Over the last six months, Icahn Enterprises’s shares have sunk to $8.15, producing a disappointing 12.3% loss - a stark contrast to the S&P 500’s 9.1% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Icahn Enterprises, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Icahn Enterprises Not Exciting?

Despite the more favorable entry price, we're cautious about Icahn Enterprises. Here are three reasons we avoid IEP and a stock we'd rather own.

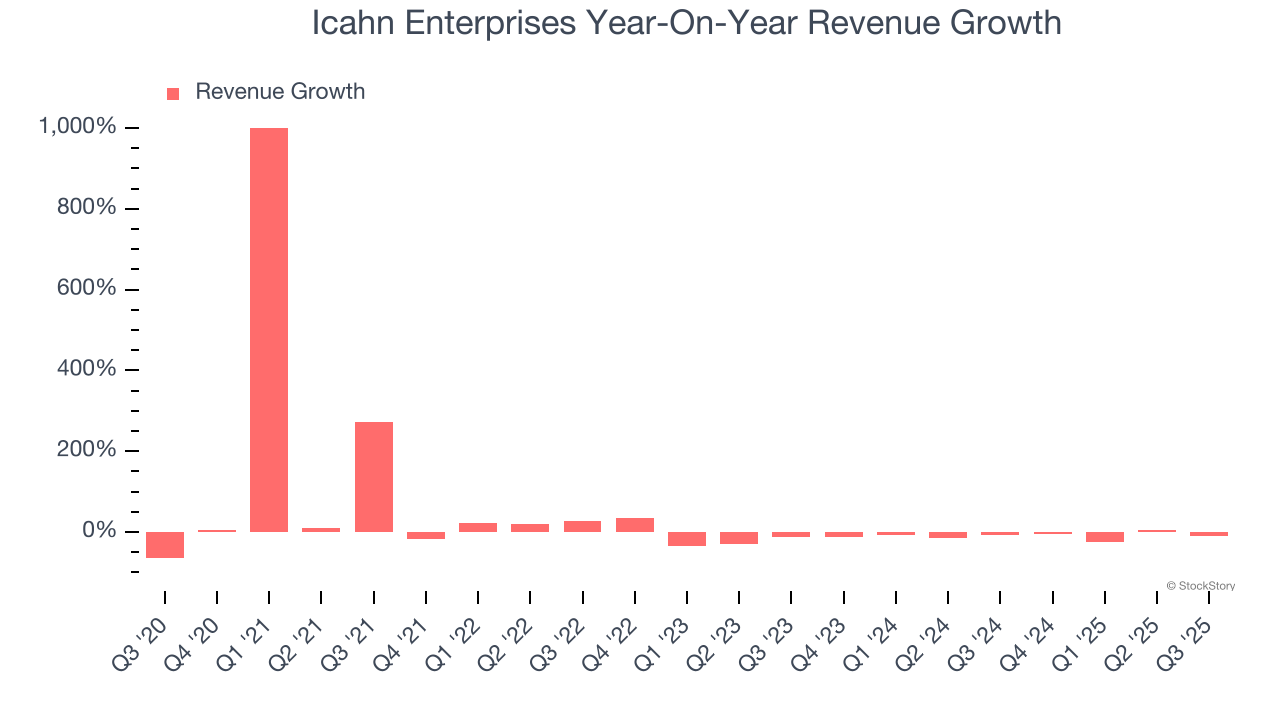

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Icahn Enterprises’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.6% over the last two years.

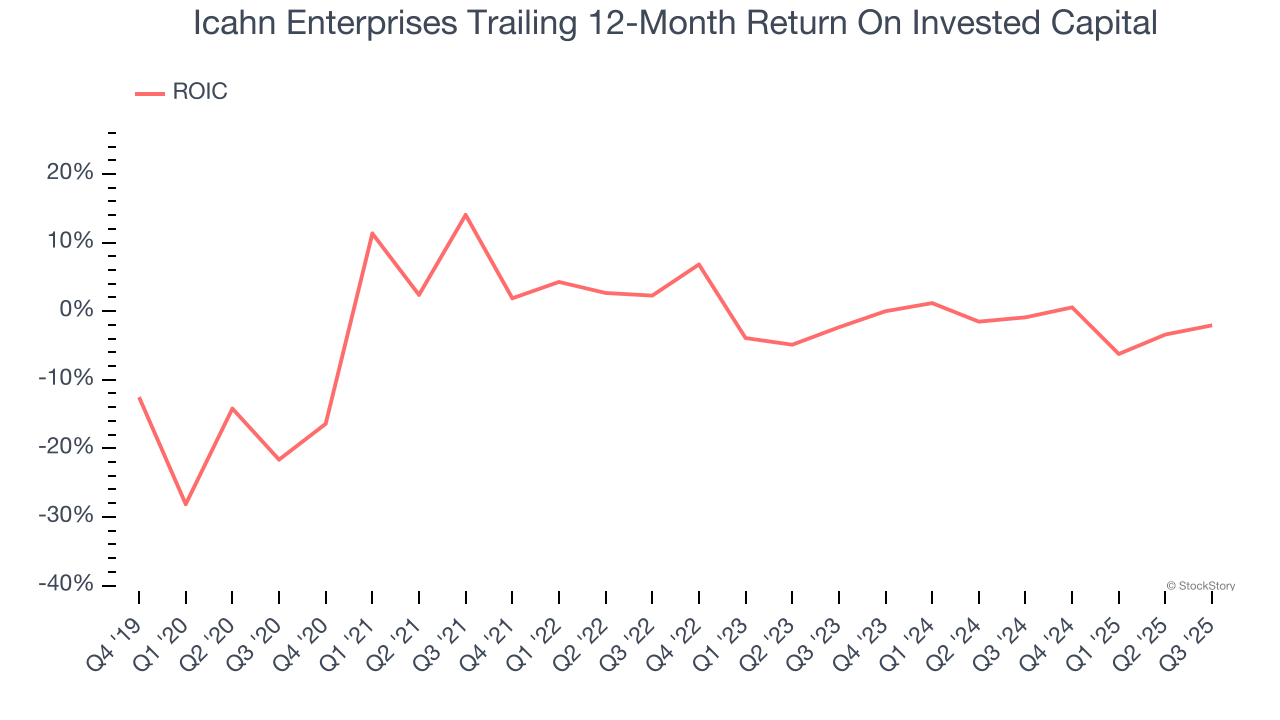

2. New Investments Fail to Bear Fruit as ROIC Declines

We like to invest in businesses with high returns, but the trend in a company’s ROIC can also be an early indicator of future business quality.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Icahn Enterprises’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

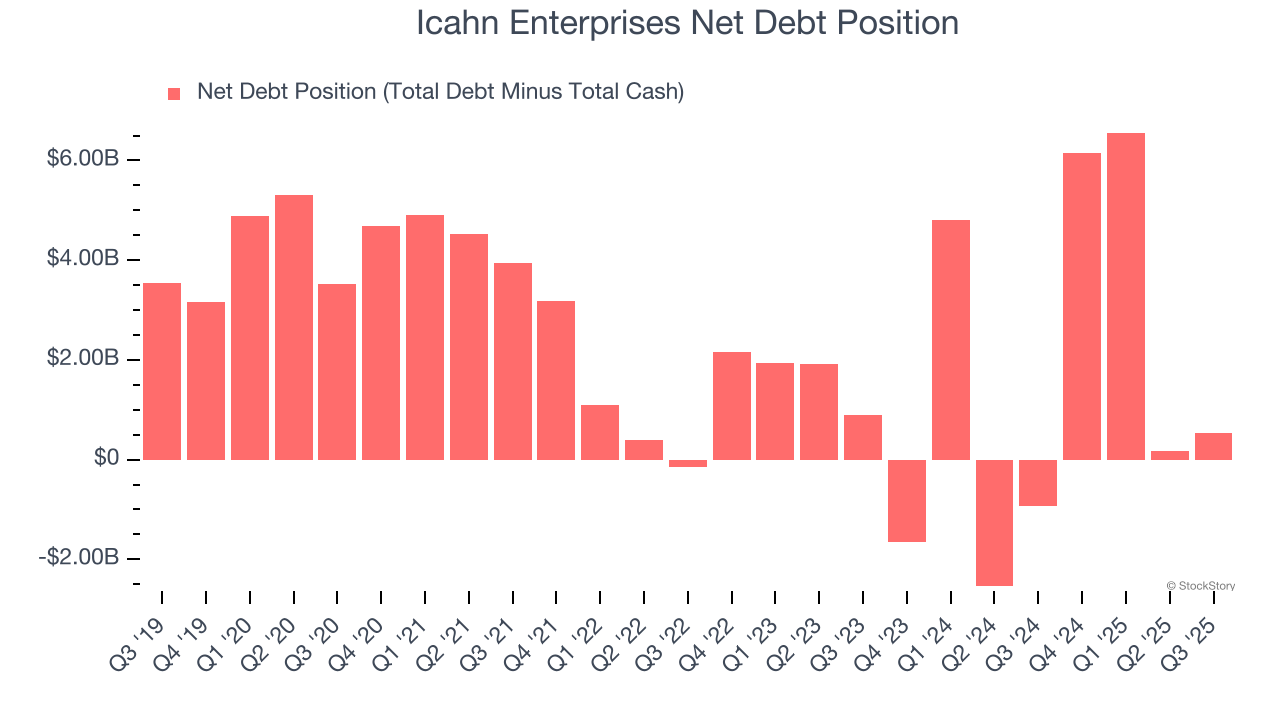

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Icahn Enterprises’s $6.60 billion of debt exceeds the $6.06 billion of cash on its balance sheet. Furthermore, its 8× net-debt-to-EBITDA ratio (based on its EBITDA of $65 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Icahn Enterprises could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Icahn Enterprises can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Icahn Enterprises isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at $8.15 per share (or a forward price-to-sales ratio of 0.5×). The market typically values companies like Icahn Enterprises based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)