Apparel retailer Under Armour (UAA) saw its stock drop 9.8% intraday on Feb. 10 following Citi analysts downgrading the stock from “Neutral” to “Sell,” despite the company reporting better-than-expected quarterly results and raising its outlook. Citi analyst Paul Lejuez cited pressures in the North American market and a slowdown in the EMEA region.

In addition, the analyst flagged rising competitive pressure from rivals in the athletic apparel environment. Lejuez has also warned that Under Armour will likely generate negative free cash flow in fiscal 2026 and may struggle to grow EPS in fiscal 2027.

So what should be done with Under Armour’s stock now?

About Under Armour Stock

Under Armour excels in performance sportswear, crafting innovative apparel, footwear, and gear for athletes worldwide. Based in Baltimore, Maryland, it pioneers moisture-wicking technology and athlete-endorsed products. The company manages global design, manufacturing, and retail channels to offer advanced casual and technical athletic wear. The company has a market capitalization of $3 billion.

A competitive apparel market and economic headwinds affecting demand have led to a 1.6% modest decline in Under Armour’s stock over the past 52 weeks. The company also suffered from a data breach last year, affecting 72 million email addresses. However, a recent earnings beat has led to a surge, as the stock is up 41.35% year-to-date (YTD). It reached a 52-week high of $7.94 on Feb. 9, but after the Citi downgrade, it is down 14% from that level.

On a forward-adjusted basis, Under Armour’s stock is trading at an 60.52x price-to-earnings forward valuation, which is significantly stretched compared to the 17.98x industry average.

Under Armour Surges on Q3 Earnings Beat, Raised FY2026 Guidance

For the third quarter of fiscal 2026 (quarter ended Dec. 31), Under Armour reported a 5.2% year-over-year (YOY) decline in its total net revenues to $1.33 billion. But it was higher than the $1.31 billion that Wall Street analysts had expected. This was driven by a 10.3% revenue decline in the North America segment. By product category, the footwear business saw a 12% decline in sales.

Under Armour incurred about $74.98 million in restructuring charges during the quarter. The company’s restructuring plan (announced in May 2024) is expected to cost up to $255 million. The firm’s adjusted net income per share for Q3 grew 12.5% from the prior-year period to $0.09, which was higher than the loss of $0.02 that Street analysts had expected.

Under Armour’s stock gained 20.4% intraday on Feb. 6 as the results were better than expected, and on the company’s belief that the December quarter was the most challenging phase of the business reset in North America, which meant that the worst part was likely over. Under Armour also raised its fiscal 2026 outlook, expecting a lower revenue drop than what was earlier expected and a decline in SG&A expenses.

Wall Street analysts have mixed views about Under Armour’s bottom line growth trajectory. For the fiscal year 2026, the company’s EPS is projected to decrease by 64.52% annually to $0.11, followed by an 100% YOY improvement to $0.22 in the following fiscal year.

What Do Analysts Think About Under Armour Stock?

In addition to the downgrade from Citi analysts, the company has received tepid reactions from Street analysts. Recently, analysts at Goldman Sachs raised the price target on Under Armour’s stock from $5.50 to $7, but kept a “Neutral” rating. The firm believes that while the company’s margins have benefited due to SG&A control and strategic progress, factors such as tariffs and competitive dynamics remain near-term risks for Under Armour.

Similarly, analyst Cristina Fernandez of Telsey Advisory Group raised the stock’s price target from $5 to $6. However, the rating for Under Armour is maintained at “Market Perform.” Barclays analysts also maintained an “Equal Weight” rating but raised the price target from $5 to $8. While analysts at the firm acknowledged that Under Armour’s fiscal 2026 guidance for sales and EBIT is at the high end of prior ranges, its turnaround remains a work in progress.

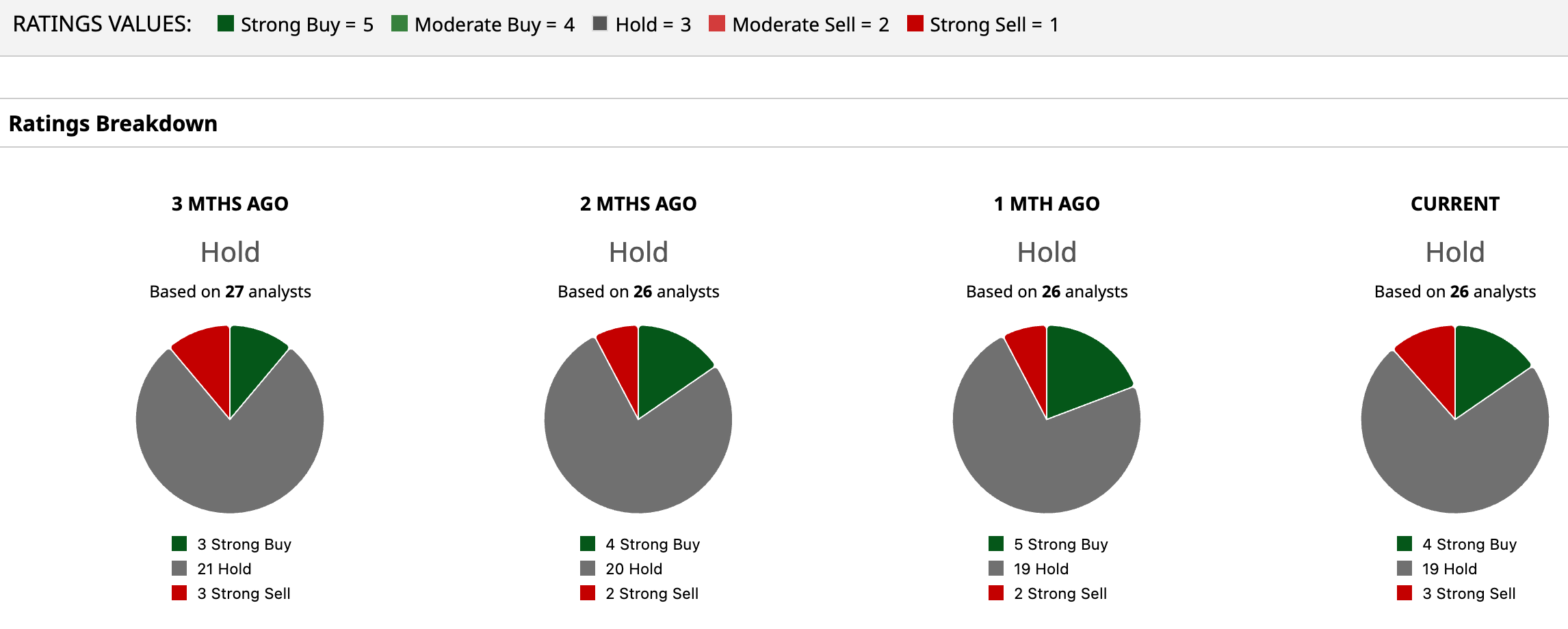

Wall Street analysts are taking a cautious stance on Under Armour’s stock now, with a consensus “Hold” rating overall. Of the 26 analysts rating the stock, four analysts gave a “Strong Buy” rating, while a majority of 19 analysts are playing it safe with a “Hold” rating, and three analysts gave a “Strong Sell” rating. The consensus price target of $7.07 represents a marginal downside from current levels. However, the Street-high price target of $11 indicates a 58.5% upside from current levels.

Key Takeaways

Analysts are tepid about Under Armour, as the company faces heightened competition. So, it might be wise to wait for further recovery before investing in the stock.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)