/AI%20(artificial%20intelligence)/AI%20Infrastructure%20by%20FOTOGRIN%20via%20Shutterstock.jpg)

Cadence Design Systems' (CDNS) new virtual artificial intelligence (AI) agent looks poised to be a gamechanger for the tech firm. Given the combination of this product and the already impressive growth of the firm's profits, CDNS stock looks like a buy for growth investors.

Also noteworthy is that research firm Wolfe Research recently cited several other compelling reasons to buy CDNS stock.

About Cadence Design Systems

The company specializes in developing various verification, simulation, and design software and platforms. Based in San Jose, California, Cadence is changing hands with a market capitalization of $81.4 billion and a forward price-to-earnings (P/E) ratio of 43.3x.

In the third quarter, Cadence's sales advanced 5% versus the same period a year earlier to $1.33 billion, while its net income soared 79% year-over-year to $287 million. Analysts on average expect its earnings per share (EPS) to jump to $6.54 this year from $5.66 in 2025. In 2024, Cadence's EPS came in at $4.50.

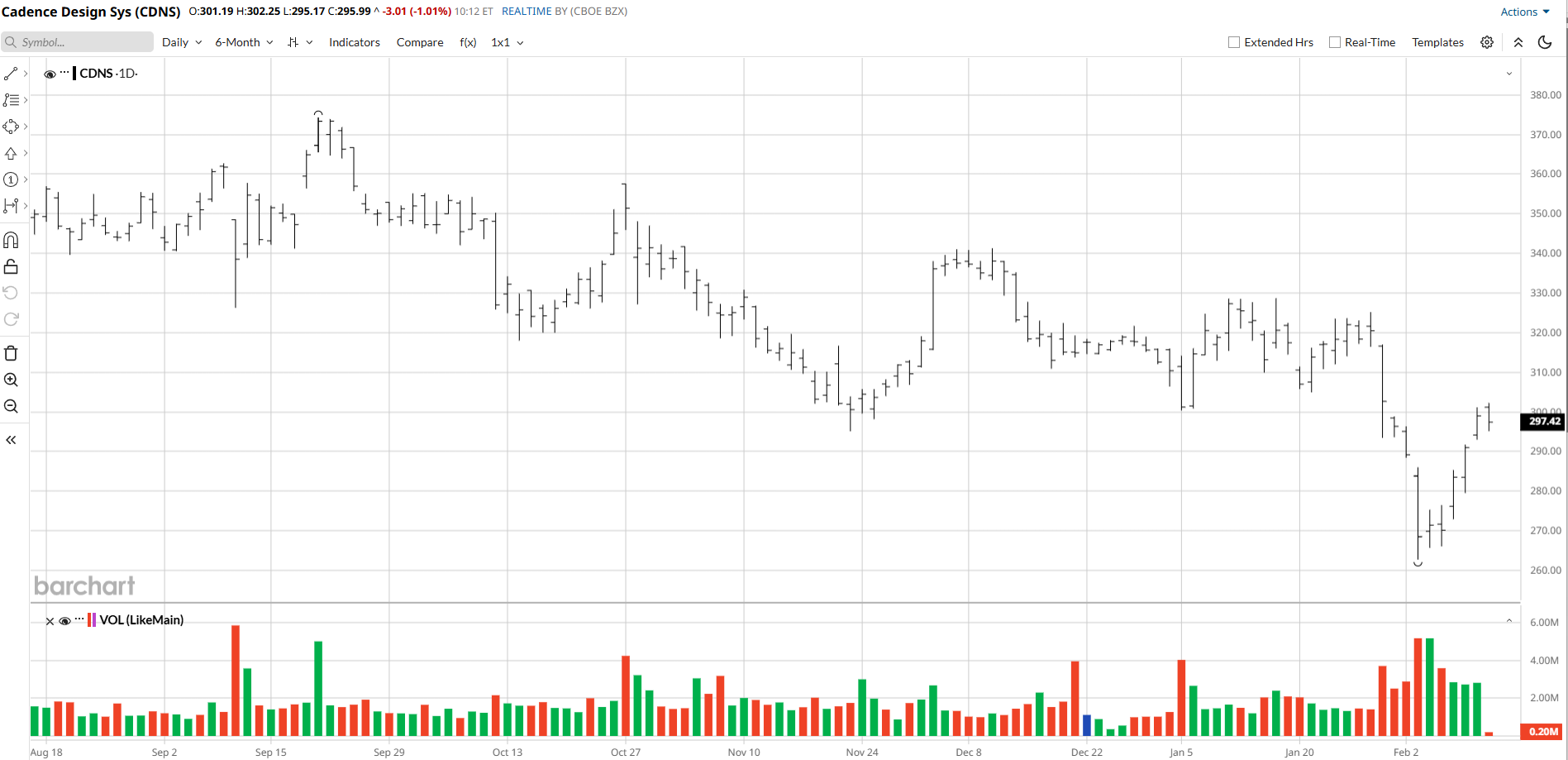

As of early trading on Feb. 11, CDNS stock has advanced 1% in the previous 12 months, while the stock is down 5% so far in 2026. But the shares have risen 9.5% in the past five days.

Cadence's New AI Agent and Why It Looks Huge

According to Cadence, its AI agrent "is the world’s first agentic workflow for automating chip design and verification” and “provides up to 10X productivity improvements for coding designs and testbenches, creating test plans, orchestrating regression testing, debugging and automatically fixing issues.”

In other words, the product allows AI chips to be created much more quickly and easily. The product also “autonomously creates and verifies designs.”

AI chips that can be produced significantly more efficiently will allow chipmakers to meaningfully reduce their costs and raise their profits. And, with many chipmakers having difficulty meeting their customers' demand, Cadence's AI agent will enable these companies to make and consequently sell many more of their products. Further, at a time when the competition among chipmakers is heating up, with Amazon (AMZN) and Alphabet (GOOG) (GOOGL) gaining major footholds in the sector, Cadence can allow these companies to lower their prices, enabling them to significantly increase their market share while maintaining high profits.

As a result of the latter two points in particular, Cadence could charge large amounts of money for its agent, causing its profit margins on the system to be extremely high.

Cadence could also eventually tweak the AI agent to enable it to enhance the speed of many other types of computer hardware, making the agent extremely ubiquitous and very valuable for the firm.

Wolfe Research Cited Additional, Positive Catalysts for CDNS

In late October 2025, Wolfe issued an upbeat note on CDNS stock. Among the positive attributes of Cadence cited by Wolfe were its 85.5% gross margins in Q3, its $7 billion backlog, and the recovery of its China business. Further, Wolfe noted that Cadence has key partnerships with major firms in the AI space.

Wolfe raised its price target on the name to $385 from $370 and kept an “Outperform” rating on the shares.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)