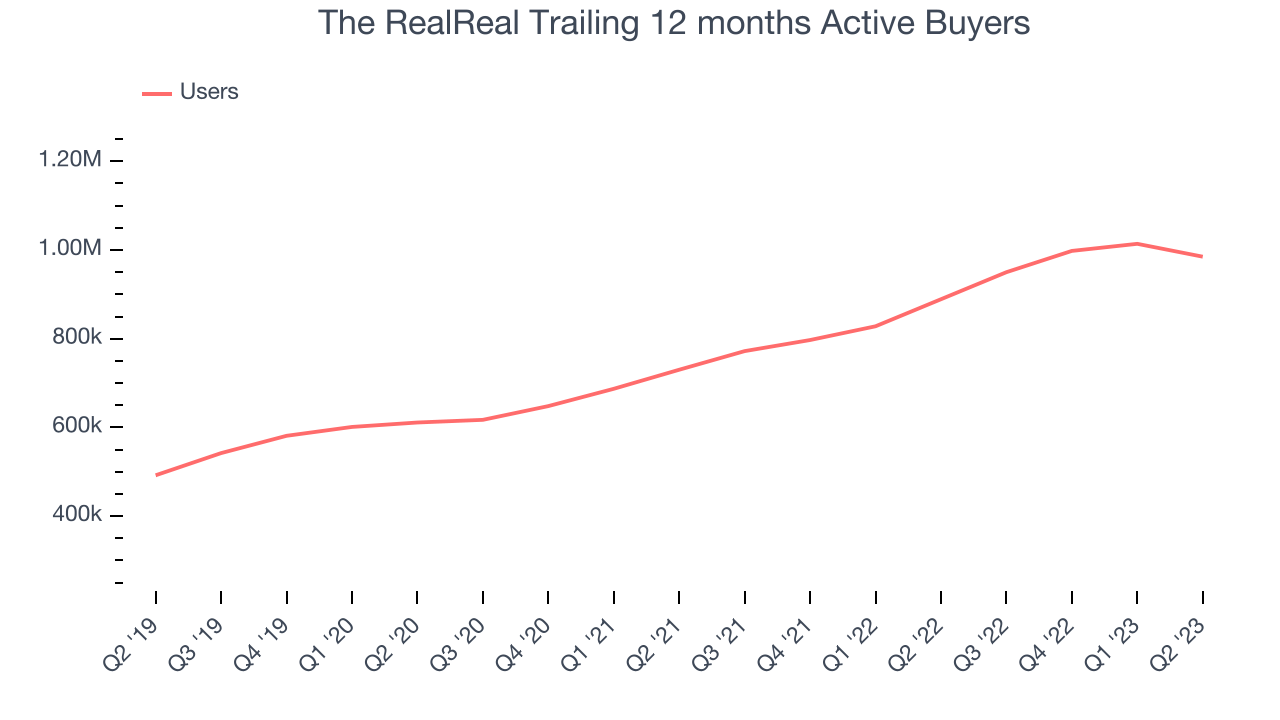

- Trailing 12 months Active Buyers : 0.99 million, up 96 thousand year on year

“Our strategic shift to re-focus on the higher margin portion of the consignment business is showing results. In the second quarter of 2023, GMV and revenue exceeded the mid-point of our guidance, and Adjusted EBITDA exceeded the high-end of our guidance range for the quarter,” said John Koryl, Chief Executive Officer of The RealReal.

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

Sales Growth

The RealReal's revenue growth over the last three years has been strong, averaging 27.2% annually. This quarter, The RealReal reported a year on year revenue decline of 15.3%, missing analysts' expectations.

The RealReal is expecting next quarter's revenue to decline 12.4% year on year to $125 million, a reversal of the 20.1% year-on-year increase it recorded in the same quarter last year. Ahead of the earnings results, analysts covering the company were projecting sales to grow 3.95% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Usage Growth

As an online marketplace, The RealReal generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, The RealReal's users, a key performance metric for the company, grew 21.5% annually to 0.99 million. This is strong growth for a consumer internet company.

In Q2, The RealReal added 96 thousand users, translating into 10.8% year-on-year growth.

Key Takeaways from The RealReal's Q2 Results

Although The RealReal, which has a market capitalization of $223.4 million, has been burning cash over the last 12 months, its more than $188.9 million in cash on hand gives it the flexibility to continue prioritizing growth over profitability.

It was good to see The RealReal add new users this quarter. Adjusted EBITDA in the quarter beat expectations, and full year guidance for adjusted EBITDA was also better than Wall Street analysts' expectations. Those really stood out as positives in these results. On the other hand, GMV guidance for next quarter and the full year both missed. Also, its weak revenue growth was a negative, and next quarter's revenue guidance missed Wall Street's expectations. Overall, the results could have been better. However, expectations were likely low for the stock given choppy financial performance in the last few quarters. The stock is up 4.59% after reporting and currently trades at $2.28 per share.

The RealReal may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)