/Cloud%20Computing%20diagram%20Network%20Data%20Storage%20Technology%20Service%20by%20onephoto%20via%20Shutterstock.jpg)

Datadog (DDOG) is up 15% over the past five days. On Tuesday, the company delivered solid Q4 and full-year 2025 earnings, paired with an upbeat outlook for 2026. Investors cheered the results, sending the stock up nearly 14% on Tuesday. While DDOG has pulled back slightly since then, optimism continues to surround the cloud company.

Now that this latest earnings reported has created so much buzz, should you buy into the hype, take profits, or simply hold the stock this month? Let's take a look.

About Datadog Stock

Headquartered in New York, Datadog is a cloud-based observability and security platform built to help organizations keep a real-time eye on their entire tech stack. Its software-as-a-service (SaaS) tools combine infrastructure and application monitoring, log management, user experience tracking, and cloud security all in one place. Businesses of all sizes use Datadog to move to the cloud faster, fix problems sooner, launch products quicker, improve security, understand users, and track essential metrics.

Over the past year or so, Datadog has been busy integrating artificial intelligence (AI) into nearly every corner of its business. With AI driving massive demand for cloud security, the company has rolled out a steady stream of new tools. In June 2025, the company launched Bits AI Agents for SRE, an AI assistant that can instantly dig into alerts and even draft incident responses and status updates on its own.

That momentum continued through last summer, when Datadog upgraded its LLM Observability platform with new agentic AI monitoring features and expanded support for LLM experimentation. On top of that, the company released its MCP server in June, which helps AI agents connect directly to data sources, and introduced Toto, Datadog’s own time-series foundation model.

The company is currently valued at a market capitalization of about $44.6 billion, and shares are currently down about 17% over the past 52-week period.

Inside Datadog’s Q4 Earnings Report

Investor enthusiasm soared earlier this week after Datadog dropped its fiscal 2025 fourth-quarter and full-year earnings report, which topped Wall Street’s estimates on both top and bottom lines. The company reported Q4 revenue of $953 million, marking a strong 29% year-over-year increase, driven by strong demand for its cloud and AI products.

Adjusted earnings also impressed. The company posted Q4 earnings per share (EPS) of $0.59, a 20% year-over-year increase and topping analysts’ estimates by about 7%.

Customer growth remained a major bright spot. Datadog ended the quarter with about 4,310 customers generating $100,000 or more in annual recurring revenue (ARR), representing a year-over-year increase of about 19%. Furthermore, the company reported 603 customers with more than $1 million in ARR, a 31% year-over-year increase.

Looking ahead to Q1, the company guided for revenue between $951 million and $961 million and EPS between $0.49 and $0.51. For the full year fiscal 2026, Datadog expects revenue between $4.06 billion and $4.10 billion and EPS between $2.08 and $2.16.

What Do Analysts Expect from Datadog Stock?

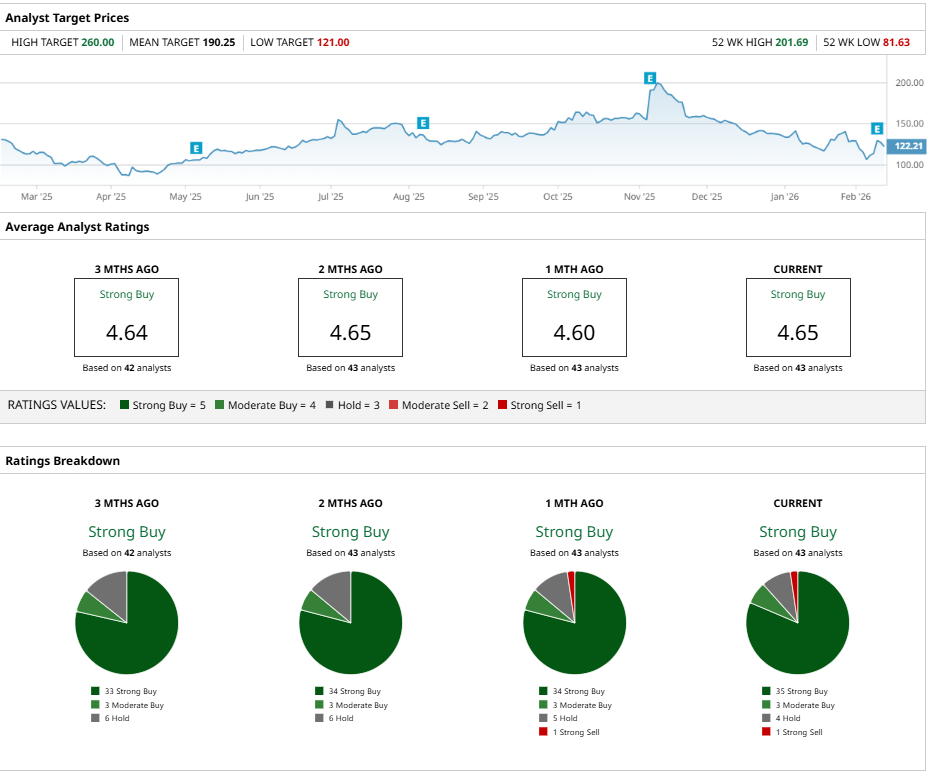

Wall Street appears confident in Datadog. The stock carries a consensus “Strong Buy” rating, and analysts are overwhelmingly bullish. Of the 42 analysts following the company, 35 have rated it a “Strong Buy.” Three have given it a “Moderate Buy” rating, and four have a “Hold” rating. Just one analyst has a “Strong Sell” rating.

Datadog has an average price target of $190.25, representing upside potential of 55% from current levels. Overall, Datadog’s momentum, financial strength, and analyst confidence suggest that the stock is a worthy investment candidate.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)