The CBOE Volatility Index closed at 18.11 on Tuesday. While that indicates a relatively calm market, the VIX is still up about 20% year-to-date, but nowhere near its 52-week high of 60.13.

Speaking of 52-week highs, there were 309 new ones on the NYSE yesterday, along with 316 on the Nasdaq. That’s nearly four times the new 52-week lows on both exchanges.

If you’re a momentum investor, there’s plenty to choose from. If you’re seeking value, you’ve got 161 stocks and ETFs to choose from that hit new 52-week lows.

With valuations relatively high, the 52-week lows hold more of an appeal for me than the 52-week highs.

Therefore, the five names I’ll consider for today’s commentary are stocks that hit new 52-week lows on Tuesday. They must have traded at least 1 million shares, be profitable, have a share price above $20, and have a market cap of at least $500 million.

NYSE New 52-Week Low - Arthur J. Gallagher (AJG)

Arthur J. Gallagher (AJG) hit a new 52-week low of $210.01 yesterday. It was the stock’s 21st new 52-week low of the past 12 months. Its shares are down 34% over the past year and 18% year to date.

It’s no surprise that the insurance broker’s stock is a Strong Sell, according to the Barchart Technical Opinion. All five are rated as such.

It seems like only yesterday that I was extolling the virtues of the Chicago-based company. In fact, it was nearly two years ago, in March 2024. The stock had just hit its 61st new 52-week high at $254.16.

As I said back then, one of its main levers of growth is through acquisitions. In 2023, it made 51 tuck-in acquisitions, adding nearly $1 billion in annual revenue. That hasn’t slowed.

In the first nine months of 2025, the company spent $15.31 billion on 26 acquisitions, taking its M&A strategy to the next level. The biggest being its $13.78 billion purchase of Dolphin TopCo, the parent of AssuredPartners Inc., a retail middle-market property/casualty and employee benefits business with nearly 11,000 employees working in 400 locations in the U.S., the UK, and Ireland.

My guess is that investors are concerned about the size of the deal, the risk of integrating AssuredPartners, and the debt taken on to complete the acquisition.

On that last point, its net debt at the end of 2023 was $7.35 billion. As of the end of 2025, it was 64% higher at $12.09 billion, with annual interest of $639 million, more than double what it was in 2023.

The opportunity to buy a smaller version of itself was too good to turn down. I think you’ll see Gallagher go back to making smaller tuck-in acquisitions in the future.

That’s a good thing.

NYSE New 52-Week Low - S&P Global (SPGI)

S&P Global (SPGI) hit a new 52-week low of $395.88 yesterday. It was the stock’s 11th new 52-week low of the past 12 months. Its shares are down 26% over the past year and 23% year to date.

S&P Global is the second of two NYSE stocks hitting new 52-week lows. It’s one of my favorite large-cap financials. Analysts also like it. Of the 26 covering SPGI, 23 (4.65 out of 5) rate it a Buy, with a $617.36 target price that is well above its current share price.

So what’s got its stock down 23% in 2026? Well, days like Tuesday haven’t helped.

S&P Global reported Q4 2025 adjusted earnings per share of $4.30, three cents below Wall Street’s estimate, while matching the consensus revenue estimate of $3.92 billion.

That wasn’t too bad. However, investors didn’t like the company’s 2026 forecast for both the top and bottom lines. Revenues will grow by 7.6% at the midpoint of its guidance, slower than in recent years. On the bottom line, it expects to earn $19.53 a share, 9.5% higher than in 2025, but slower than last year’s 14% increase.

Like many information-based stocks, SPGI’s valuation has fallen amid investor concern that AI could eat into its various businesses. The company is more optimistic.

“The scale of innovation and pace of AI integration in our products and internal processes was a leap forward for our clients and the business,” Barron’s reported Martina Cheung’s comments.

I’m as confident as Cheung is that this is a mere bump in the road. Buying SPGI now and keeping some dry powder for later, should it drift lower in the weeks ahead, makes sense for long-term investors.

Nasdaq New 52-Week Low - Goosehead Insurance (GSHD)

Goosehead Insurance (GSHD) hit a new 52-week low of $48.16 yesterday. It was the stock’s 29th new 52-week low of the past 12 months. Its shares are down 55% over the past year and 32% year to date.

If nothing else, the small-cap insurance stock has a memorable name.

Goosehead made my list because its share volume yesterday was 1.67 million, 4.5 times higher than its 30-day average. GSHD stock fell nearly 13% on the day.

The Texas-based insurance agency network sells home, auto, and other forms of insurance protection to individuals and families through a combination of franchisee insurance agents (82% of its total written premium (TWP) for 2025) and its corporate offices (18%).

Founded in 2003, it went public at $10 a share in April 2018. So, even with the swan dive over the past year, initial IPO buyers still holding remain up 400% in less than eight years.

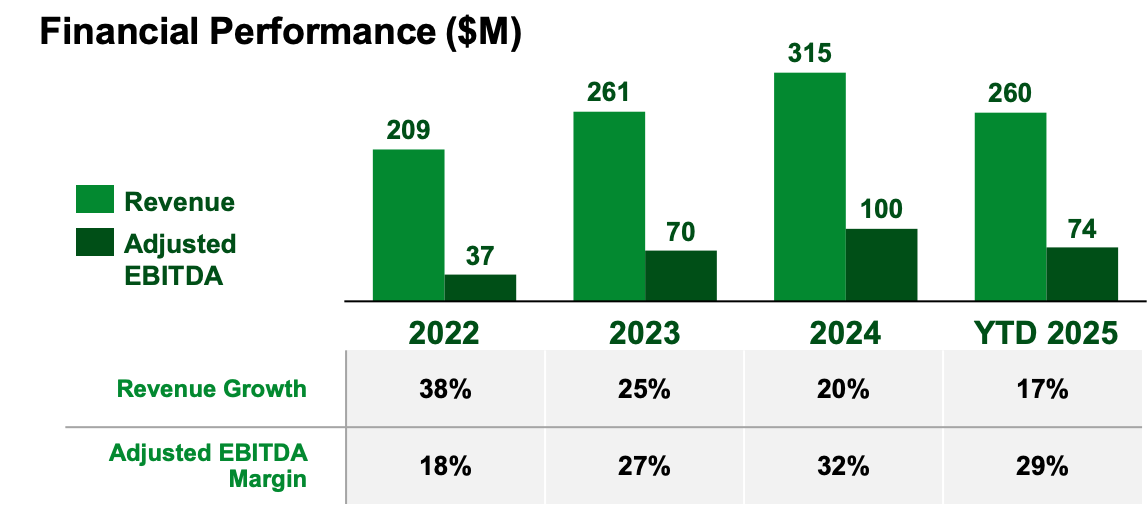

This chart explains some of the investor apprehension.

Source: Goosehead Investor Presentation November 2025

The question is whether 2024 was the peak of Goosehead’s revenue growth or whether it can reenergize the growth engine in 2026. It reports Q4 2025 results on Feb. 17.

Analysts are all over the map about Goosehead. Of the 14 that cover it, five are Buys, two Sells, and seven Holds (3.43 out of 5). The good news is that the target price of $87.58 is 75% higher than its current price.

It took the company 17 years to reach $1 billion in annual TWP, two years to double to $2 billion, and two more to double again to $4 billion. Yet its $4.3 billion in TWP for the 12 months ended Sept. 30, 2025, was just 2% of the $207.3 billion in personal lines generated by independent agencies.

The opportunity remains significant.

Nasdaq New 52-Week Low - Morningstar (MORN)

Morningstar (MORN) hit a new 52-week low of $150.00 yesterday. It was the stock’s 35th new 52-week low of the past 12 months. Its shares are down 50% over the past year and 26% year to date.

I have never had a paid subscription to Morningstar Investor, the Chicago-based company’s retail investor-focused investment service. However, I’ve often referenced its free-to-use data when writing about stocks I’ve covered. In my opinion, it’s top-notch and reasonably inexpensive at $249 annually. That’s 0.25% on a $100,000 DIY portfolio. But I digress.

Joe Mansueto founded the company from his one-bedroom apartment in 1984. He’s served two stints as CEO -- 1984 to 1996 and 2000 to 2016 -- but now is Executive Chairman.

Up until the early 2000s, I worked in the mutual fund industry in Toronto. Financial advisors widely used Morningstar. They still do. My work exposed me to this growing business.

When it went public in 20o5, it had annual revenue of $227.1 million. In the 12 months ended Sept. 30, 2025, it was $2.4 billion, a compound annual growth rate (CAGR) of 12.5%.

That kind of growth has been achieved through a combination of acquisitions and organic sales growth.

Morningstar has five reportable segments: Morningstar Direct (37% of revenue), PitchBook (30%), Morningstar Credit (15%), Morningstar Wealth (11%), and Morningstar Retirement (7%).

Morningstar Investor operates under the Morningstar Wealth segment. It’s much less important to top-line revenue, which is driven by Morningstar Direct, its asset manager platform, and PitchBook, which provides data and information for private capital markets—the two account for two-thirds of the company’s revenue and 75% of its adjusted operating income.

Morningstar went public in May 2005 at $18 a share. Its CAGR is 10.93% in the 20.75 years, about 200 basis points higher than the S&P 500. Yet its volatility over the past five years has increased dramatically, leading to significant peaks and valleys.

It’s in one of those valleys. Opportunity presents itself. If I could only buy one of the four based on value, Morningstar is it.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)