The Russell 2000 (IWM) is a popular instrument for options traders due to its high liquidity and volatility.

Today we’re looking at an income trade known as a broken wing butterfly.

A broken wing butterfly is a butterfly spread with long put strikes that are not at the same distance from the short put strike.

A broken wing butterfly has more risk on one side of the spread than on the other.

You can also think of it as a butterfly with a “skipped strike”.

The trade is set up with a neutral bias and a large profit tent below the current price.

A broken wing butterfly with puts is usually created buying a put, selling two lower puts and buying one further out-of-the-money put.

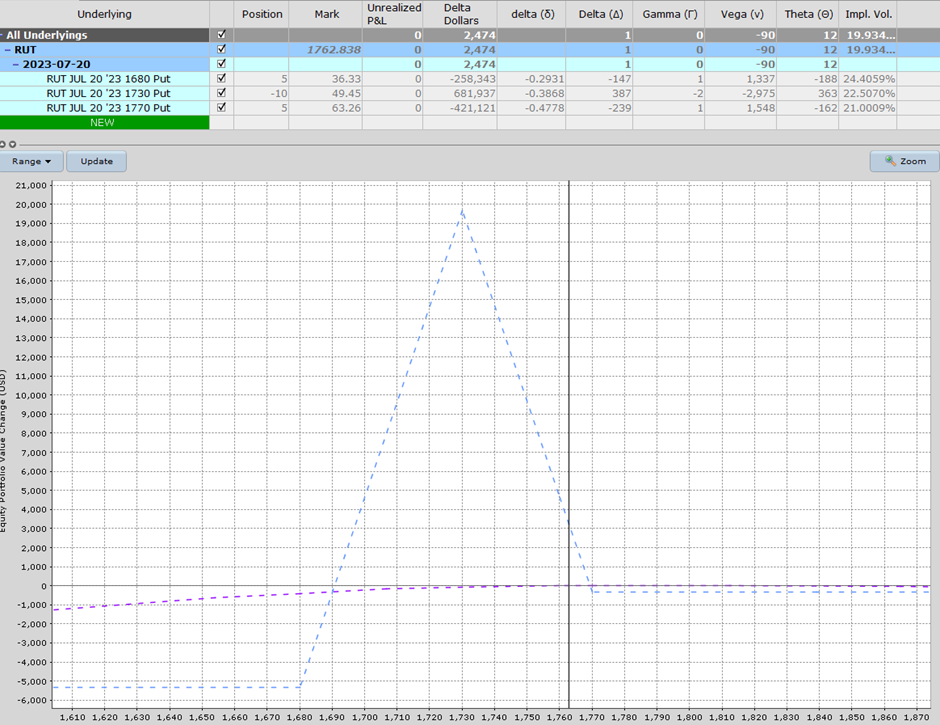

RUT Broken Wing Butterfly Example

On RUT, a July 20 expiry broken wing butterfly could be set up through buying the 1770 put, selling two of the 1730 puts and buying the 1680 put.

Here are the details of the trade as of yesterday’s close:

Buy 1 July 20, 1680 put @ 36.35

Sell 2 July 20, 1730 put @ 49.45

Buy 1 July 20, 1770 put @ 63.25

Notice that the upper strike put is 40 points away from the middle put and the lower put is 50 points away.

This broken wing butterfly trade will result in a net debit of $350, which means that the most the trade can lose on the upside is $350.

The worst that can happen is all the puts expire worthless leaving the trader with an $350 loss which is 6.54% on capital at risk.

The maximum loss is 5,350 and maximum gain is 19,650.

The ideal scenario for the trade is that RUT stays relatively stable over the next month or so.

The trade starts with delta of +1, so has a miniscule bullish bias to start.

In terms of risk management, I would set a stop loss of 5% of the capital at risk and look for a gain of 5-10%.

This is what the trade looks like as of today:

The blue line is the profit and loss at expiration and the purple line is the T+0 line. T+0 just means “today”.

Notice that the T+0 line is very flat, so the trade will not move much at all in the first few weeks.

This type of trade is sometimes called a “vacation trade” because you can place them right before a vacation and not have to worry about them too much.

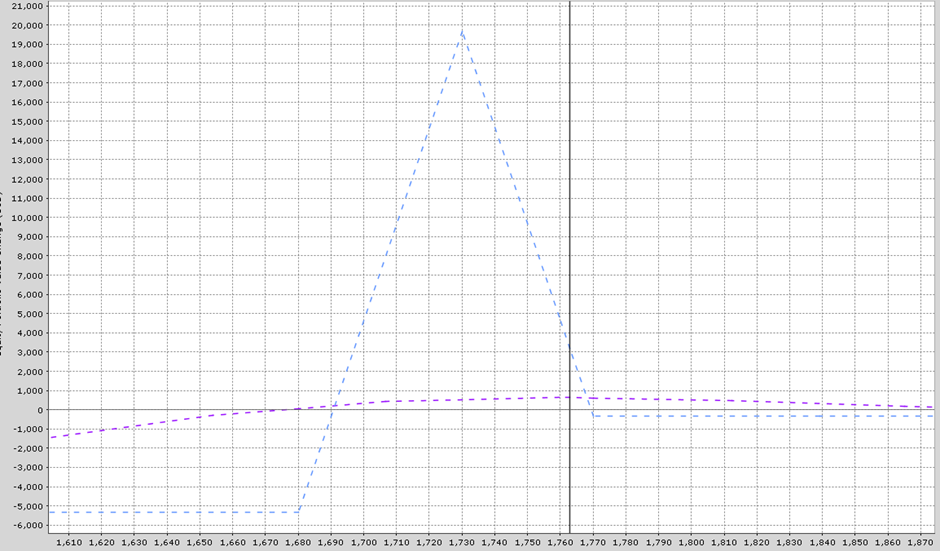

What does the trade look like in three weeks’ time? Let’s take a look.

Looking pretty good between say 1680 and 1850.

Summary

This strategy should move fairly slowly unless there is a large move in the index price.

I like to set price alerts, in this case at 1680 and 1790 at which point I will adjust the trade.

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

If you have questions on this strategy, please let me know.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Moderation in U.S. Consumer Prices Boost Stocks

- This Stock Is a Buy: Brookfield Asset Management Looks to Credit Market for Growth

- Is It Time To Bet on a Market Recovery? 3 Sectors Poised for Growth in a Post-Pandemic Era

- Unusual Call Option Activity in Microsoft Indicates a Bullish Outlook on MSFT Stock

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

/Amazon%20pickup%20%26%20returns%20building%20by%20Bryan%20Angelo%20via%20Unsplash.jpg)